- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal (PYPL): Margin Expansion Reinforces Value Narrative as Shares Trade Below Peer Valuations

Reviewed by Simply Wall St

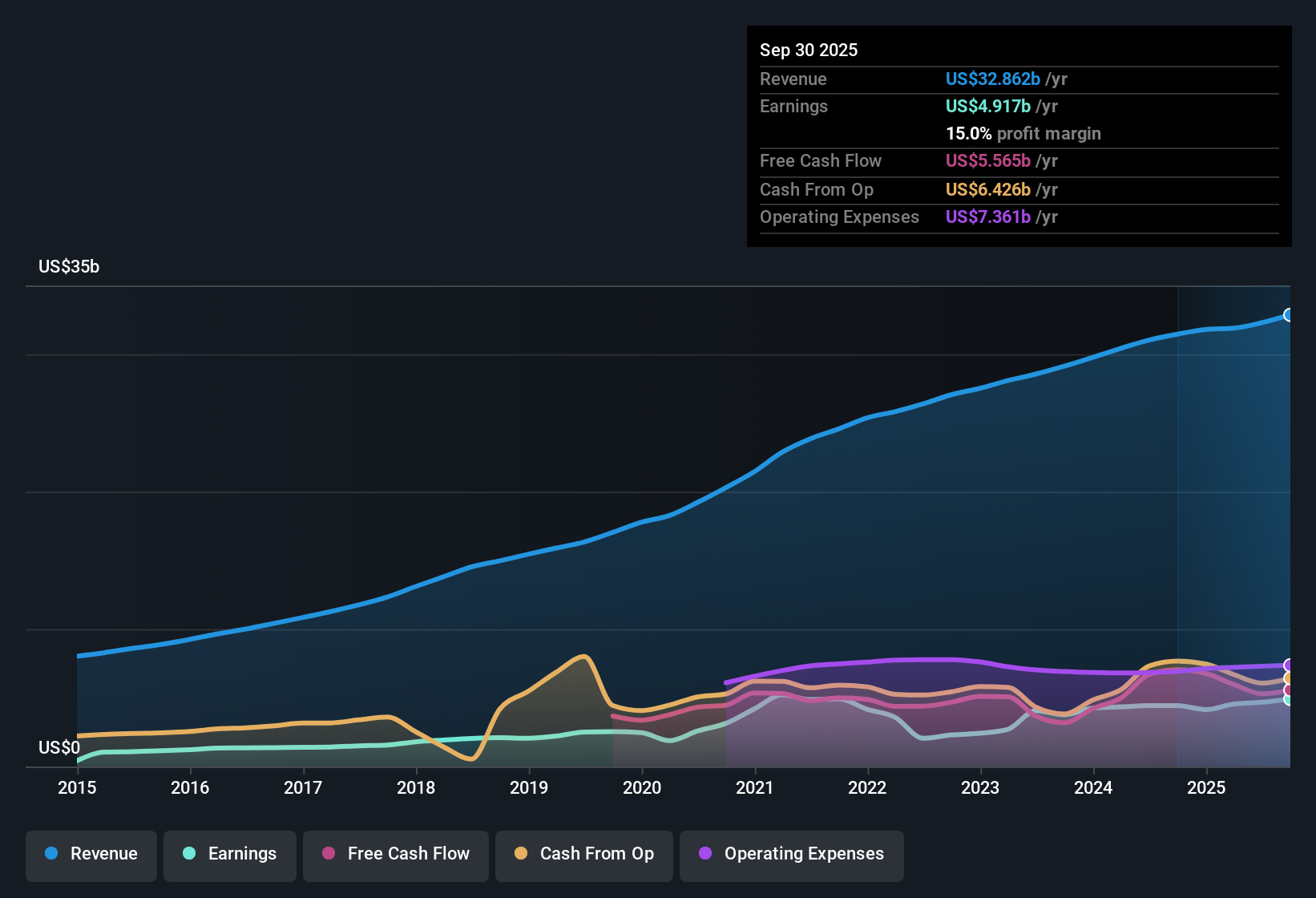

PayPal Holdings (PYPL) posted earnings growth of 3.2% per year over the last five years, with growth picking up to 11% last year. Net profit margins also improved, reaching 15% from 14.1% the previous year, and analysts expect annual earnings and revenue increases of 5.64% and 5.8%, respectively. With its price-to-earnings ratio sitting at 14, below the industry average, and no major risks noted, PayPal's latest results highlight strong profits, expanding margins, and relative value compared to peers.

See our full analysis for PayPal Holdings.Next up, we will look at how these results compare with some of the most widely followed narratives and market opinions to see what holds up and what might surprise investors.

See what the community is saying about PayPal Holdings

Merchant Services Push Boosts Transaction Margins

- Value-added services like optimized debit routing and fraud protection are contributing to higher transaction margins, which have helped lift PayPal’s net profit margin to 15%, up from 14.1% last year.

- Analysts' consensus view expects initiatives including the expansion of branded checkout, the rollout of Buy Now, Pay Later (BNPL), and enhanced merchant services to accelerate total payment volume growth.

- This is evidenced by the uptick in margin alongside increased consumer engagement driven by smart wallet and omnichannel experiences.

- Consensus narrative notes that continued focus on these higher-margin services could maintain or even expand margins. This supports the company’s transformation into a broader commerce platform.

- See how the consensus thinking measures up in our full coverage. 📊 Read the full PayPal Holdings Consensus Narrative.

Share Repurchases Drive Per-Share Growth

- Analysts anticipate the number of PayPal shares outstanding will decline by 4.7% per year over the next three years, providing an additional tailwind to earnings per share growth even as overall profit margins are expected to edge slightly lower.

- Analysts' consensus view frames steady buybacks as an offset to only modest earnings growth forecasts, with per-share metrics rising faster than headline net income.

- This reduction in share count helps bridge the gap between projected revenue growth of 5.8% per year and the more moderate earnings growth forecast of 5.64% per year, boosting long-term investor returns.

- Consensus narrative points out that although headline growth lags the broader US market, share repurchases could enable PayPal to outperform on a per-share basis. This is an important angle for long-term holders.

Valuation Remains Attractive Versus Industry

- PayPal’s price-to-earnings ratio stands at 14, below both the peer average of 17.5 and the diversified financial industry average of 16.6. Its $73.02 share price is also below the $82.24 analyst price target and well under the $123.82 DCF fair value.

- Analysts' consensus view points to this discounted valuation as a meaningful opportunity, arguing that even with lower forecasted growth than industry peers, current pricing offers a margin of safety.

- What’s notable is that fair value estimates, whether based on consensus or discounted cash flow, provide significant headroom over today’s trading price. The future PE implied by analyst projections (15.8x in 2028) remains below the sector standard.

- Consensus narrative stresses that for the stock to close this gap, PayPal only needs to deliver steady, not spectacular, performance. This is something the historical trend of profit growth and value-enhancing capital returns supports.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PayPal Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the numbers in your own way? In just a few minutes, you can craft your unique perspective and share your take. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding PayPal Holdings.

See What Else Is Out There

While PayPal’s per-share metrics are supported by buybacks, its overall earnings growth is expected to trail both the broader market and sector peers.

If you want to focus on established companies set to deliver stronger earnings growth, be sure to check out high growth potential stocks screener (60 results) for more compelling ideas right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion