- United States

- /

- Capital Markets

- /

- NasdaqCM:MEGL

Magic Empire Global Leads This Trio Of Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight downturn following a recent rally, investors are increasingly drawn to opportunities that might offer both resilience and growth potential. Penny stocks, despite their somewhat antiquated label, continue to attract attention as they often represent smaller or emerging companies with unique prospects. By focusing on those with strong financial foundations and clear growth paths, investors can uncover valuable opportunities within this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.82 | $403.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.57 | $2.28B | ✅ 3 ⚠️ 3 View Analysis > |

| Peraso (NasdaqCM:PRSO) | $0.8062 | $2.92M | ✅ 5 ⚠️ 4 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.74 | $78.85M | ✅ 5 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ✅ 1 ⚠️ 5 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.41 | $454.11M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.59 | $77.35M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.84 | $6.03M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $136.47M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8281 | $76.45M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 765 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Magic Empire Global (NasdaqCM:MEGL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magic Empire Global Limited operates in Hong Kong, offering corporate finance advisory and underwriting services, with a market cap of $3.04 million.

Operations: The company's revenue is primarily derived from its brokerage segment, which generated HK$15.43 million.

Market Cap: $3.04M

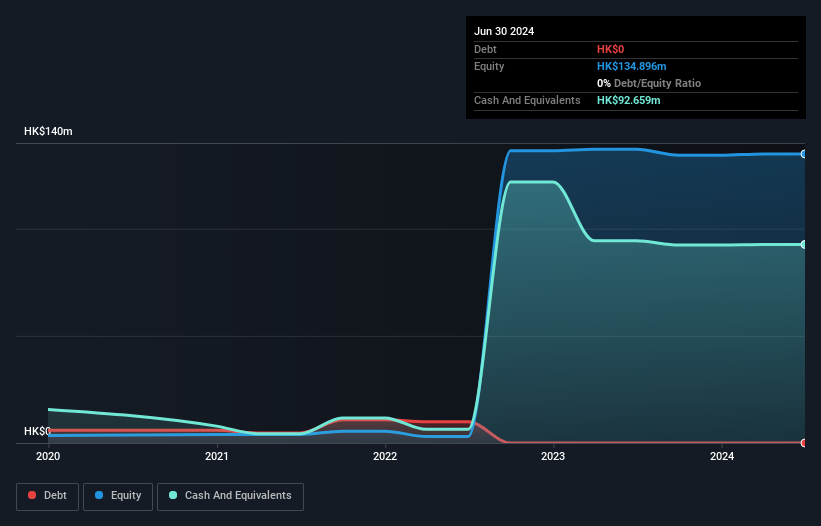

Magic Empire Global Limited, with a market cap of US$3.04 million, recently resolved a Nasdaq bid price deficiency, regaining compliance with listing requirements after its stock maintained a closing bid price of $1.00 for 10 consecutive days. Despite having no debt and short-term assets significantly exceeding liabilities (HK$95.7M vs HK$1.7M), the company is unprofitable and has seen losses increase by 82.3% annually over five years. Revenue from its brokerage segment stands at HK$15 million, indicating limited meaningful revenue streams while volatility remains high, reflecting the inherent risks associated with penny stocks like MEGL.

- Get an in-depth perspective on Magic Empire Global's performance by reading our balance sheet health report here.

- Gain insights into Magic Empire Global's past trends and performance with our report on the company's historical track record.

Angi (NasdaqGS:ANGI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Angi Inc. operates as a platform connecting home service professionals with consumers both in the United States and internationally, with a market cap of approximately $790.43 million.

Operations: Angi's revenue is primarily derived from its Domestic - ADS and Leads segment, which generated $962.60 million, followed by the International segment at $128.99 million and Domestic - Services at $93.52 million.

Market Cap: $790.43M

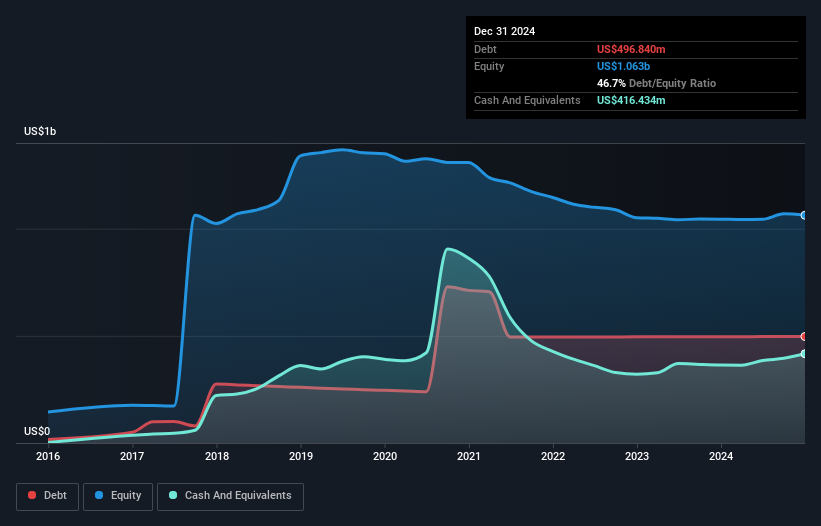

Angi Inc., with a market cap of approximately US$790.43 million, has recently achieved profitability, reporting a net income of US$36 million for 2024 compared to a net loss the previous year. The company's debt is well managed, with interest payments covered by EBIT and operating cash flow covering 31.4% of its debt. However, Angi's short-term assets do not fully cover its long-term liabilities, indicating potential financial strain. Recent corporate changes include executive shifts and an impending spin-off from IAC Inc., which could impact future strategic directions and shareholder value amidst ongoing restructuring efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Angi.

- Examine Angi's earnings growth report to understand how analysts expect it to perform.

Blend Labs (NYSE:BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. offers a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $921.80 million.

Operations: The company generates revenue through its Blend Platform, which accounts for $115.76 million, and Title services, contributing $46.26 million.

Market Cap: $921.8M

Blend Labs, Inc., with a market cap of US$921.80 million, offers a cloud-based software platform for financial services firms and is currently unprofitable. Despite this, the company has no debt and maintains a cash runway exceeding three years based on current free cash flow. Recent strategic partnerships with Leader Bank and Talk’uments enhance its mortgage lending capabilities by integrating automated workflows and multilingual support, respectively. Additionally, Blend's collaboration with Truework aims to streamline income verification processes for lenders. The company's recent shelf registration filing suggests potential capital raising activities to support ongoing growth initiatives.

- Dive into the specifics of Blend Labs here with our thorough balance sheet health report.

- Gain insights into Blend Labs' future direction by reviewing our growth report.

Summing It All Up

- Get an in-depth perspective on all 765 US Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Magic Empire Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MEGL

Magic Empire Global

Provides corporate finance advisory services in Hong Kong.

Flawless balance sheet slight.

Market Insights

Community Narratives