- United States

- /

- Consumer Finance

- /

- NasdaqGM:NRDS

NerdWallet, Inc.'s (NASDAQ:NRDS) Business Is Yet to Catch Up With Its Share Price

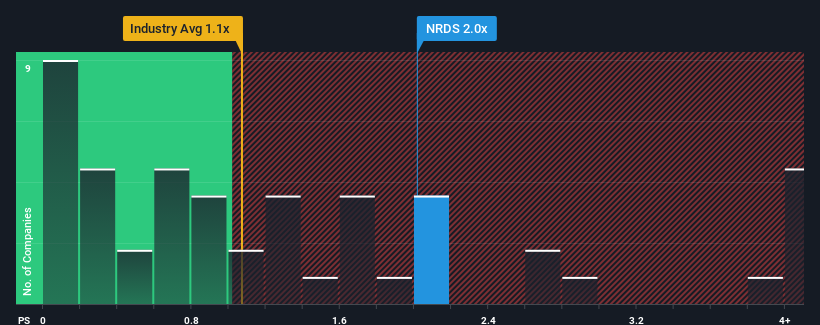

When close to half the companies in the Consumer Finance industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, you may consider NerdWallet, Inc. (NASDAQ:NRDS) as a stock to potentially avoid with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for NerdWallet

What Does NerdWallet's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, NerdWallet has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on NerdWallet will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

NerdWallet's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an excellent 148% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.9% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that NerdWallet's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for NerdWallet, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 1 warning sign for NerdWallet that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NerdWallet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NRDS

NerdWallet

Operates a digital platform that provides financial guidance to consumers and small and mid-sized businesses (SMB) in the United States, the United Kingdom, Australia, and Canada.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.