- United States

- /

- Capital Markets

- /

- NasdaqGS:NDAQ

Nasdaq (NasdaqGS:NDAQ) Enhances Philippine Infrastructure with New Eqlipse Trading Platform

Reviewed by Simply Wall St

Nasdaq (NasdaqGS:NDAQ) recently expanded its technology partnership with The Philippine Stock Exchange, enhancing its trading infrastructure with the advanced Nasdaq Eqlipse Trading platform. This move adds to the solid performance Nasdaq has showcased, reflected in a nearly 11% rise in its share price over the last month. The surge can be attributed to robust Q1 earnings, increased dividends, and strategic collaborations in Asia. These developments occur amidst a tech sector rally and broader market recovery following recent declines due to budget deficit concerns. While the broader market index saw a 1.1% drop, Nasdaq's initiatives contributed positively to its distinct upward trajectory.

Nasdaq has 1 weakness we think you should know about.

The recent enhancement of Nasdaq's trading infrastructure through its collaboration with The Philippine Stock Exchange using the Nasdaq Eqlipse Trading platform may have significant impacts on Nasdaq's operations. This partnership could potentially bolster Nasdaq's technological prowess in Asia, aligning well with its ongoing product innovation and market expansion initiatives. As Nasdaq further integrates these systems, it may enhance both revenue and earnings, due to potential operational efficiencies and market share gains as projected in its narrative.

Nasdaq's shares have seen an impressive 123.14% total return over a five-year period, demonstrating substantial long-term shareholder value creation. This performance is noteworthy when juxtaposed with its one-year absolute return exceeding both the US Capital Markets industry, which saw a 23.6% rise, and the broader US Market's 11.1% gain. The company's recent market movements reflect this extended period of favorable performance, providing investors with a robust example of consistent value creation.

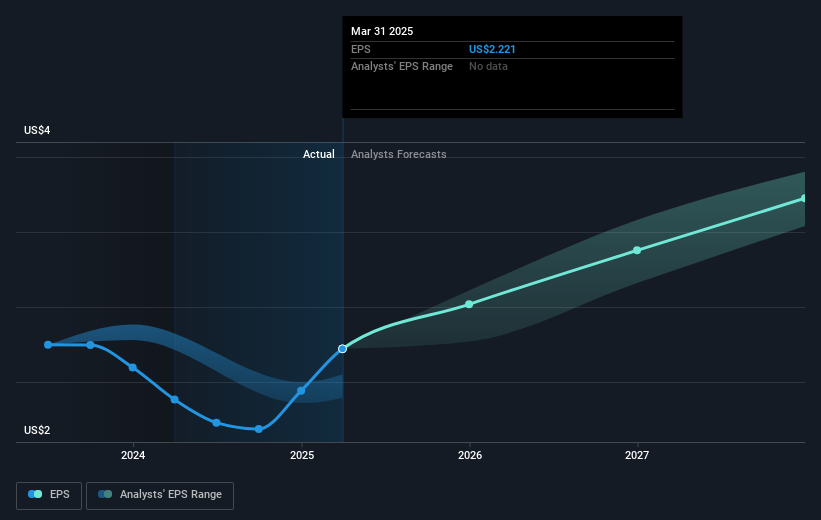

Current forecasts, however, indicate an expected revenue decline of 6% annually over the next three years, alongside a projected earnings rise of about 10.4% per annum. These expectations come amid increasing profit margins, aiming to grow from 16.4% to 31.2% by 2028. If Nasdaq capitalizes on its partnerships and innovations effectively, it could mitigate some revenue pressure. The recent share price surge, hovering around US$78.08, approaches the analyst consensus price target of US$83.72, suggesting limited upside potential in the short term while still reflecting the market's confidence in Nasdaq's strategic direction.

Understand Nasdaq's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nasdaq might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDAQ

Nasdaq

Operates as a technology company that serves capital markets and other industries worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives