- United States

- /

- Consumer Finance

- /

- NasdaqGS:NAVI

Navient (NAVI): Losses Deepen 38.8% Annually, Raising Doubts About Turnaround Narratives

Reviewed by Simply Wall St

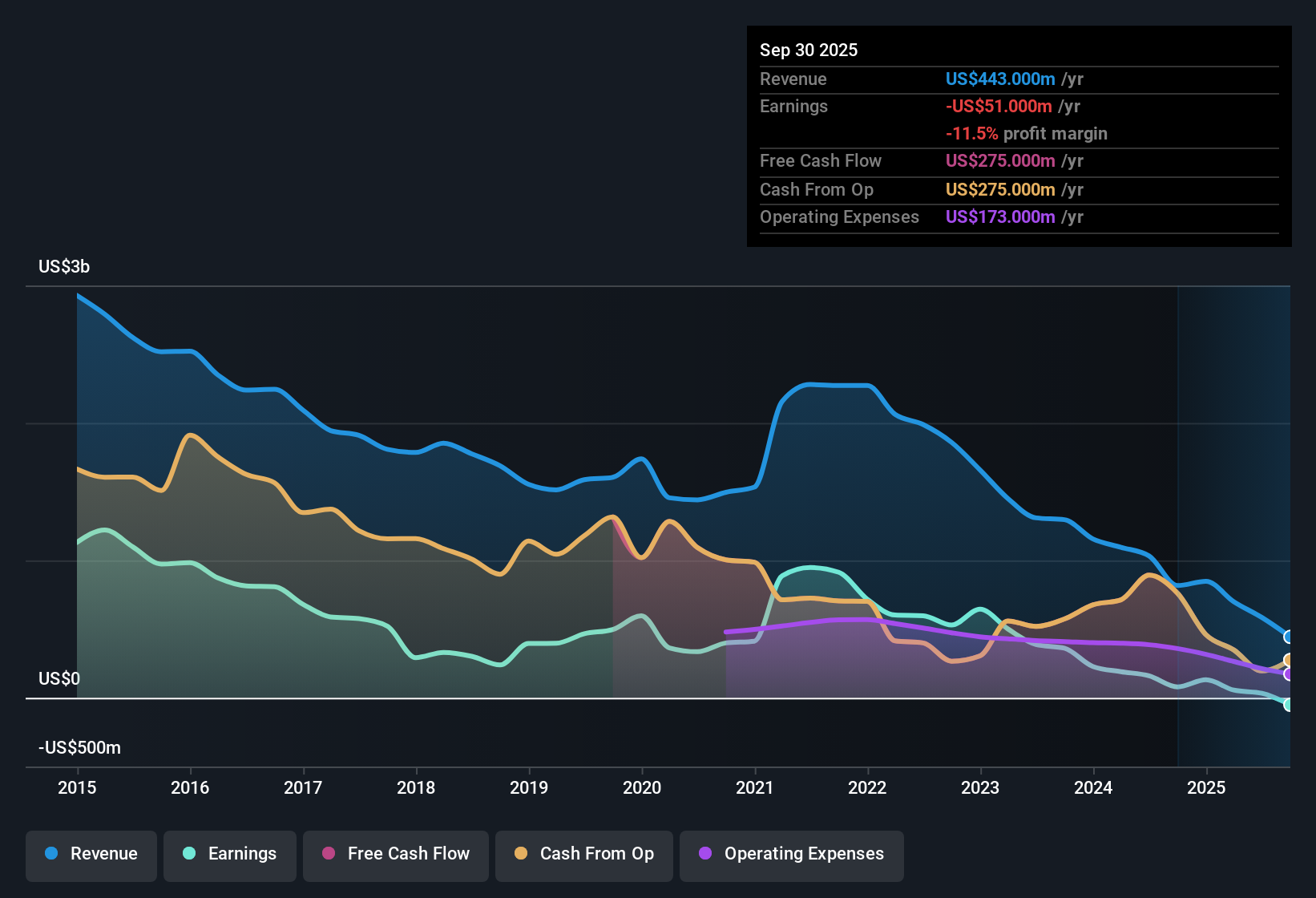

Navient (NAVI) remains unprofitable, with net losses increasing by 38.8% per year over the past five years and no improvement in profit margin in the last twelve months. Shares recently traded at $11.99, which is above the estimated fair value of $10.87 and reflects a higher Price-To-Sales ratio than the consumer finance industry average. Investors are looking to the forecasted annual earnings growth of 197.63% and a possible return to profitability within three years, along with revenue growth projected at 10.8% per year, as key factors in turning the story around.

See our full analysis for Navient.Next up, we will see how these headline numbers stack up against the wider narratives in the market. Some might fit, while others will get put to the test.

See what the community is saying about Navient

Expense Cuts Drive Margin Ambition

- Navient aims to reduce operating expenses by $400 million as part of ongoing divestitures and simplification efforts. This figure is on track according to the filing.

- Analysts' consensus view states these cost reductions, along with the push for digitization and borrower technology, are expected to deliver two major benefits:

- They are expected to directly increase net margins and earnings leverage as loan originations grow, reinforcing the company’s profit turnaround story.

- Sustained margin expansion depends on these efficiency gains matching market expectations, especially as the business shifts from legacy portfolios to new, growth-focused lending.

- Consensus narrative notes analysts expect profit margins to jump from 5.7% today to 48.2% in three years, a dramatic expansion enabled by these underlying changes.

📊 Read the full Navient Consensus Narrative.

Delinquency and Credit Quality Worries

- Ongoing “elevated delinquency and provision expenses” are highlighted in risk sections, driven by higher late-stage delinquencies and a less favorable macro environment.

- Bears argue that this uptick in delinquency and provision costs undermines projected margin growth:

- Higher-than-expected credit losses would erode net interest income and could cause actual earnings to fall short of consensus expectations.

- The need for repeat reserve “true-ups” and recurring special charges underscores how unpredictable borrower repayment trends threaten both stability and investor confidence in the turnaround.

Trading Above DCF Fair Value, Below Peers

- Navient’s stock trades at $11.99, which is 10.3% above its DCF fair value of $10.87, but well below the average Price-To-Sales (P/S) ratio of 10.6x for peer companies.

- According to the analysts' consensus view:

- The stock’s P/S ratio of 2.7x is much higher than the industry average of 1.3x, raising concerns about expensive valuation. However, it appears “good value” next to selected comparable companies trading at much steeper multiples.

- With the current price just below the consensus target of $13.00, the market seems to be taking a wait-and-see approach, balancing upside from growth catalysts against real risks in credit quality and legacy portfolio runoff.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Navient on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a unique take on these figures? Share your perspective and build your narrative in just a few minutes: Do it your way.

A great starting point for your Navient research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Navient’s rising delinquency expenses, unpredictable credit quality, and higher-than-average valuation highlight its vulnerability compared to peers with more consistent financial footing.

If you want to focus on companies with steadier finances and fewer credit risks, check out solid balance sheet and fundamentals stocks screener (1984 results) for investment ideas that emphasize strong balance sheets and financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navient might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVI

Navient

Provides technology-enabled education finance and business processing solutions for education, health care, and government clients in the United States.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives