- United States

- /

- Diversified Financial

- /

- NasdaqGS:JKHY

A Look at Jack Henry & Associates (JKHY) Valuation as Shares Struggle to Regain Momentum

Reviewed by Kshitija Bhandaru

Jack Henry & Associates (JKHY) shares have seen modest movement recently, with the stock closing at $154.46 and delivering a slight uptick of 0.2% over the past day. Investors are taking stock of its performance over the past month and quarter, where returns have softened. This has prompted some to revisit its longer-term growth outlook.

See our latest analysis for Jack Henry & Associates.

After a notably weak run through the past quarter, Jack Henry & Associates is still looking to regain its momentum. The share price has slid this year, and its 1-year total shareholder return is down 15.7%, reminding investors that recent price moves reflect broader caution around growth and valuation expectations.

If you’re weighing your options after this shift, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

This all raises a crucial question: are Jack Henry & Associates shares quietly trading at a discount, or are current prices a fair reflection of its growth prospects and already factored into the market?

Most Popular Narrative: 15.7% Undervalued

Jack Henry & Associates is trading at $154.46, while the most popular narrative sets fair value at $183.18, a meaningfully higher level. The gap raises questions about the growth drivers behind that valuation, building anticipation for the perspective that follows.

The company is experiencing accelerated adoption of its cloud-native platforms and SaaS offerings (cloud revenue up 11% year-over-year, now 32% of total revenue and 77% of core clients hosted in private cloud), which is expected to drive higher recurring revenue, improved margins, and higher free cash flow conversion as legacy on-premise contracts decline.

What’s fueling this premium? The narrative hinges not just on digital transformation, but a blend of sticky high-value clients, recurring contracts, and sector dynamics most investors overlook. Want to see the quantitative assumptions and bold forecasts shaping this story? The numbers might surprise you, so dive in to unlock the details behind this valuation.

Result: Fair Value of $183.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing industry consolidation and contract pricing pressure remain meaningful headwinds that could limit Jack Henry’s growth and threaten this bullish narrative.

Find out about the key risks to this Jack Henry & Associates narrative.

Another View: What Do Market Ratios Say?

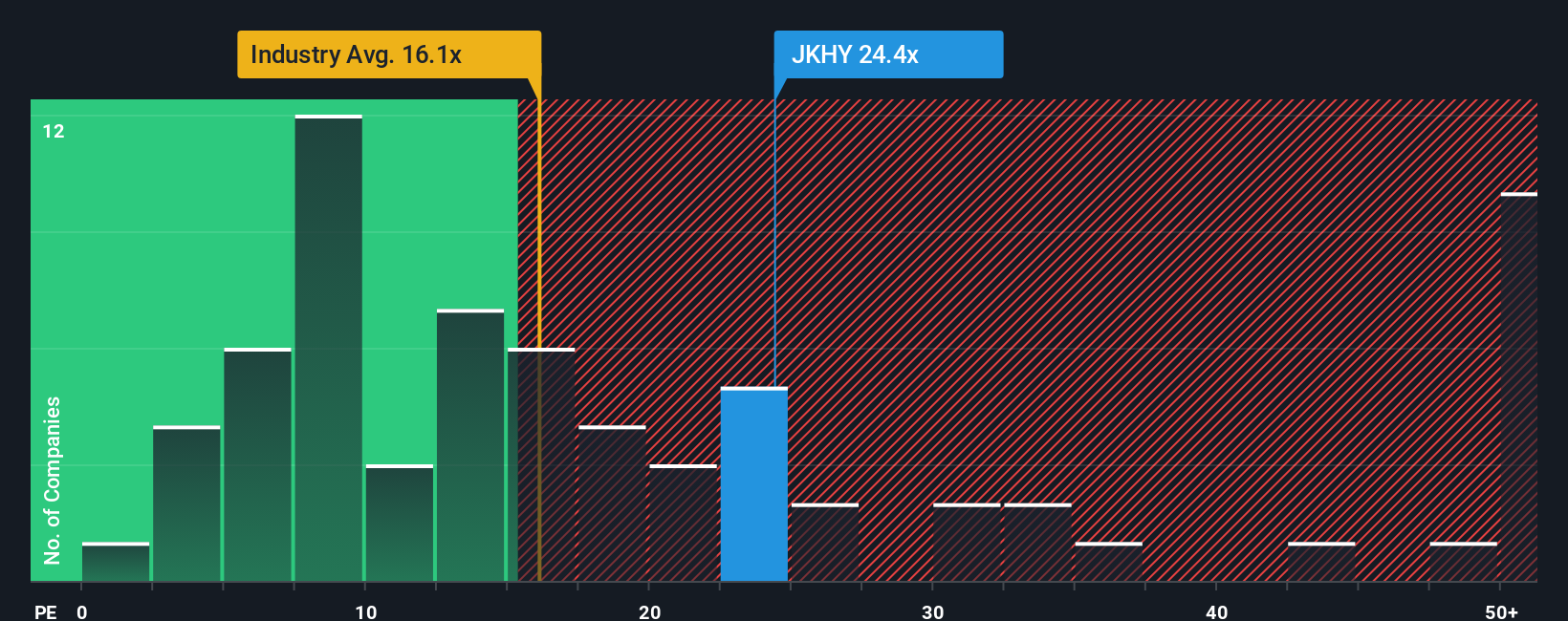

While the popular narrative pegs Jack Henry & Associates as undervalued, market ratios tell a different story. Its price-to-earnings ratio is 24.6x, which is well above both the peer average (18.8x) and the US Diversified Financial industry average (16x), and considerably higher than its fair ratio of 15x. This premium suggests investors could be paying up for perceived stability or future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jack Henry & Associates Narrative

If this story doesn’t fit your view or you want to dig deeper, you can chart your own course and uncover insights in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Jack Henry & Associates.

Looking for More Smart Investment Ideas?

Don’t rely on just one stock when a world of fresh opportunities awaits; see what’s possible with the right approach and a few minutes of research.

- Find untapped value by reviewing these 872 undervalued stocks based on cash flows where profitable companies could be trading for less than they’re worth.

- Capitalize on disruptive technology by starting with these 24 AI penny stocks and look into businesses advancing artificial intelligence and automation.

- Strengthen your passive income by checking out these 18 dividend stocks with yields > 3% and find companies offering yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JKHY

Jack Henry & Associates

Operates as a financial technology company that connects people and financial institutions through technology solutions and payment processing services.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives