- United States

- /

- Diversified Financial

- /

- NasdaqCM:PAYS

Paysign, Inc. (NASDAQ:PAYS) Stocks Shoot Up 30% But Its P/S Still Looks Reasonable

Paysign, Inc. (NASDAQ:PAYS) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 28%.

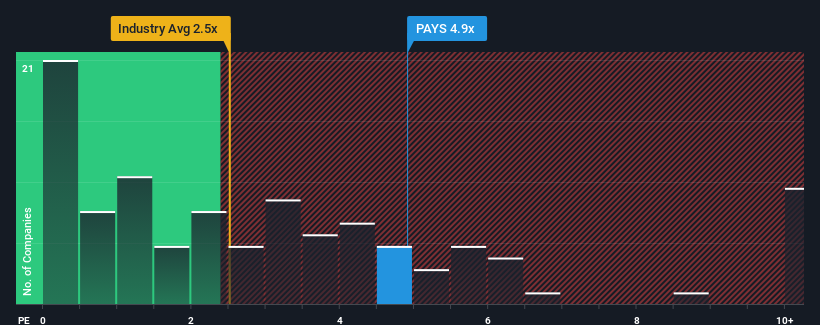

Since its price has surged higher, given around half the companies in the United States' Diversified Financial industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Paysign as a stock to avoid entirely with its 4.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Paysign

How Has Paysign Performed Recently?

Paysign certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Paysign.What Are Revenue Growth Metrics Telling Us About The High P/S?

Paysign's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an excellent 96% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 18% as estimated by the four analysts watching the company. With the industry only predicted to deliver 1.4%, the company is positioned for a stronger revenue result.

With this information, we can see why Paysign is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Paysign's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Paysign maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Diversified Financial industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Paysign is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PAYS

Paysign

Provides prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing services for businesses, consumers, and government institutions.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives