- United States

- /

- Capital Markets

- /

- NasdaqGS:MORN

Can Morningstar (MORN) Redefine Benchmarking or Does the New Index Reinforce Old Perceptions?

Reviewed by Simply Wall St

- Morningstar, Inc. recently launched the PitchBook US Modern Market 100 Index, a first-of-its-kind benchmark combining 90 leading US-listed companies and 10 major VC-backed private firms such as SpaceX, OpenAI, and Stripe into a single measure of the modern equity landscape.

- This new index offers investors unified access to both public and significant late-stage private equity exposure, reflecting market demand for more inclusive benchmarks, especially in innovative technology-driven sectors often underrepresented in traditional indexes.

- We'll explore how this blended public-private equity index strengthens Morningstar's investment narrative as a provider of advanced benchmarking tools.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Morningstar's Investment Narrative?

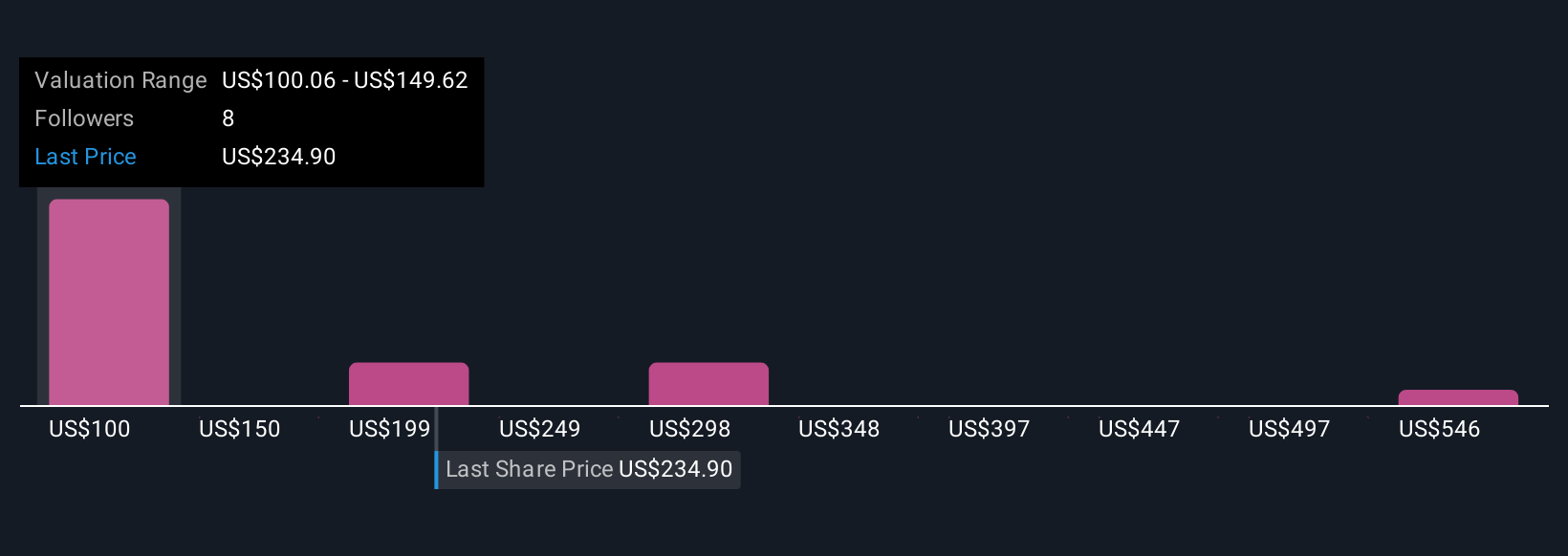

To own shares of Morningstar, you need a belief in the company's long-term commitment to delivering new data-driven tools for global investors and advisors. The recent launch of the PitchBook US Modern Market 100 Index brings an innovative dimension by merging public and late-stage private equity into a single, investable benchmark, directly answering the growing demand for better access to innovation-focused assets. While this new product signals Morningstar’s ongoing efforts to broaden its reach and enhance its relevance amid competitive headwinds, initial market reaction has been muted and share price remains well below analyst targets. The steady dividend affirms confidence in near-term cash flows, but after a period of earnings featuring one-off gains and softer top-line growth, the biggest catalyst remains Morningstar’s ability to translate flagship index launches and recent product enhancements into recurring revenues. The primary risk is market skepticism about the financial impact of these new solutions, given the company’s recent underperformance against the broader US market and industry peers.

But with all this innovation, slow revenue growth is a key concern to watch. Morningstar's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MORN

Morningstar

Provides independent investment insights in the United States, Asia, Australia, Canada, Continental Europe, the United Kingdom, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives