- United States

- /

- Diversified Financial

- /

- NasdaqGS:RELY

Remitly (RELY) Valuation Check After Investor Day Targets and ‘Rule of 40’ Profitability Push

Reviewed by Simply Wall St

Remitly Global (RELY) just used its Investor Day to reset the story, laying out fresh revenue targets for 2026 and 2028 while committing to a Rule of 40 balance between growth and profitability.

See our latest analysis for Remitly Global.

The upbeat Investor Day message seems to have sparked a short term rebound, with a 1 month share price return of 11.8 percent. However, that sits against a much weaker year to date share price return of minus 36.8 percent and a still solid three year total shareholder return of about 36 percent. This suggests that long term believers are hanging on while momentum is only just starting to rebuild.

If this kind of reset has you thinking about where growth stories can go next, it could be worth scanning fast growing stocks with high insider ownership for other under the radar compounders.

With shares still trading at a steep discount to analyst targets despite accelerating growth and a clear path to profitability, investors now face a key question: is this a mispriced compounder, or is future upside already baked in?

Most Popular Narrative Narrative: 34.2% Undervalued

With Remitly Global’s fair value pegged well above the recent 14.15 dollar close, the most followed narrative points to meaningful upside if its thesis lands.

The strategic launch of stablecoin functionality and multicurrency wallets positions Remitly to capitalize on the accelerating adoption of digital financial services and rising global smartphone penetration, which should drive higher customer acquisition, improve retention, and diversify revenue streams.

Curious how a fast expanding revenue base, rising margins, and a punchy future earnings multiple can still imply upside at today’s price? The narrative lays out the full math behind that gap between fair value and the market’s current view.

Result: Fair Value of $21.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny on stablecoins and intensifying fintech competition could squeeze margins and slow adoption, which may challenge this upbeat valuation narrative.

Find out about the key risks to this Remitly Global narrative.

Another Lens on Value

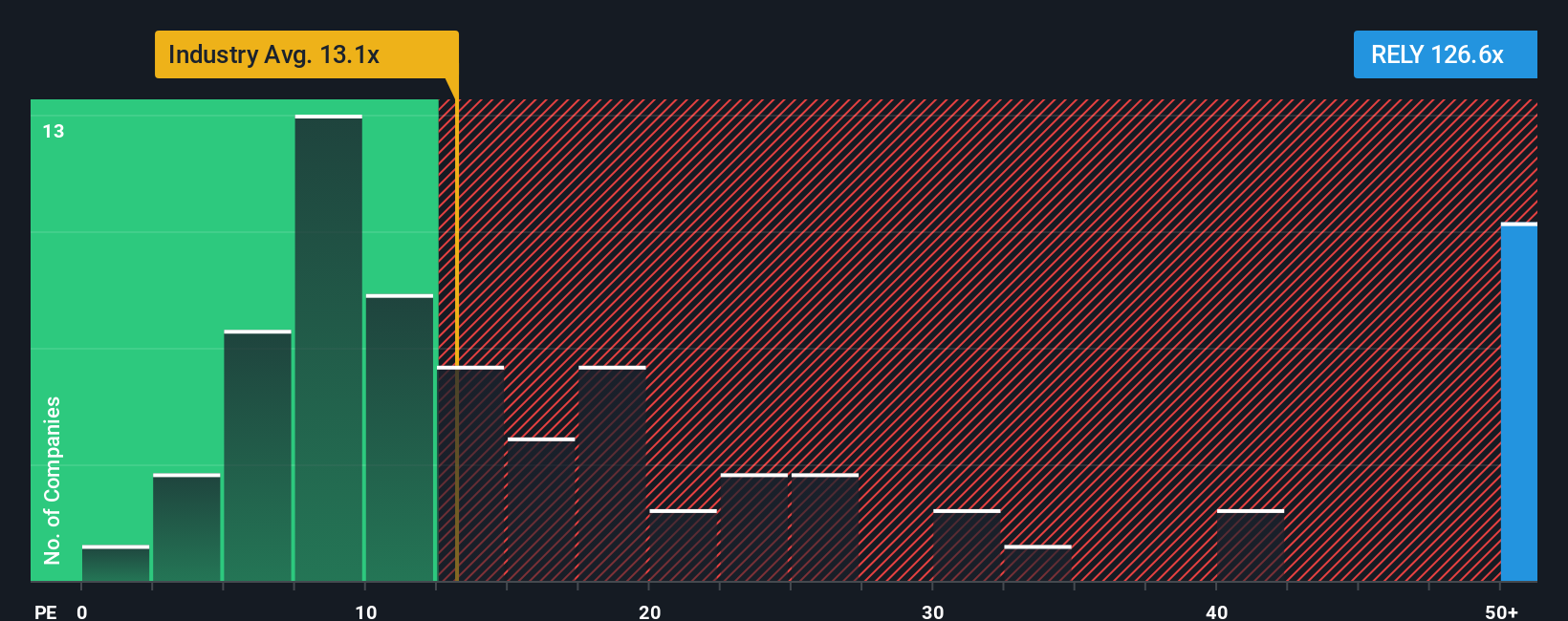

While the narrative points to upside, the earnings picture tells a tougher story. Remitly trades on a rich 140.9 times earnings versus about 31.3 times for peers and a fair ratio of 29.3 times, which suggests meaningful valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Remitly Global Narrative

If you see the numbers differently or want to dig into the drivers yourself, you can build a personalized narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Remitly Global.

Looking for more investment ideas?

Friends who act on great ideas early usually see the biggest rewards, so do not stop at Remitly when the market is full of other powerful setups.

- Capture potential multibaggers at the smallest end of the market by reviewing these 3590 penny stocks with strong financials with disciplined balance sheets and genuine growth momentum.

- Ride structural tailwinds in automation and data with these 27 AI penny stocks that are using intelligent technologies to reshape entire industries.

- Identify potentially attractive entry points by scanning these 894 undervalued stocks based on cash flows that the market has not fully appreciated based on their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RELY

Remitly Global

Engages in the provision of digital financial services in the United States, Canada, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026