- United States

- /

- Capital Markets

- /

- NasdaqGS:OXSQ

Oxford Square Capital's (NASDAQ:OXSQ) Stock Price Has Reduced 37% In The Past Year

Oxford Square Capital Corp. (NASDAQ:OXSQ) shareholders will doubtless be very grateful to see the share price up 36% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. In fact the stock is down 37% in the last year, well below the market return.

View our latest analysis for Oxford Square Capital

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Oxford Square Capital share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. Extraordinary items have impacted profits over the last twelve months.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

Oxford Square Capital's dividend seems healthy to us, so we doubt that the yield is a concern for the market. We'd be more worried about the fact that revenue fell 37% year on year. The market may be extrapolating the decline, leading to questions around the sustainability of the EPS.

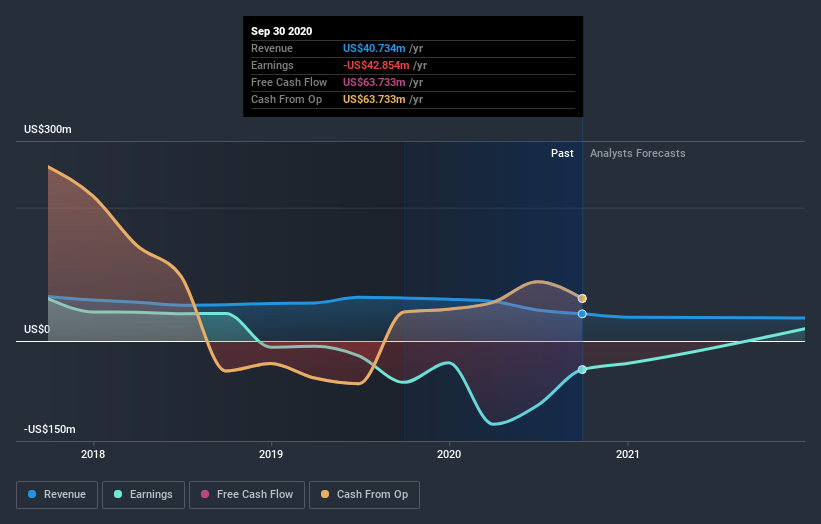

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Oxford Square Capital the TSR over the last year was -25%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Oxford Square Capital had a tough year, with a total loss of 25% (including dividends), against a market gain of about 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Oxford Square Capital is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Oxford Square Capital, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:OXSQ

Oxford Square Capital

A business development company, operates as a closed-end, non-diversified management investment company.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives