- United States

- /

- Diversified Financial

- /

- NasdaqCM:RPAY

Investors Appear Satisfied With Repay Holdings Corporation's (NASDAQ:RPAY) Prospects

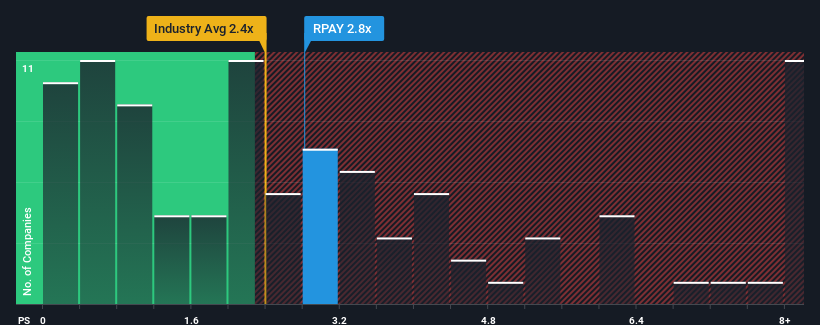

With a median price-to-sales (or "P/S") ratio of close to 2.4x in the Diversified Financial industry in the United States, you could be forgiven for feeling indifferent about Repay Holdings Corporation's (NASDAQ:RPAY) P/S ratio of 2.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Repay Holdings

How Has Repay Holdings Performed Recently?

Recent times haven't been great for Repay Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Repay Holdings.How Is Repay Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Repay Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 114% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 4.5% over the next year. With the industry predicted to deliver 4.3% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Repay Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Repay Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Repay Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Repay Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPAY

Repay Holdings

A payments technology company, provides integrated payment processing solutions that enables consumers and businesses to make payments using electronic payment methods in the United States.

Adequate balance sheet and slightly overvalued.