- United States

- /

- Diversified Financial

- /

- NasdaqCM:PRTH

Investors push Priority Technology Holdings (NASDAQ:PRTH) 14% lower this week, company's increasing losses might be to blame

Priority Technology Holdings, Inc. (NASDAQ:PRTH) shareholders might be concerned after seeing the share price drop 14% in the last week. But that doesn't change the fact that the returns over the last year have been pleasing. To wit, it had solidly beat the market, up 48%.

In light of the stock dropping 14% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

See our latest analysis for Priority Technology Holdings

Priority Technology Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Priority Technology Holdings grew its revenue by 14% last year. That's a fairly respectable growth rate. Buyers pushed the share price 48% in response, which isn't unreasonable. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

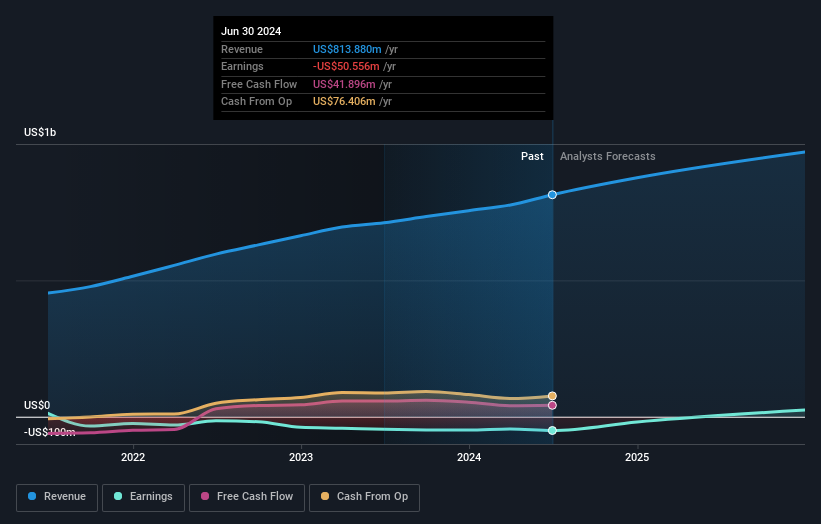

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Priority Technology Holdings will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Priority Technology Holdings shareholders have received a total shareholder return of 48% over one year. There's no doubt those recent returns are much better than the TSR loss of 3% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Priority Technology Holdings (1 is significant!) that you should be aware of before investing here.

Priority Technology Holdings is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRTH

Priority Technology Holdings

Operates as a payment technology company in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives