- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NDAQ): Assessing Valuation After Recent Share Price Dip and Market Momentum

Reviewed by Kshitija Bhandaru

Nasdaq (NDAQ) shares have edged higher over the past week, reflecting recent market momentum and a steady investor appetite. In the past month, however, the stock has slipped a bit. This may provide some potential for value-focused investors to take a closer look.

See our latest analysis for Nasdaq.

While Nasdaq’s share price dipped in the last month, its broader performance paints a much stronger picture. Momentum has built steadily, with a year-to-date share price return of 15.45% and an impressive 24.69% total shareholder return over the past year. This demonstrates growing confidence in the stock’s long-term story.

If you’re curious about which other financial stocks are capturing market momentum, now is a smart time to explore fast growing stocks with high insider ownership

With Nasdaq trading below some analyst targets despite recent gains, the question becomes whether the current dip presents a genuine buying opportunity or if the market has already taken the company’s future prospects into account.

Most Popular Narrative: 12% Undervalued

Nasdaq’s last close of $89.39 sits well below the narrative-based fair value of $101.67, suggesting analysts see considerable room for upside from current levels.

Nasdaq’s strategic investments in product innovation, international market expansion, and new product launches, especially in the index business, are expected to drive sustained revenue growth. These initiatives aim to strengthen their global position and diversify revenue streams from the Nasdaq 100, supporting long-term earnings performance.

What drives this bullish outlook? Growth blueprints, ambitious expansion, and a future profit margin the market rarely grants to exchanges. The key financial gears behind this perspective are not what you would expect. Find out what sets this valuation apart.

Result: Fair Value of $101.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable macroeconomic conditions and mounting competition from rival exchanges could quickly challenge the optimistic outlook regarding Nasdaq’s future growth.

Find out about the key risks to this Nasdaq narrative.

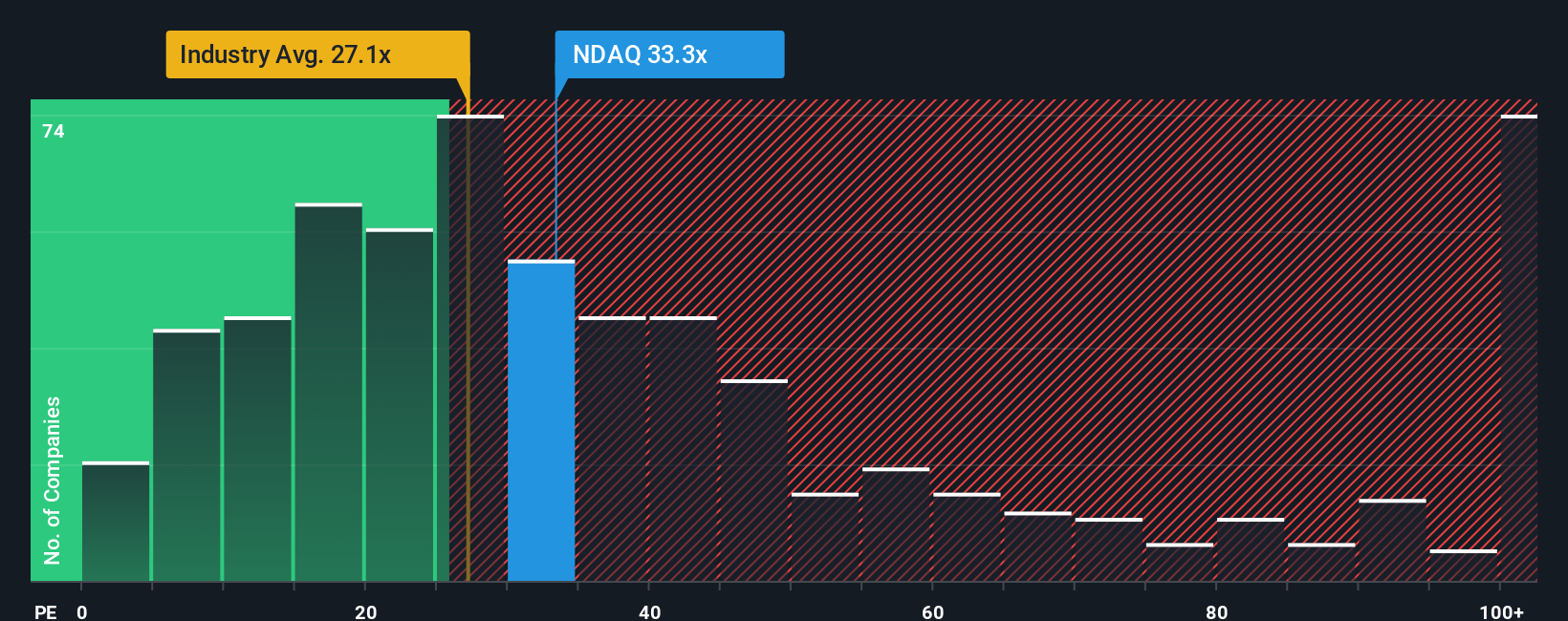

Another View: Valuing Nasdaq By Its Earnings Multiple

While analysts see fair value well above the current share price, another approach takes a hard look at Nasdaq’s earnings multiple. Shares trade at 34 times earnings, above both the peer average of 33.1 and the US industry average of 24.9, and nearly double the fair ratio of 18. This suggests the market is already pricing in optimistic expectations, raising the stakes for continued outperformance.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If you’d rather draw your own conclusions or want to take a hands-on approach, you can dig into the key figures and assemble your own view in just a few minutes. Do it your way

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let today’s opportunity slip by. Take charge of your financial future with stock picks built on real fundamentals and emerging market trends.

- Capture the excitement of high-growth sectors and see which companies stand out among these 25 AI penny stocks shaping tomorrow’s digital world.

- Add steady income to your portfolio by checking out these 18 dividend stocks with yields > 3% that have strong yields and resilient financials.

- Benefit from rapid advances in computing by targeting these 26 quantum computing stocks at the leading edge of breakthrough technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives