- United States

- /

- Capital Markets

- /

- NasdaqGS:LPLA

A Fresh Look at LPL Financial (LPLA) Valuation Following Latest Wealth Management Team Addition

Reviewed by Simply Wall St

LPL Financial Holdings (LPLA) has announced that Longstreet Wealth Management, managing around $175 million in assets, is transitioning from Raymond James to LPL’s broker-dealer and Registered Investment Advisor platform. This move highlights LPL’s appeal for experienced advisory teams seeking technology-driven and flexible solutions.

See our latest analysis for LPL Financial Holdings.

LPL Financial Holdings’ ability to attract experienced teams like Longstreet Wealth Management has kept investor confidence high, with a 6.13% share price return year to date and a robust 6.7% total shareholder return over the past year. That momentum builds on impressive long-term results, including a 47.1% total return over three years and a remarkable 282.5% over five years. This suggests the stock’s growth story is still in play even as short-term price moves remain mixed.

If you’re curious what other fast-moving companies with insider conviction are getting attention, now’s a great time to broaden your investing universe and spot fast growing stocks with high insider ownership

With LPL shares still trading at a meaningful discount to analyst price targets, investors may be wondering whether this signals an undervalued opportunity for new investors or if the market is already factoring in the company’s potential for future growth.

Most Popular Narrative: 17.3% Undervalued

With analysts setting fair value at $420.93 and the last close at $348.10, the narrative points to meaningful upside if growth targets are hit. The price gap centers attention on whether LPL’s long-term earnings power is being underestimated by the current market.

Strategic investments in proprietary technology platforms and automation are driving ongoing operational efficiencies, leading to improved operating leverage and sustainable gains in net margins. This is reflected in enhanced margin guidance and cost discipline initiatives that are ahead of schedule.

Want to know what fuels this ambitious price target? The foundation is a bullish take on how tech upgrades could boost profitability, plus expectations for growth rates not seen in years. What is the missing link behind the math? Only a deeper look reveals which forecasted leaps in revenue and margins are wired into this number.

Result: Fair Value of $420.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as margin pressure from fee compression and volatility from rate-sensitive revenues. These factors could dampen LPL’s growth outlook.

Find out about the key risks to this LPL Financial Holdings narrative.

Another View: Pricing by Peers and Industry Standards

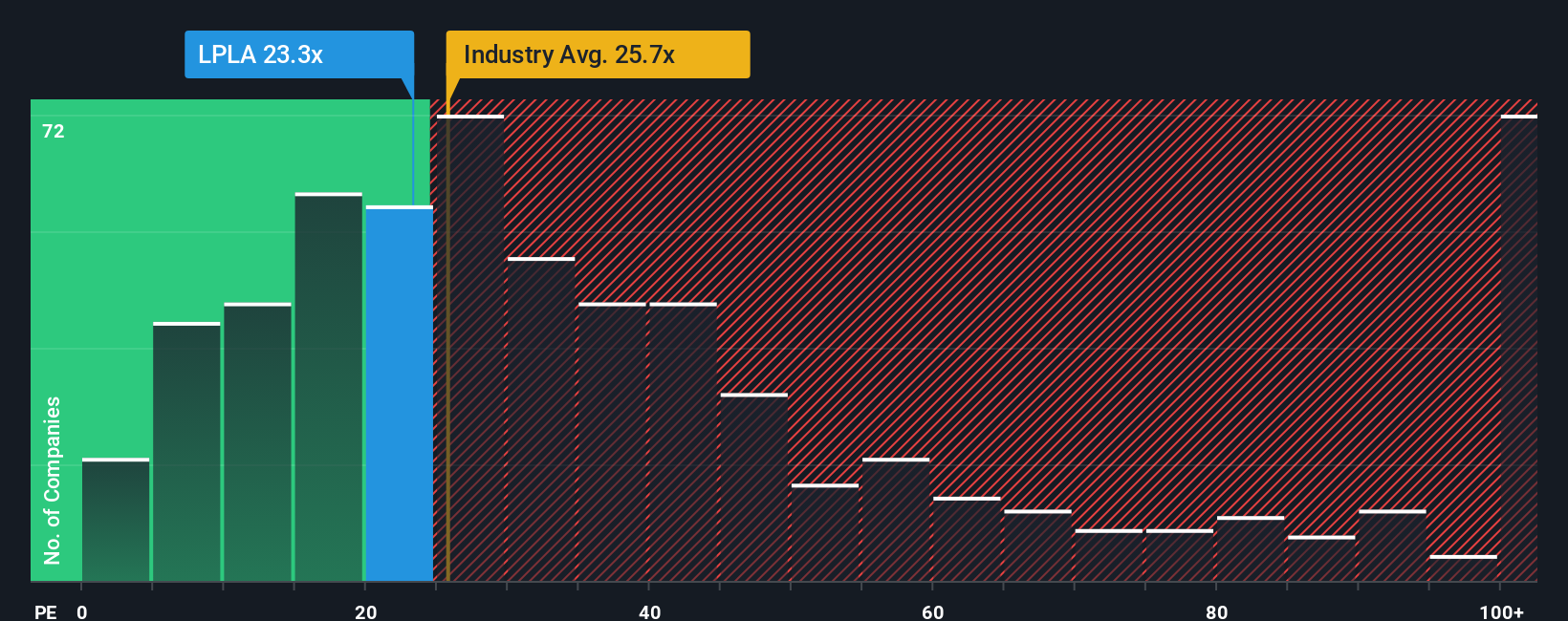

Looking at LPL Financial Holdings from a pricing perspective, its price-to-earnings ratio stands at 33.4x, much higher than the US Capital Markets industry average of 23.2x and the peer average of 21.2x. In addition, it is well above the fair ratio calculated at 21.5x. This premium signals that investors may be paying steeply for growth expectations. The question remains whether this optimism is really justified or if it exposes the share to correction risk if the outlook cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LPL Financial Holdings Narrative

If you want to challenge this view or believe you have fresh insights from your own analysis, crafting your personal perspective is quick and straightforward. Typically, it takes under three minutes, so why not Do it your way

A great starting point for your LPL Financial Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Market Opportunities?

Smart investors keep their options open. Don’t miss out on fresh high-potential stocks by using the Simply Wall St Screener for fast access to new ideas shaping the market.

- Capture hidden value plays by reviewing these 924 undervalued stocks based on cash flows with standout fundamentals at attractive prices.

- Boost your income potential with these 14 dividend stocks with yields > 3% featuring robust dividend yields above 3%.

- Tap into healthcare’s next wave by checking these 30 healthcare AI stocks which brings artificial intelligence to medical innovation and patient care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LPLA

LPL Financial Holdings

Provides an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success