- United States

- /

- Diversified Financial

- /

- NasdaqCM:PRTH

Priority Technology Holdings' (NASDAQ:PRTH) growing losses don't faze investors as the stock jumps 15% this past week

One simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Priority Technology Holdings, Inc. (NASDAQ:PRTH) share price is up 87% in the last three years, clearly besting the market return of around 33% (not including dividends).

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Priority Technology Holdings

Given that Priority Technology Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Priority Technology Holdings saw its revenue grow at 22% per year. That's much better than most loss-making companies. While the compound gain of 23% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Priority Technology Holdings. A window of opportunity may reveal itself with time, if the business can trend to profitability.

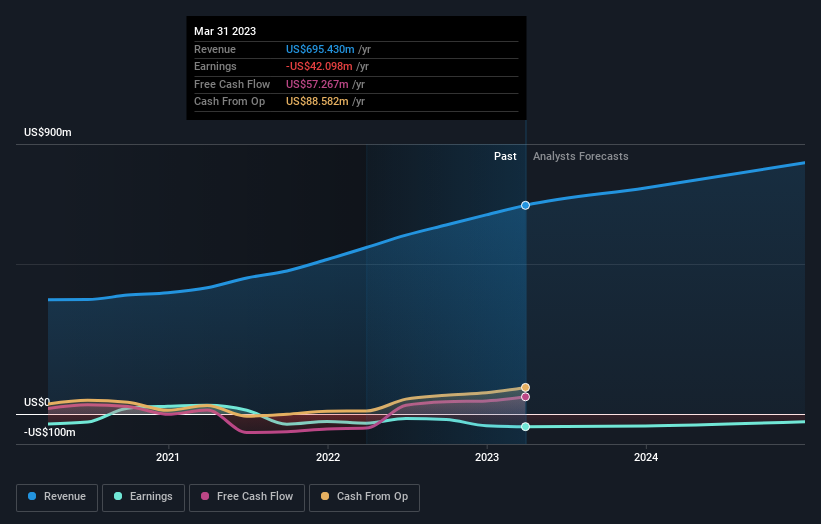

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Priority Technology Holdings in this interactive graph of future profit estimates.

A Different Perspective

Priority Technology Holdings shareholders are down 5.0% for the year, but the broader market is up 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 23% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Priority Technology Holdings better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Priority Technology Holdings you should be aware of.

Priority Technology Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Priority Technology Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRTH

Priority Technology Holdings

Operates as a payment technology company in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives