- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

How Recent Rate Cut Shapes Northern Trust’s Value Debate in 2025

Reviewed by Bailey Pemberton

If you have been watching Northern Trust lately and wondering if now is the time to make a move, you are not alone. The stock has been on an interesting ride: after climbing an impressive 39.2% over the last year and 21.1% so far this year, it has taken a slight dip with a 5.8% drop in the past week and a milder 1.8% decline in the past month. These fluctuations have kept investors guessing, especially as rumors of potential acquisitions by financial giants like Goldman Sachs have swirled through the headlines. While nothing concrete has emerged from those talks, the speculation itself has played a role in boosting, or at times unsettling, investor sentiment.

More recently, Northern Trust also trimmed its prime rate by a quarter point, signaling its response to broader market shifts. Moves like these can recalibrate both risk and opportunity, so it is worth paying attention not just to the headlines, but to what is baked into the company’s share price right now.

Curious about Northern Trust’s current value? We have run the numbers, digging into six classic valuation checks. Out of six, the company is undervalued in three. That gives Northern Trust a valuation score of 3, which might make it appealing, but the real story may be more nuanced than a single score can reveal.

Let’s walk through these valuation approaches together before diving into an even more insightful lens for understanding whether Northern Trust’s current stock price is justified.

Approach 1: Northern Trust Excess Returns Analysis

The Excess Returns valuation model is designed to assess how effectively a company generates profits from its investments, above and beyond its cost of equity. It focuses on two main components: the return generated on invested capital and how much this return exceeds what shareholders would demand in exchange for investment risk.

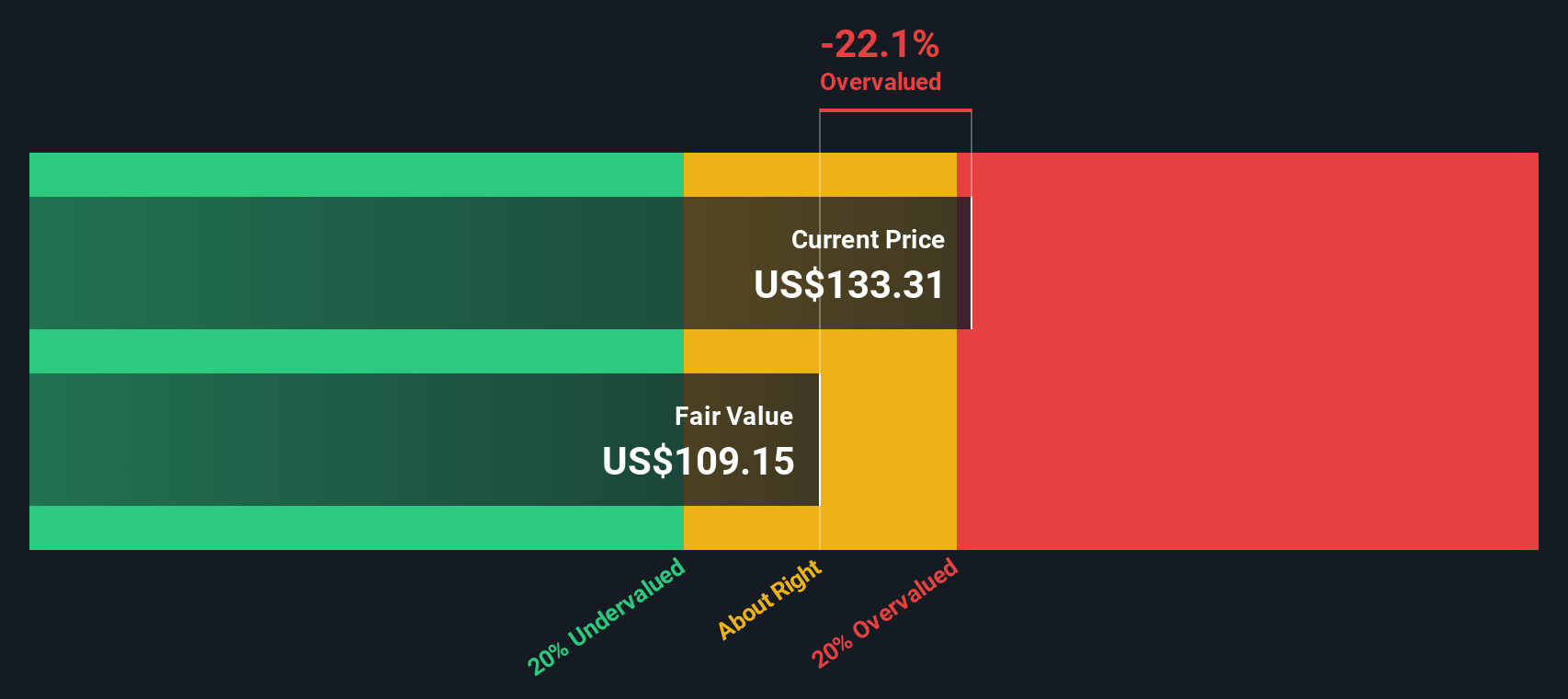

For Northern Trust, analysts estimate a book value of $62.65 per share and project a future stable book value of $67.68 per share. The company’s stable earnings per share (EPS) are estimated at $9.85, based on the weighted future Return on Equity predictions from 12 analysts. Its cost of equity is calculated at $6.89 per share, resulting in an excess return of $2.96 per share. Northern Trust reports an average return on equity of 14.55%, suggesting steady returns over time.

Using these figures, the Excess Returns model sets an intrinsic share value of $109.45. At today’s price, however, the stock is trading about 14.0% above this calculated value, which indicates that it is currently overvalued according to this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Northern Trust may be overvalued by 14.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Northern Trust Price vs Earnings

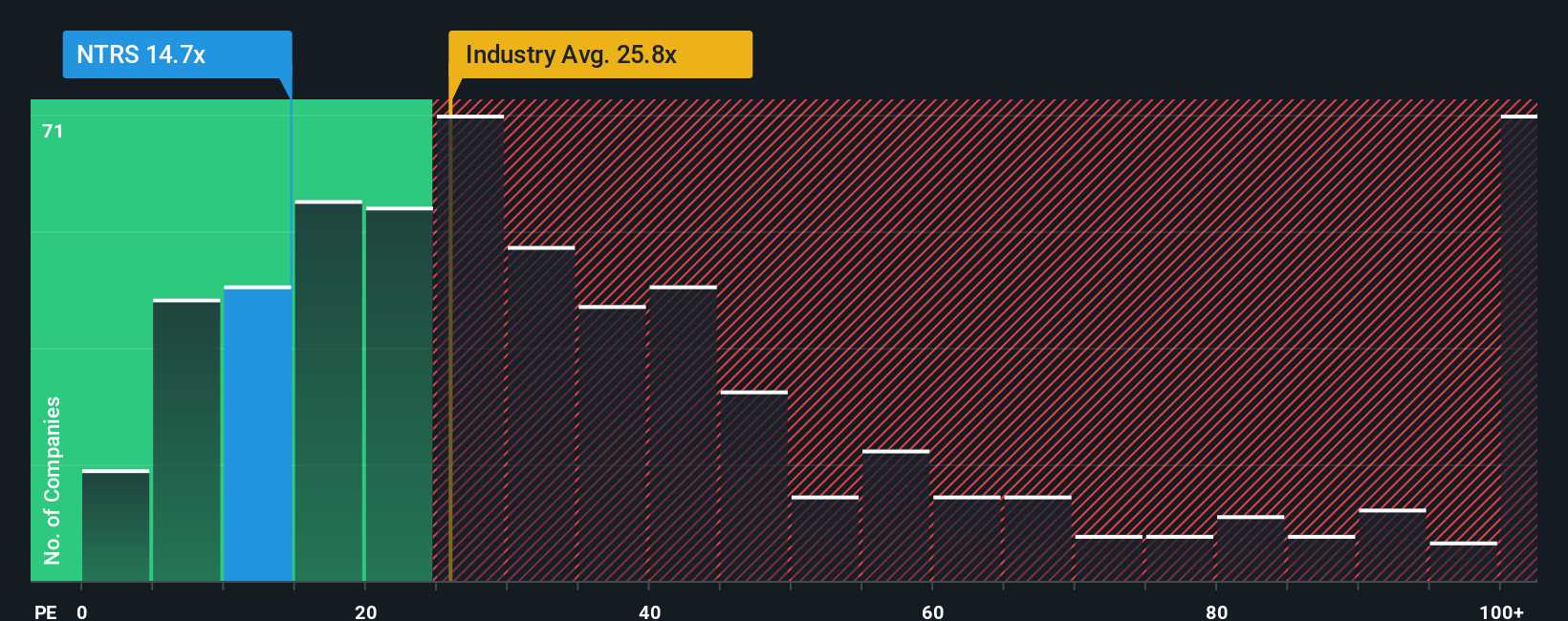

The Price-to-Earnings (PE) ratio is widely regarded as the go-to metric when valuing profitable companies like Northern Trust. This multiple tells investors how much they are paying today for each dollar of current earnings, making it especially useful when earnings are relatively stable and predictable. A company's appropriate or “fair” PE ratio depends not just on its profitability, but also on growth prospects, risk profile, and how those compare to peers within the same industry.

For Northern Trust, the current PE ratio stands at 14.2x. To put that into context, the Capital Markets industry average PE is 24.9x, while the peer group for Northern Trust averages a much higher 43.2x. On the surface, this makes Northern Trust look much cheaper than either its direct competitors or the overall industry. This could attract value-seeking investors looking for an apparent bargain.

However, Simply Wall St’s proprietary “Fair Ratio” takes the analysis one step further. This metric accounts for more than just the averages by factoring in critical aspects such as Northern Trust’s outlook for earnings growth, its operating risks, profit margins, industry classification, and market cap to arrive at a nuanced view of what a justifiable PE ratio really is. For Northern Trust, the Fair Ratio is calculated at 16.1x. Because this proprietary approach weighs what actually makes each company unique, it serves as a stronger decision-making yardstick than simple peer or industry comparisons alone.

Given Northern Trust is trading at a 14.2x PE, which is quite close to the Fair Ratio benchmark of 16.1x, the market appears to be valuing the shares about right relative to the company’s fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Northern Trust Narrative

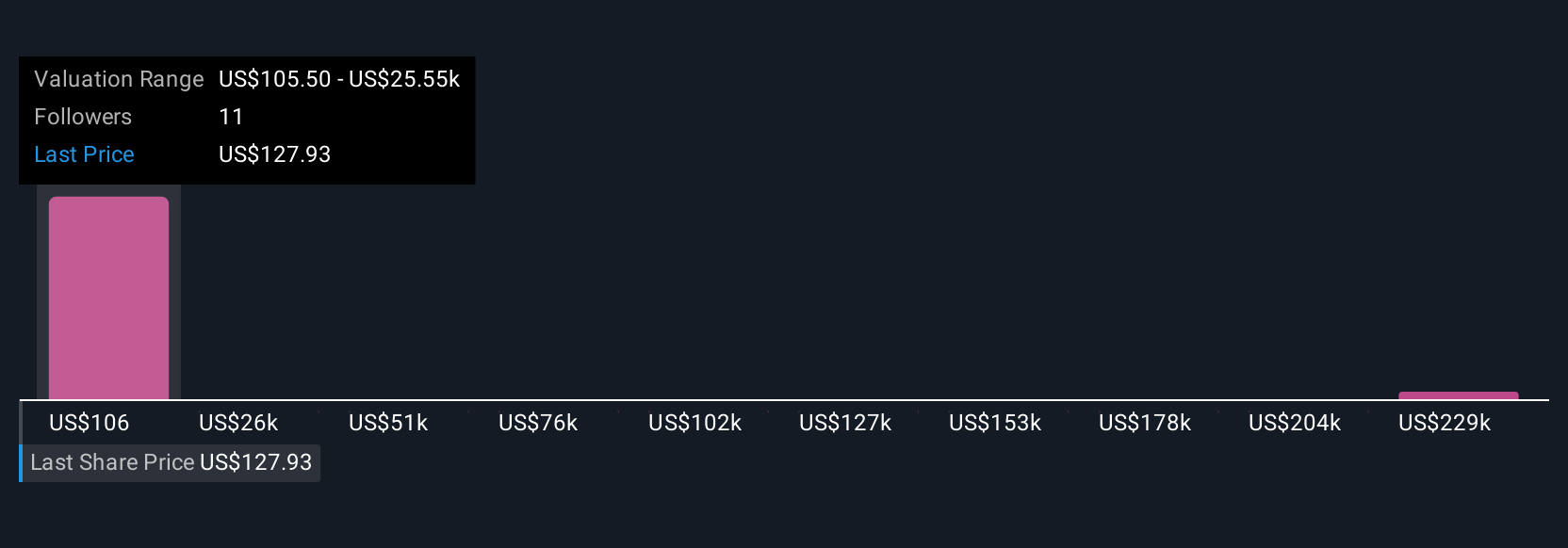

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just looking at numbers; it’s your perspective on a company, connecting your story of where Northern Trust is headed with your own forecasts for revenue, earnings, and profit margins. Narratives link the business’s big picture with detailed financial models, showing how your view leads to a fair value estimate and, ultimately, a buy or sell decision.

On Simply Wall St’s Community page, millions of investors use Narratives to easily build and update these stories for thousands of companies, including Northern Trust. By comparing each Narrative’s fair value to today’s price, you can see whether an investment case stacks up or not, and Narratives get smarter in real time as news or financial results come out.

For example, Northern Trust’s most bullish Narrative assumes alternatives and digital growth will drive sustained profit, setting a fair value at $135, while the most bearish expects pressure from fees and passive investing to shrink margins, targeting just $101. This illustrates how Narratives empower you to make clear, up-to-date decisions rooted in the business’s evolving story.

Do you think there's more to the story for Northern Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives