- United States

- /

- Consumer Finance

- /

- NasdaqGS:NAVI

Navient (NAVI): Evaluating Valuation as Fed Rate Cut Hopes Drive Renewed Investor Interest

Reviewed by Simply Wall St

Navient (NAVI) shares rose sharply as investors reacted to New York Fed President John Williams’ comments hinting at a possible Federal Reserve interest rate cut in December. For lenders, rate cuts can make lending activity more attractive.

See our latest analysis for Navient.

Navient’s 3.1% share price gain today comes on the heels of renewed investor optimism about falling borrowing costs, but this pop stands in contrast to a tough year. While recent updates about its dividend and growth plans got some attention, momentum has mostly faded. The year-to-date share price return is -9.1%, and the one-year total shareholder return is -20.2%, signaling caution even as the stock reacts quickly to shifts in rate expectations.

If you’re curious to see what else might be gathering steam in this market, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding and investor optimism returning, the key question is whether Navient’s current price reflects all the good news already or if there is still an overlooked buying opportunity as the market anticipates future growth.

Most Popular Narrative: 7.9% Undervalued

With Navient's last close at $11.87 and the narrative projecting a fair value almost 8% higher, the market may not be pricing in all key drivers behind the stock's future potential. The stage is set as some analysts see the company's growth strategy and efficiency gains meaningfully improving its earnings outlook.

Expansion in private graduate loans, streamlined federal policies, and efficient securitization position Navient for higher revenues, durable earnings, and improved net margins. Expense reductions, digitization, and borrower technology enhance earnings leverage, market share, and asset quality, supporting long-term growth and profitability.

Curious about what’s fueling this bullish price target? The story hinges on some aggressive growth forecasts and a future profit margin that will surprise even industry insiders. Find out exactly what those bold assumptions are and why they matter so much in the narrative’s calculation.

Result: Fair Value of $12.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit risks or unexpected regulatory shifts could quickly undermine analyst forecasts and challenge Navient’s generally positive outlook.

Find out about the key risks to this Navient narrative.

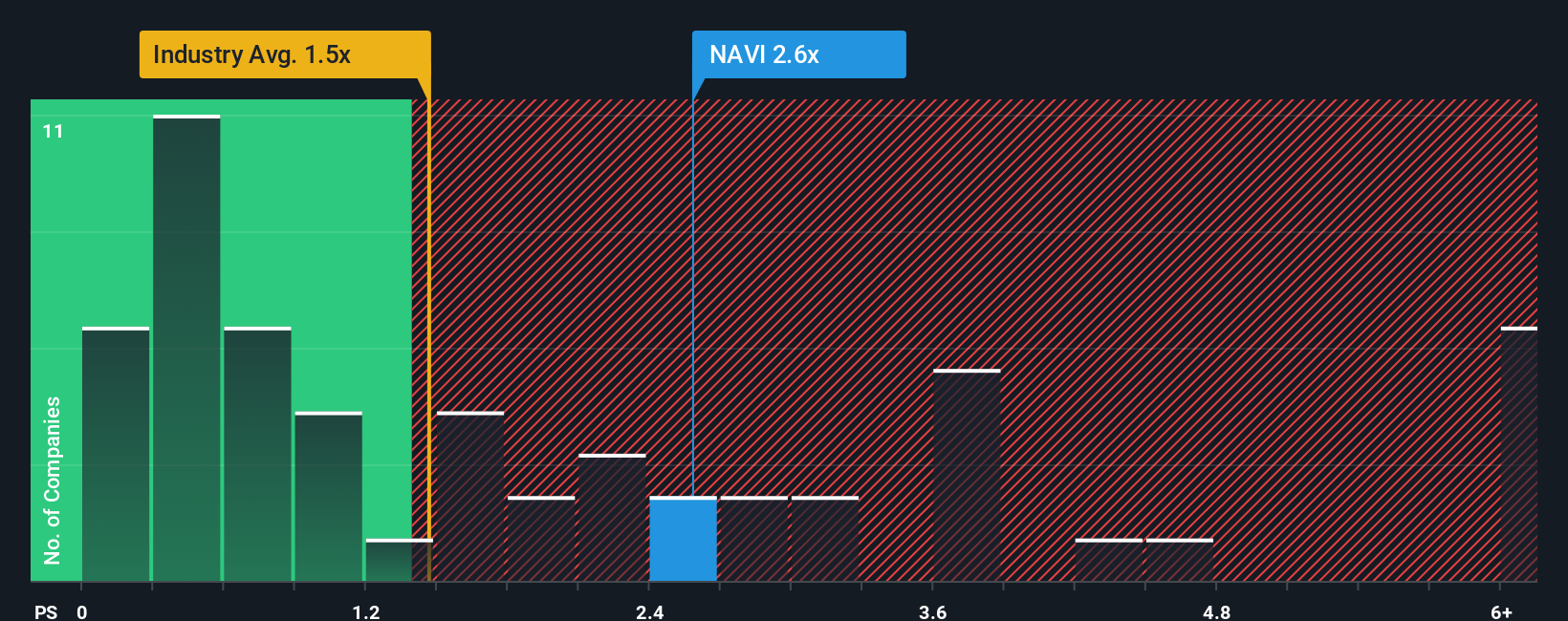

Another View: How Market Ratios Stack Up

Looking from a price-to-sales perspective, Navient trades at 2.6 times sales, which is much higher than the US Consumer Finance industry average of 1.5 times. This is close to the fair ratio estimate of 2.6, suggesting the current price leaves little room for surprise gains. Does this narrower margin raise the stakes for investors, or is it a sign to dig deeper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Navient Narrative

If you want to dig into the numbers or chart your own outlook, it's quick and easy to build your perspective in just a few minutes, so why not Do it your way

A great starting point for your Navient research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your money sit idle while opportunities are multiplying all around you. Make your next smart move with these powerful stock ideas:

- Lock in serious yield potential and steady income with these 15 dividend stocks with yields > 3%, featuring reliable companies proven to reward shareholders year after year.

- Accelerate your portfolio’s growth by tapping into these 26 AI penny stocks, where innovative businesses are setting the pace in artificial intelligence and automation breakthroughs.

- Capitalize on undervalued opportunities by acting on these 918 undervalued stocks based on cash flows, with standout cash flow potential before they catch the wider market’s eye.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navient might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NAVI

Navient

Provides technology-enabled education finance and business processing solutions for education, health care, and government clients in the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives