- United States

- /

- Capital Markets

- /

- NasdaqGS:MKTX

The Bull Case For MarketAxess Holdings (MKTX) Could Change Following Divergent Trading Volumes and International Expansion

Reviewed by Sasha Jovanovic

- MarketAxess Holdings Inc. recently announced a 4% year-over-year decline in third-quarter average daily trading volume, primarily driven by weaker activity in U.S. High-Grade Credit and U.S. Government Bonds, but saw double-digit growth in Eurobonds and Emerging Markets trading volumes.

- A key development includes the company's rollout of new electronic trading workflows, such as for Indian Government Bonds, as part of its effort to diversify and expand international market reach.

- We'll examine how the growth in emerging markets credit trading could impact MarketAxess's investment narrative and longer-term outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

MarketAxess Holdings Investment Narrative Recap

To be a shareholder of MarketAxess Holdings, you have to believe in the company's ability to broaden its revenue base through geographic and asset class expansion, as reliance on the U.S. High-Grade Credit market creates concentration risk. The recent update, a 4% year-over-year decline in total trading volume despite robust growth in Eurobonds and Emerging Markets, is important, but it does not materially change the biggest short-term catalyst, which remains the company's push to bring more large institutional trading blocks onto its electronic platform. However, the trend of shifting business to lower-margin protocols remains a key risk to watch.

The rollout of the fully electronic trading workflow for Indian Government Bonds directly ties into recent growth in emerging markets trading volumes. This move exemplifies MarketAxess’s ongoing effort to diversify revenue streams, providing exposure to new client segments and asset classes that could support the company's largest growth catalyst, expanding international market share and volume.

By contrast, investors should not overlook how lower average fee capture as trading shifts to portfolio or lower-margin protocols could become a significant headwind if...

Read the full narrative on MarketAxess Holdings (it's free!)

MarketAxess Holdings' outlook anticipates $1.1 billion in revenue and $370.5 million in earnings by 2028. This is based on a projected 7.9% annual revenue growth rate and an increase in earnings of $147.7 million from the current $222.8 million.

Uncover how MarketAxess Holdings' forecasts yield a $212.08 fair value, a 20% upside to its current price.

Exploring Other Perspectives

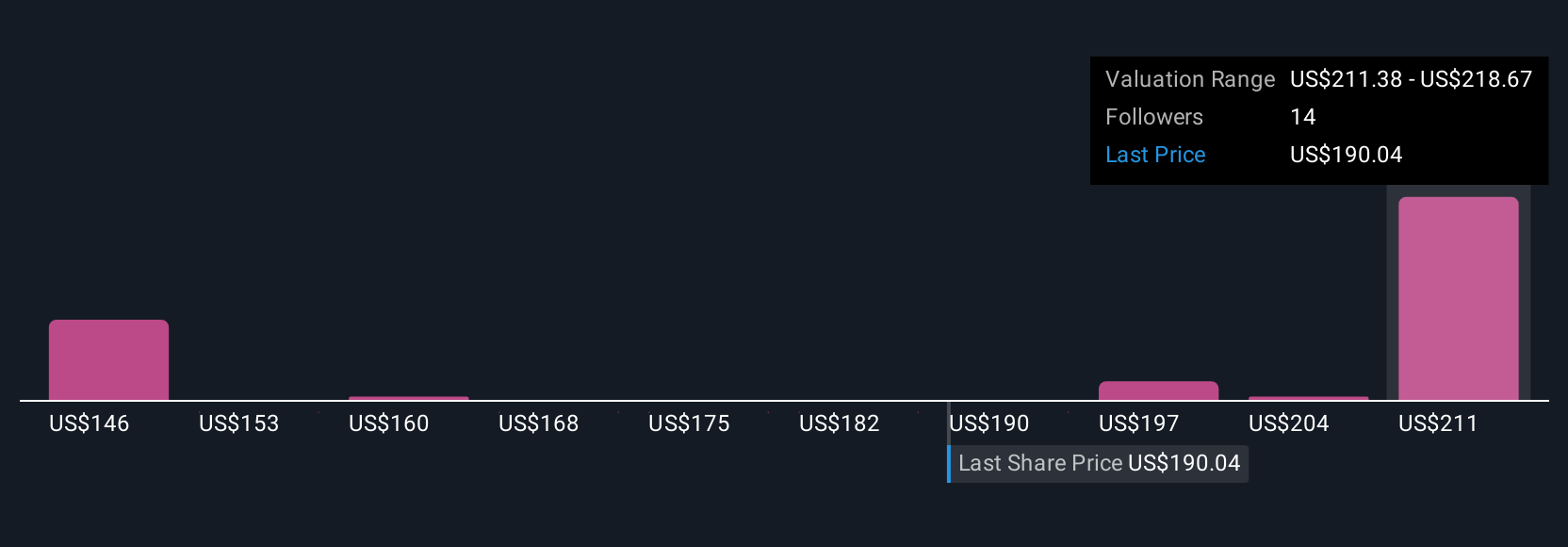

Six Simply Wall St Community members valued MarketAxess Holdings between US$144.19 and US$212.08 per share. With market participants considering fee compression and competitive risks, be aware how differing views shape expectations for future performance.

Explore 6 other fair value estimates on MarketAxess Holdings - why the stock might be worth as much as 20% more than the current price!

Build Your Own MarketAxess Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MarketAxess Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MarketAxess Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKTX

MarketAxess Holdings

Operates an electronic trading platform for institutional investor and broker-dealer firms in the United States, the United Kingdom, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives