- United States

- /

- Capital Markets

- /

- NasdaqGS:PWP

Even With A 25% Surge, Cautious Investors Are Not Rewarding Perella Weinberg Partners' (NASDAQ:PWP) Performance Completely

The Perella Weinberg Partners (NASDAQ:PWP) share price has done very well over the last month, posting an excellent gain of 25%. The last month tops off a massive increase of 117% in the last year.

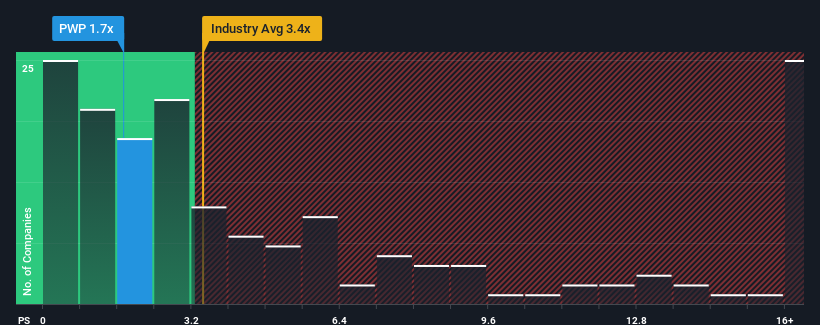

In spite of the firm bounce in price, Perella Weinberg Partners may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Capital Markets industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Perella Weinberg Partners

How Perella Weinberg Partners Has Been Performing

Perella Weinberg Partners certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Perella Weinberg Partners.How Is Perella Weinberg Partners' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Perella Weinberg Partners' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Revenue has also lifted 11% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 9.3% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Perella Weinberg Partners' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Perella Weinberg Partners' P/S Mean For Investors?

Perella Weinberg Partners' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Perella Weinberg Partners' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Perella Weinberg Partners that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PWP

Perella Weinberg Partners

An independent advisory firm, provides strategic and financial advice services in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives