- United States

- /

- Consumer Finance

- /

- NasdaqGS:QFIN

Qifu Technology (NasdaqGS:QFIN): Evaluating Valuation as AI Efficiency and Shareholder Returns Draw Investor Interest

Reviewed by Kshitija Bhandaru

For investors keeping an eye on Qfin Holdings (NasdaqGS:QFIN), recent events might be worth a closer look. The company is standing out thanks to its disciplined approach to risk, even as it navigates ongoing economic and regulatory hurdles. What has really set Qfin apart is a blend of steady profitability, efficient operations powered by artificial intelligence, and tangible steps toward international growth. At the same time, management continues to share the company’s success with shareholders through consistent capital returns.

While these developments attracted investor attention, the share price tells its own story. Over the past year, Qfin Holdings has delivered a 26% total return, with a remarkable 165% gain over the past three years. However, the past three months have seen the stock pull back close to 30%. Momentum has cooled recently, but long-term growth and industry-leading profitability keep Qfin in the conversation as a potential value play.

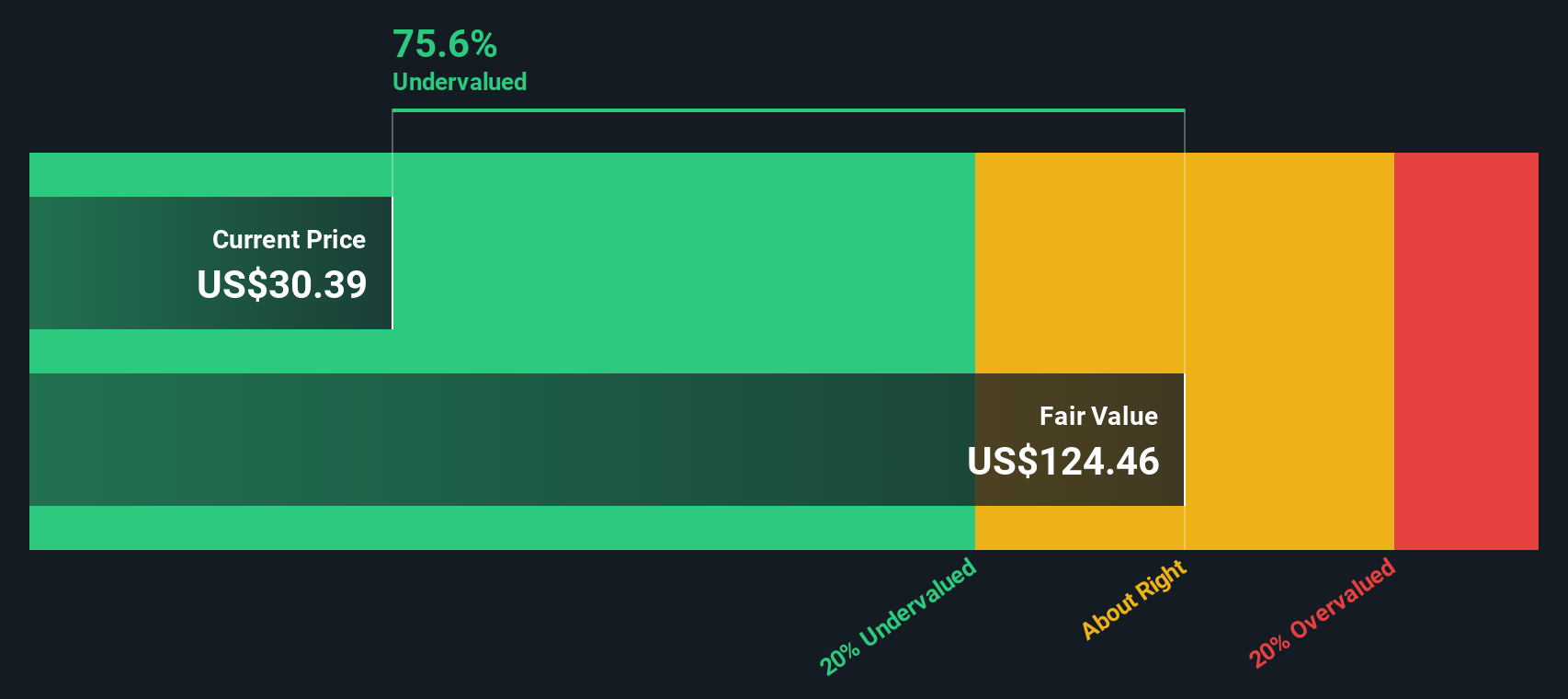

With the stock trading at what many consider a discounted valuation, the question now is whether Qfin is offering a compelling entry point or if the market’s caution signals that future growth is already priced in.

Most Popular Narrative: 38.5% Undervalued

According to the most widely followed narrative, Qfin Holdings is considered significantly undervalued and is trading well below what analysts see as its fair value based on future earnings power, profit margins, and business risks.

Qfin's ongoing integration of advanced AI and large language models into its risk assessment and user profiling systems is already reducing default rates (for example, FPD 7-day down 5%, improved model KS scores) and improving operational efficiency, which should protect and gradually enhance net margins in the medium and long term.

Want to know what’s driving this massive discount to fair value? The secret sauce is buried in bold growth projections and profit margins, paired with a surprisingly conservative future earnings multiple. Want to see what expectations are fueling this bullish narrative? Don’t miss the full breakdown—it could change how you see Qfin’s upside.

Result: Fair Value of $49.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in regulatory policy or ongoing weakness in consumer credit demand could challenge Qfin's growth story and have an impact on its future returns.

Find out about the key risks to this Qfin Holdings narrative.Another View: Discounted Cash Flow Signals More Upside

Taking a different approach, our DCF model also suggests Qfin is undervalued based on the company’s future cash flows. This method gives a similar result. Is the market overlooking Qfin’s true earnings power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qfin Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qfin Holdings Narrative

If you see the numbers differently or want to dig deeper, you can build your own view of Qfin Holdings in just a few minutes. Do it your way.

A great starting point for your Qfin Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of the curve, Simply Wall Street’s powerful Screener helps you pinpoint stocks with real growth potential and unique advantages. Don’t settle for average opportunities. Try these handpicked ideas and get a step closer to your next big winner.

- Accelerate your investment strategy by uncovering hidden potential in emerging companies with strong fundamentals through our penny stocks with strong financials.

- Boost your portfolio’s income by targeting steady payers. Find companies delivering yields above 3% using our dividend stocks with yields > 3%.

- Ride the next wave of innovation by seeking out firms at the forefront of artificial intelligence advancements with our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qfin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QFIN

Qfin Holdings

Qfin Holdings, Inc., together with its subsidiaries, operate AI- driven credit-tech platform under the Qifu Jietiao brand in the People’s Republic of China.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives