- United States

- /

- Diversified Financial

- /

- NasdaqGS:MQ

How Investors Are Reacting To Marqeta (MQ) Class Action Investigation Over Regulatory Disclosures

Reviewed by Sasha Jovanovic

- Bragar Eagel & Squire, P.C. recently announced an investigation into Marqeta, Inc. on behalf of long-term shareholders following a class action complaint that alleges the company understated regulatory challenges, prompting a cut to its Q4 2024 guidance.

- This investigation could raise questions about Marqeta’s prior disclosures and the risk of regulatory headwinds impacting its business outlook and investor confidence.

- Given the heightened regulatory concerns raised in the class action complaint, we’ll consider how this development may influence Marqeta’s investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Marqeta Investment Narrative Recap

To be a Marqeta shareholder, you have to believe the company can maintain its role as a technology leader powering modern card-issuing while withstanding customer concentration and regulatory risks. The recent investigation into Marqeta’s prior disclosures may intensify concerns over regulatory headwinds, currently the biggest risk to the business, but at present, there is no indication that it materially changes the near-term catalysts around customer wins or innovation-driven growth.

Among recent company announcements, Marqeta’s raised full-year revenue guidance stands out. While strong lending and expense management performance had boosted growth outlooks, the regulatory scrutiny highlighted by the investigation may now be an even more important factor influencing execution and investor sentiment around these targets.

Yet in contrast to the optimism around new product launches, rising compliance and regulatory costs could be a more immediate concern investors should be aware of…

Read the full narrative on Marqeta (it's free!)

Marqeta's narrative projects $900.6 million revenue and $47.9 million earnings by 2028. This requires 17.6% yearly revenue growth and a $112.6 million increase in earnings from -$64.7 million today.

Uncover how Marqeta's forecasts yield a $7.02 fair value, a 42% upside to its current price.

Exploring Other Perspectives

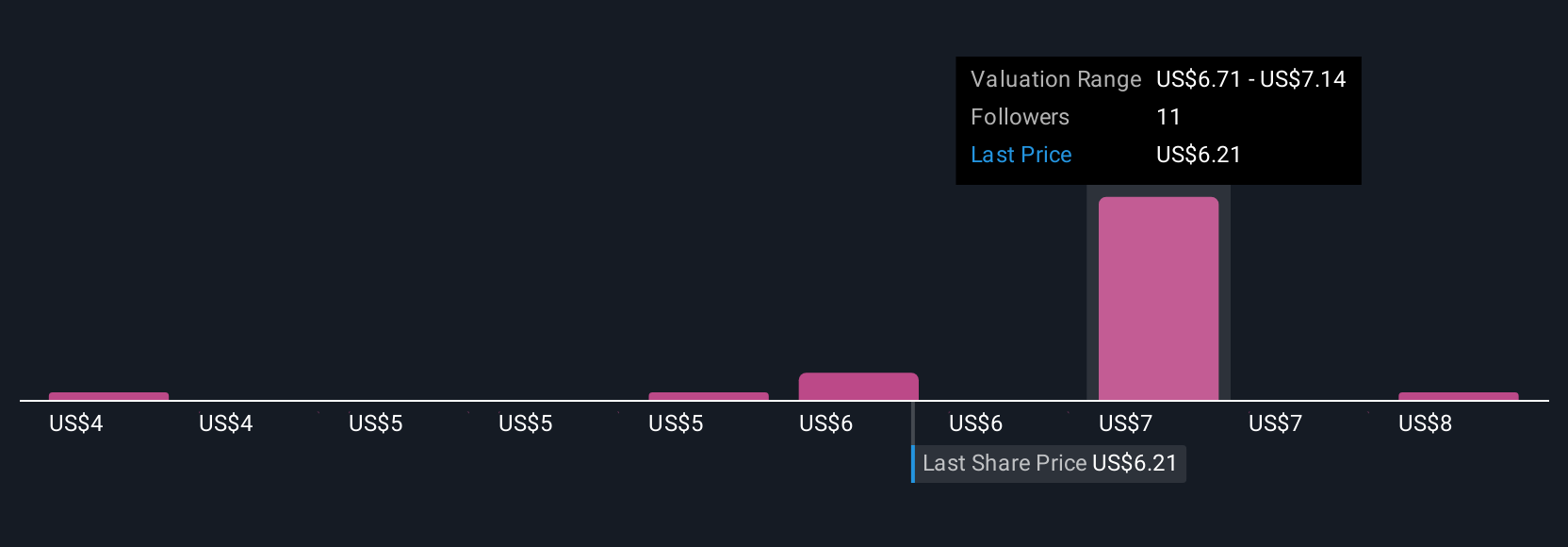

Six fair value estimates from the Simply Wall St Community span from US$3.70 to US$8.00, highlighting wide-ranging opinions. In light of ongoing regulatory risks, these different viewpoints suggest you may want to consider several scenarios for Marqeta’s future performance.

Explore 6 other fair value estimates on Marqeta - why the stock might be worth 25% less than the current price!

Build Your Own Marqeta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marqeta research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Marqeta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marqeta's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MQ

Marqeta

Operates a cloud-based open API platform for card issuing and transaction processing services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives