- United States

- /

- Diversified Financial

- /

- NasdaqCM:RPAY

Market Cool On Repay Holdings Corporation's (NASDAQ:RPAY) Revenues

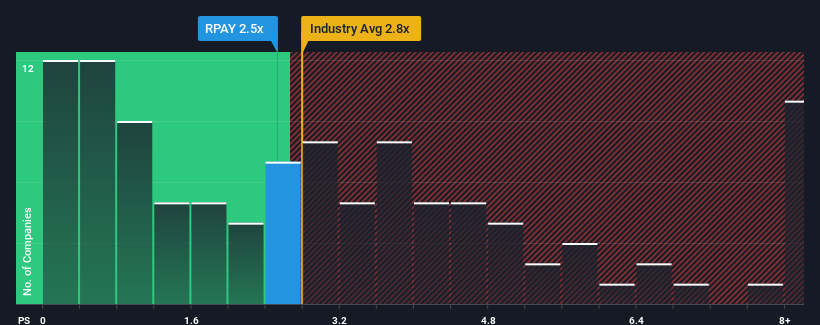

It's not a stretch to say that Repay Holdings Corporation's (NASDAQ:RPAY) price-to-sales (or "P/S") ratio of 2.5x right now seems quite "middle-of-the-road" for companies in the Diversified Financial industry in the United States, where the median P/S ratio is around 2.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Repay Holdings

How Repay Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, Repay Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Repay Holdings will help you uncover what's on the horizon.How Is Repay Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Repay Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 5.3% gain to the company's revenues. The latest three year period has also seen an excellent 75% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 7.9% during the coming year according to the ten analysts following the company. That's shaping up to be materially higher than the 3.7% growth forecast for the broader industry.

With this information, we find it interesting that Repay Holdings is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Repay Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Repay Holdings you should be aware of.

If you're unsure about the strength of Repay Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPAY

Repay Holdings

Repay Holdings Corporation, payments technology company, provides integrated payment processing solutions to industry-oriented markets in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives