- United States

- /

- Capital Markets

- /

- OTCPK:PHCF.F

If You Had Bought Puhui Wealth Investment Management (NASDAQ:PHCF) Stock A Year Ago, You Could Pocket A 118% Gain Today

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Puhui Wealth Investment Management Co., Ltd. (NASDAQ:PHCF) share price has soared 118% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 73% gain in the last three months. Puhui Wealth Investment Management hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Puhui Wealth Investment Management

Puhui Wealth Investment Management isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Puhui Wealth Investment Management saw its revenue shrink by 31%. So we would not have expected the share price to rise 118%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

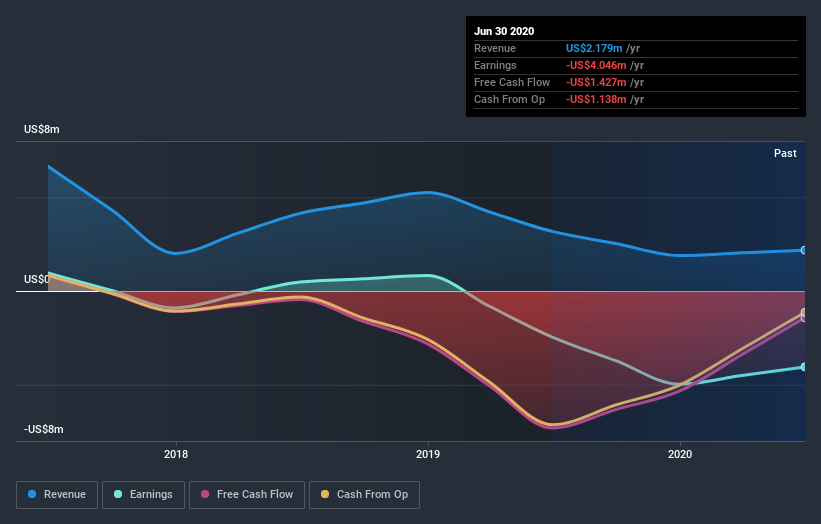

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Puhui Wealth Investment Management boasts a total shareholder return of 118% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 73% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Puhui Wealth Investment Management better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with Puhui Wealth Investment Management (including 2 which don't sit too well with us) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Puhui Wealth Investment Management, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:PHCF.F

Puhui Wealth Investment Management

Through its subsidiaries, provides third-party wealth management services in the People's Republic of China.

Low with weak fundamentals.