- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

How Do LPL Financial’s (LPLA) Acquisition Moves Reshape Its Growth and Capital Priorities?

Reviewed by Sasha Jovanovic

- LPL Financial Holdings Inc. recently reported its third quarter 2025 results, showing revenue of US$4.55 billion but experiencing a net loss of US$29.52 million compared to net income a year earlier, alongside ongoing focus on acquisitions, organic growth investment, and a declared US$0.30 per share dividend.

- An interesting observation is that despite not repurchasing any shares in the latest quarter, LPL has completed over 36.42 million shares in buybacks since 2014, while also closing the Commonwealth acquisition and maintaining a capital allocation framework prioritizing both growth and shareholder returns.

- We'll now examine how LPL Financial Holdings' recent financial results and acquisition activities affect its long-term investment outlook and growth thesis.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

LPL Financial Holdings Investment Narrative Recap

To be a shareholder in LPL Financial Holdings, you need to see long-term opportunity in the company’s ability to leverage advisor recruitment, expand its technology platform, and successfully integrate recent acquisitions amid industry fee compression and interest rate sensitivity. The third quarter’s net loss is a short-term setback, but it does not materially affect the most important catalyst, continued advisor and asset growth, while the biggest risk remains execution on recent M&A and integration.

The recently closed acquisition of Commonwealth is especially relevant, showcasing ongoing efforts to scale and increase earnings potential. This aligns with LPL’s strategic focus on both organic and acquired growth as a primary driver, even as quarterly earnings face volatility.

By contrast, investors should pay close attention to the ongoing challenge of margin pressure from falling interest rates and shrinking fee income if …

Read the full narrative on LPL Financial Holdings (it's free!)

LPL Financial Holdings' narrative projects $23.0 billion revenue and $1.9 billion earnings by 2028. This requires 18.7% yearly revenue growth and an increase of $0.8 billion in earnings from the current $1.1 billion.

Uncover how LPL Financial Holdings' forecasts yield a $420.93 fair value, a 12% upside to its current price.

Exploring Other Perspectives

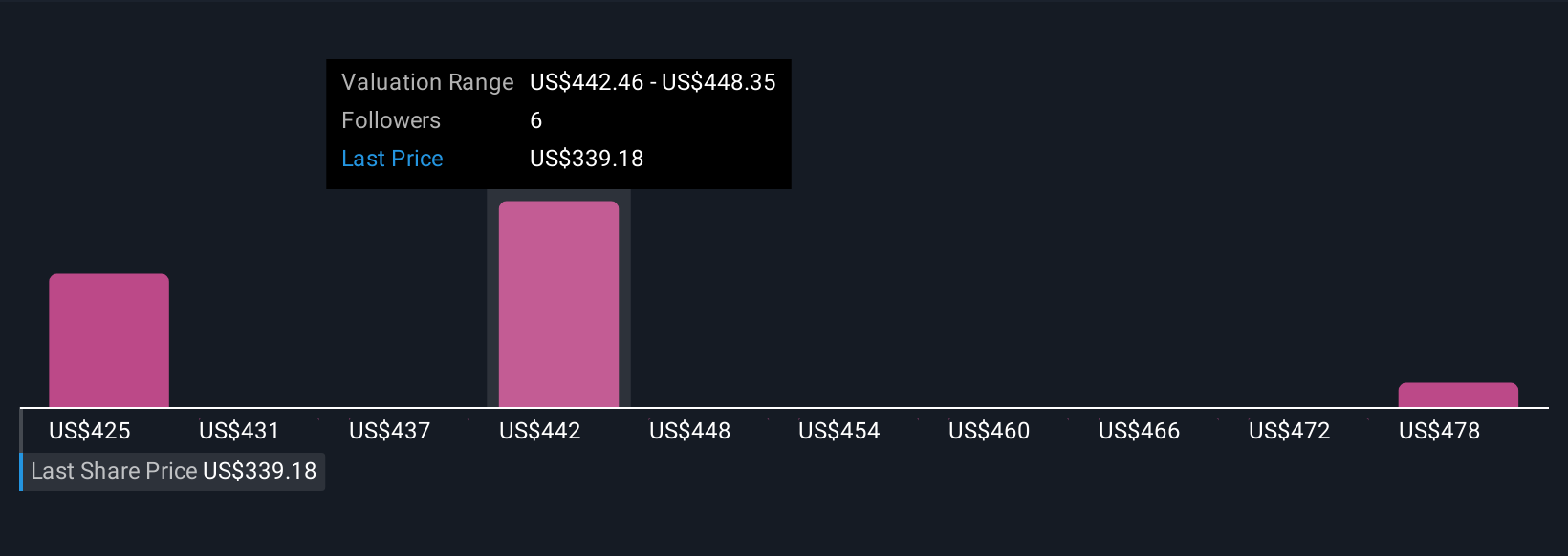

Simply Wall St Community members have placed fair value estimates for LPL Financial Holdings between US$358 and US$484 from 3 analyses, with wide variations reflecting different growth forecasts. With execution on recent acquisitions being a current focal point, these varied outlooks signal the importance of individual research before forming an opinion.

Explore 3 other fair value estimates on LPL Financial Holdings - why the stock might be worth just $358.17!

Build Your Own LPL Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LPL Financial Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free LPL Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LPL Financial Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives