- United States

- /

- Diversified Financial

- /

- NasdaqGS:PYPL

PayPal Holdings (NasdaqGS:PYPL) Partners With OKX To Simplify Crypto Purchases In Europe

Reviewed by Simply Wall St

PayPal Holdings (NasdaqGS:PYPL) saw its shares rise by 15% over the last quarter, coinciding with several strategic initiatives, including a collaboration with OKX to facilitate cryptocurrency transactions across the European Economic Area. This potential enhancement in market presence may have bolstered investor confidence despite broader market uncertainties such as trade tensions. Other developments, like partnerships with major athletic conferences and fast-food chains, as well as board changes, possibly strengthened the company's operational and governance outlook. Amidst a flat overall market performance, these efforts likely contributed positively to PayPal's share price movement.

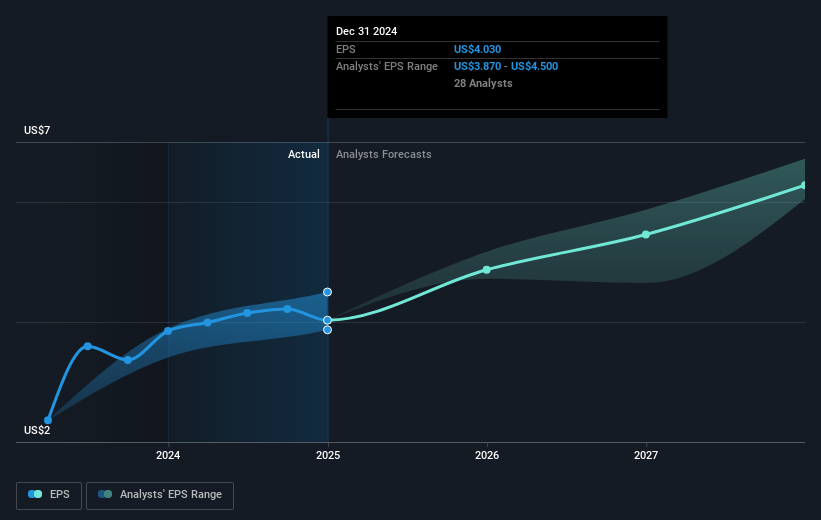

The recent collaboration between PayPal and OKX to enable cryptocurrency transactions across the European Economic Area could strengthen PayPal’s transition to a commerce-focused platform, enhancing its market position amidst trade tensions. Partnerships with major athletic conferences and fast-food chains may further reinforce PayPal's service offerings, driving transaction volumes and deepening merchant relationships. These developments align with PayPal’s strategic shift towards value-added services, potentially enhancing revenue growth and supporting improved earnings forecasts. The smart wallet and Venmo expansion initiatives reinforce PayPal's positioning in the digital payments landscape, contributing to analyst expectations of increased engagement and transaction frequency.

Considering PayPal’s year-over-year total shareholder return of 18.01%, the latest quarterly share price increase builds on a strong existing performance. Over the longer term, PayPal's shares have recorded gains, reflecting consistent growth efforts. In comparison to the broader market and the US Diversified Financial industry, PayPal's return exceeded the market's 11.4% increase over the past year. However, its recent growth rate of 4.8% remains below the industry average of 8.5%.

With an analyst consensus price target of US$82.32, PayPal’s current price of US$68.05 illustrates a 17.3% potential upside, suggesting that market participants might anticipate continued favorable developments. Revenue is projected to grow to US$37.7 billion by 2028, while anticipated earnings of US$5.5 billion indicate a long-term trajectory that would support a higher valuation. Despite potential risks from competition and regulatory changes, the ongoing strategic initiatives underpin revenue and earning prospects, which could help align PayPal’s stock price more closely with analyst expectations in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PYPL

PayPal Holdings

Operates a technology platform that enables digital payments for merchants and consumers worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)