- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

Marqeta (MQ) Valuation Check After $100 Million Share Buyback Amid Revenue and Margin Challenges

Reviewed by Simply Wall St

Marqeta (MQ) just rolled out a new share repurchase program of up to $100 million. This capital allocation move stands out given its recent revenue declines and margin pressure.

See our latest analysis for Marqeta.

The buyback news lands after a choppy stretch for Marqeta, with a 32.44% year to date share price return but a weaker 3 year total shareholder return of negative 24.12%. This suggests momentum is only cautiously rebuilding around the current 4.94 dollar share price.

If this capital return story has your attention, it is also worth exploring other payment and software driven names through high growth tech and AI stocks to see which platforms have stronger growth and sentiment behind them.

With shares trading about 25% below analyst targets, but revenue still under pressure, is Marqeta a discounted play on payments infrastructure, or is the market already baking in as much future upside as it should?

Most Popular Narrative: 20.1% Undervalued

With Marqeta last closing at 4.94 dollars against a narrative fair value of 6.18 dollars, the story hinges on ambitious growth and profitability shifts.

The completed TransactPay acquisition gives Marqeta full program management and EMI capabilities in Europe, enabling entry into larger enterprise opportunities, uniformity of service across North America and Europe, and easier multi market expansion for clients. This unlocks new revenue streams, increases take rates, and improves earnings scalability.

Curious how steady double digit revenue growth, a sharp swing into profitability, and a premium future earnings multiple all connect to that fair value? Read on.

Result: Fair Value of $6.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Marqeta’s heavy reliance on a few major customers, along with intensifying competition in card issuing, could quickly undermine those optimistic growth and margin assumptions.

Find out about the key risks to this Marqeta narrative.

Another Angle on Valuation

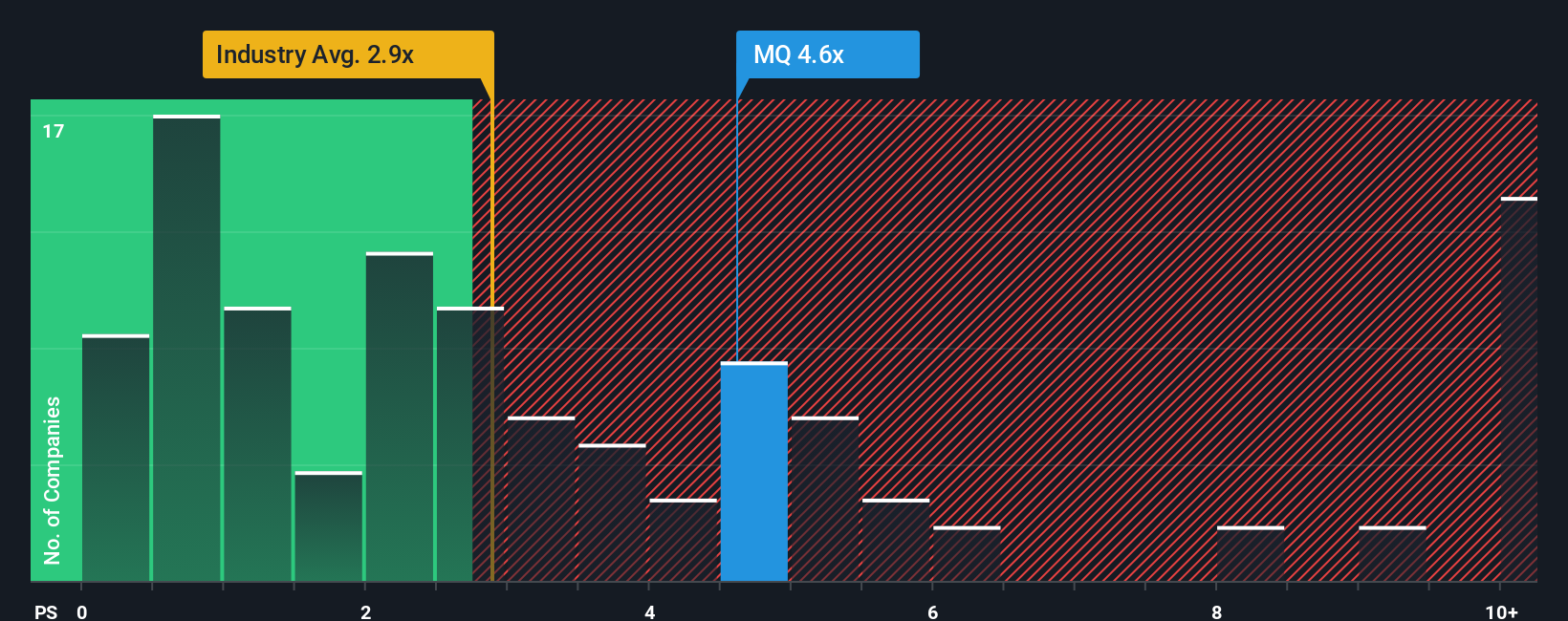

While the narrative fair value suggests upside, the revenue multiple sends a cooler signal. Marqeta trades at 3.7 times sales, well above both peers at 1.4 times and a fair ratio of 2.6 times. If sentiment turns, that gap could unwind quickly, not expand.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marqeta Narrative

If you see the Marqeta story differently, or want to dig into the numbers yourself, you can craft a personalized narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Marqeta.

Looking for more investment ideas?

Before you move on, consider scanning curated stock ideas that match different strategies so you are not focused on just one story.

- Capture potential turnarounds by targeting these 3612 penny stocks with strong financials that pair tiny price tags with resilient fundamentals.

- Explore structural tech themes by focusing on these 26 AI penny stocks positioned in machine learning, automation, and intelligent software platforms.

- Identify value-focused opportunities with these 13 dividend stocks with yields > 3% that emphasize cash payouts as part of total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)