- United States

- /

- Diversified Financial

- /

- NasdaqCM:MBIN

Merchants Bancorp (MBIN): Assessing Valuation in Light of Recent Federal Reserve Rate Cut

Reviewed by Kshitija Bhandaru

The Federal Reserve’s unexpected decision to cut its benchmark interest rate by a quarter point, alongside hints of more cuts to come, is making waves across the financial sector. Merchants Bancorp (MBIN) is feeling this ripple effect, with its shares climbing in the immediate aftermath of the announcement. Rate cuts generally lighten the funding cost burden for banks and could open doors to increased lending and profitability. This dynamic has many investors rethinking their outlook on MBIN and its peers.

This latest move from the Fed injects a fresh narrative into a year that has otherwise been tricky for Merchants Bancorp. Despite a brief rally after the news, MBIN’s stock remains down 28% over the past year. Short-term momentum is mixed, with modest gains last week but declines over the past month and three months. When viewed over a longer period, the bank has delivered a strong 395% return over three years and an even higher five-year performance, indicating that bigger forces and long-term growth potential may be at play beneath the recent volatility.

With the latest shift in Fed policy and MBIN’s history of long-run growth, is there overlooked value here, or is the market already factoring in expectations for a rebound?

Price-to-Earnings of 7x: Is it justified?

Based on its price-to-earnings (P/E) ratio, Merchants Bancorp appears undervalued compared to both its industry peers and the broader market. The company is trading at a P/E of 7, which is significantly lower than the peer average of 17.4 and the US diversified financial industry average of 16.8.

The P/E ratio compares a company’s market price to its earnings per share, offering investors a sense of whether a stock is expensive or cheap relative to its earnings. In the financial sector, this metric is especially important as it reflects how the market values current profitability and future growth prospects.

Given that MBIN is priced much lower than comparable firms, this suggests that the market could be discounting the bank’s future earnings potential. However, if MBIN’s earnings stabilize or improve, the current valuation may prove attractive for value-focused investors.

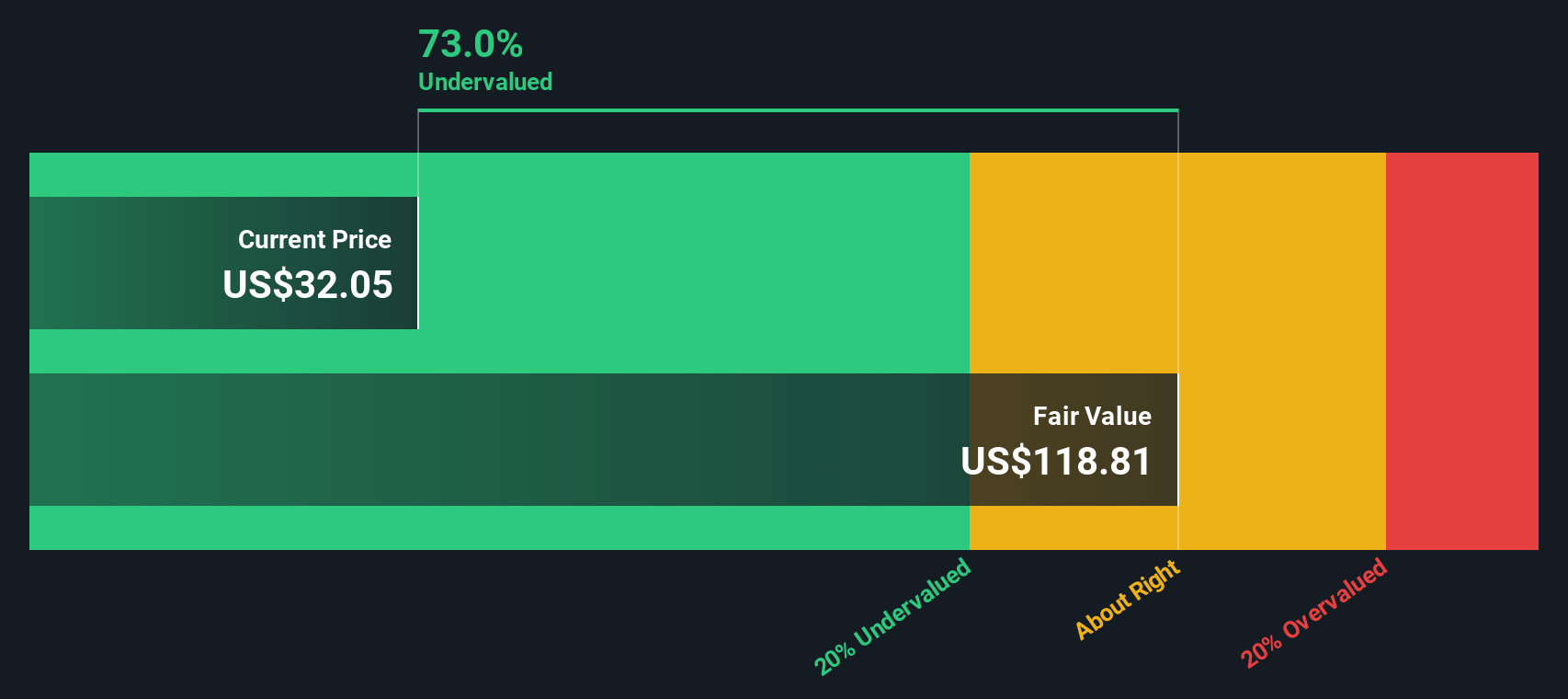

Result: Fair Value of $117.9 (UNDERVALUED)

See our latest analysis for Merchants Bancorp.However, ongoing volatility in returns and uncertain future earnings could still challenge the bullish outlook for Merchants Bancorp in the months ahead.

Find out about the key risks to this Merchants Bancorp narrative.Another View

Looking at Merchants Bancorp through our DCF model gives another angle. This approach suggests the market is still undervaluing shares, which is consistent with the earlier conclusion. However, does this method truly capture what matters most to investors?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Merchants Bancorp to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Merchants Bancorp Narrative

If you want to challenge these results or prefer your own analysis, you can put together your independent assessment of Merchants Bancorp in just a few minutes. Do it your way.

A great starting point for your Merchants Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one angle. Broaden your portfolio by using the Simply Wall Street Screener. Miss this, and you could leave potential gains on the table.

- Uncover the world of hidden opportunities by checking out penny stocks with strong financials and see which lesser-known companies have the financial muscle to surprise the market.

- Power up your strategy with breakthrough picks in artificial intelligence by browsing AI penny stocks, where innovation and growth potential meet.

- Lock in reliable income streams by targeting stocks offering above-market returns with dividend stocks with yields > 3% and grow your wealth while you sleep.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBIN

Merchants Bancorp

Operates as the diversified bank holding company in the United States.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives