- United States

- /

- Capital Markets

- /

- NasdaqGS:PSEC

Prospect Capital (PSEC): Does Insider Buying Signal a Compelling Valuation After Mixed Q4 Earnings?

Reviewed by Kshitija Bhandaru

When a company’s director puts more skin in the game, investors tend to take notice. That is exactly what happened at Prospect Capital (PSEC) when Director Eugene S. Stark picked up another 2,500 shares, adding to a run of insider buying at a time when many are watching the company’s bottom line closely. Following Prospect Capital’s latest earnings report, which showed earnings per share outpacing expectations while revenue lagged, this wave of insider activity is raising eyebrows about what might be next for the stock. It is an intriguing setup for anyone wondering if those on the inside see value that the market may be missing.

It is worth stepping back to see how Prospect Capital’s story has unfolded over the past year. While the stock enjoyed a slight boost after reporting mixed financials, momentum has not been on its side overall. Shares are down nearly 45% over the past year and lower across all major timeframes, suggesting investors are still cautious about the company’s outlook in spite of rising insider confidence and a high-profile Q4 earnings beat on net income. Other recent moves, such as the string of director purchases, have yet to spark a sustained rally.

After this challenging year, is Prospect Capital trading at a discount that offers a real opportunity, or are investors right to be wary about whether future growth is already baked into the price?

Price-to-Sales of 1.7x: Is it justified?

Prospect Capital currently trades at a price-to-sales ratio of 1.7x, which is well below the US Capital Markets industry average of 4.1x. This suggests that, based on revenue, the stock appears undervalued compared to its sector peers.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of revenue generated by a company. It is a useful metric for evaluating financial firms like Prospect Capital, especially when profits fluctuate or the business is temporarily unprofitable.

This discounted valuation might indicate that the market has concerns about the firm’s future growth prospects or profitability, resulting in a lower premium placed on its sales. However, investors should consider whether the gap to industry peers could close if the company’s fundamentals improve, or if current challenges will keep the stock trading at a discount.

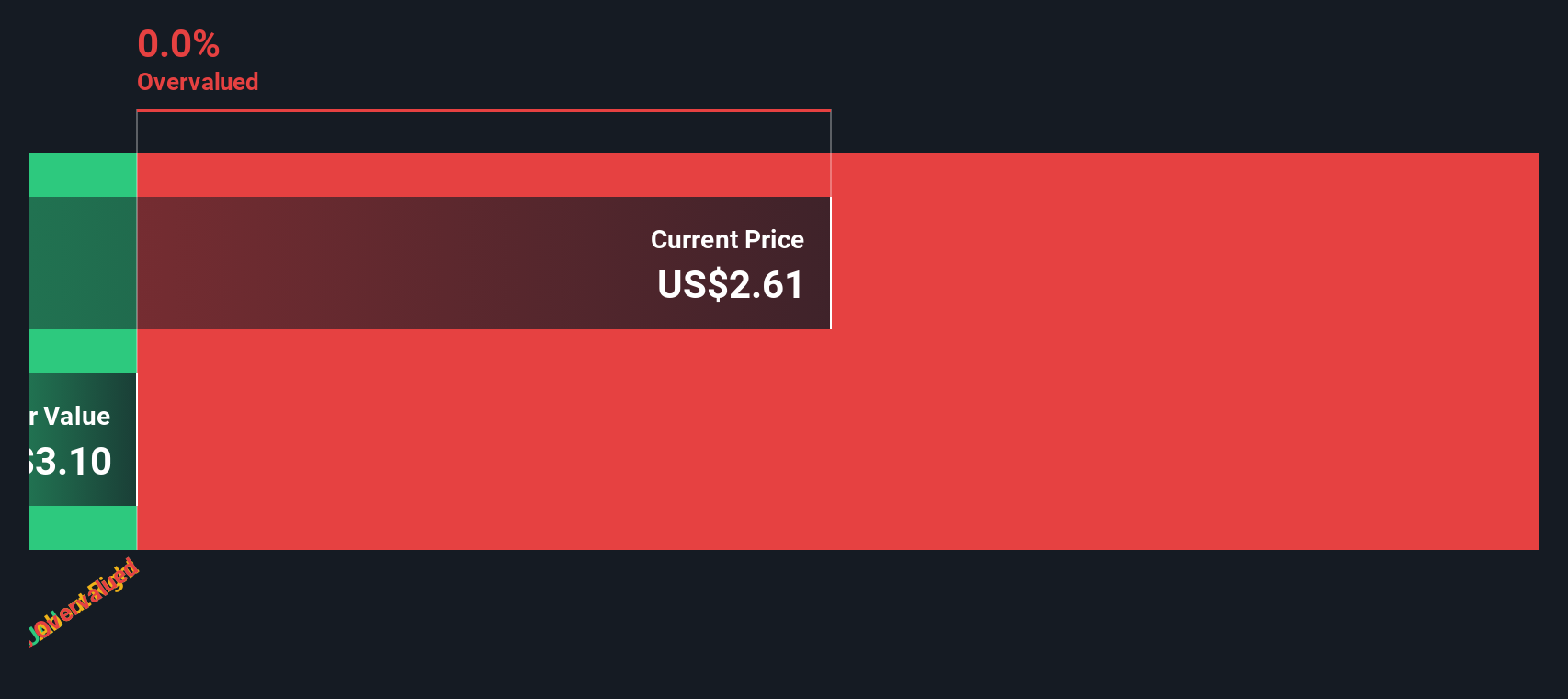

Result: Fair Value of $2.50 (UNDERVALUED)

See our latest analysis for Prospect Capital.However, continued declines in revenue and the company’s negative net income raise fair questions about whether downside risks could be greater than potential value opportunities.

Find out about the key risks to this Prospect Capital narrative.Another View: What Does Our DCF Model Suggest?

Looking at Prospect Capital from another angle, the SWS DCF model provides a different perspective. This approach tries to estimate the company's true worth based on projected cash flows and a risk-adjusted discount rate. In this case, the DCF result does not support the idea that the stock is significantly undervalued. Could the market be right about the risks, or is there value that the multiples approach is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Prospect Capital Narrative

If you are thinking about different angles or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Prospect Capital research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Take charge of your search and spot new growth stories, value plays, and standout themes in today’s fast-moving market.

- Uncover hidden gems that aim for big growth and quality financials by starting with our penny stocks with strong financials selection.

- Supercharge your watchlist with powerful companies reshaping healthcare using artificial intelligence, all found through our healthcare AI stocks.

- Maximize your income with businesses offering robust, above-average yields by checking out our picks for dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PSEC

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives