- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Will Northern Trust’s (NTRS) Firm Rejection of Merger Rumors Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Recently, Northern Trust’s CEO publicly reaffirmed the company’s commitment to independence, directly addressing prior merger rumors involving Bank of New York Mellon and responding to ongoing market speculation.

- This statement, paired with a series of updated research reports focusing on the company’s resilience and growth in core business lines, has clarified uncertainties around M&A potential and highlighted Northern Trust’s operational strengths for investors.

- We’ll examine how the CEO’s strong denial of merger rumors and emphasis on independence may reshape Northern Trust’s investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Northern Trust Investment Narrative Recap

To be a Northern Trust shareholder, you need confidence in steady client demand for asset servicing and wealth management, alongside faith in disciplined cost control, technology investment, and management’s ability to fend off industry competition. The CEO’s denial of merger rumors may ease short-term uncertainties around a potential acquisition, but it does not materially affect the central catalysts, ongoing client wins and operational leverage, or shift the main risk related to slower-than-market earnings growth.

The recently announced $2.5 billion share repurchase program stands out, especially as the company’s independence was emphasized. This action supports Northern Trust’s ongoing capital flexibility, underlining its ability to return capital to shareholders and invest for future growth, which remains one of the most relevant catalysts as the market weighs the company’s underlying financial strength.

However, investors should be aware that despite robust fee income and a history of share buybacks, the biggest risk remains that...

Read the full narrative on Northern Trust (it's free!)

Northern Trust is projected to deliver $8.2 billion in revenue and $1.4 billion in earnings by 2028. This reflects a forecast annual revenue decline of 1.6% and a $0.7 billion decrease in earnings from the current $2.1 billion.

Uncover how Northern Trust's forecasts yield a $133.21 fair value, a 5% upside to its current price.

Exploring Other Perspectives

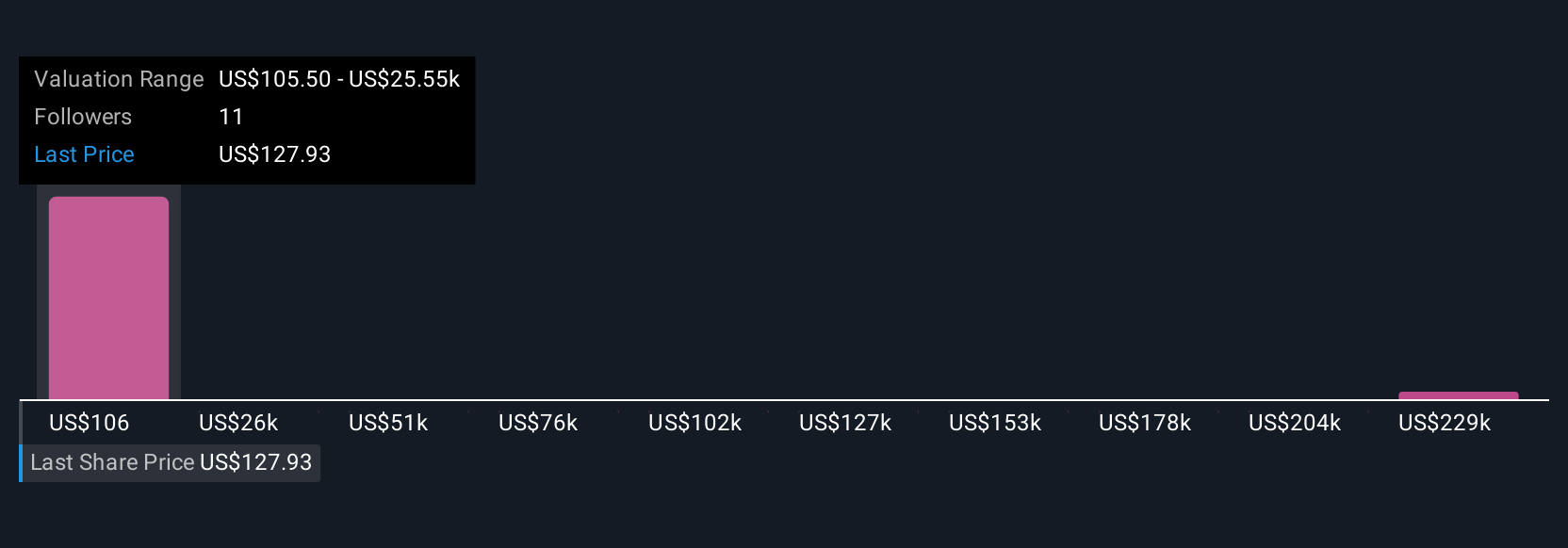

Four private investors in the Simply Wall St Community have estimated Northern Trust’s fair value anywhere from US$109 to a striking US$254,541 per share. While opinions differ, disciplined cost control featured in recent analyst updates may influence future performance and invites you to consider how broadly investor expectations can spread.

Explore 4 other fair value estimates on Northern Trust - why the stock might be worth 14% less than the current price!

Build Your Own Northern Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northern Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Trust's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives