- United States

- /

- Consumer Finance

- /

- NasdaqGM:JFIN

Unearthing Hidden Gems in the US Market November 2024

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, but over the past 12 months, it has risen by an impressive 33%, with earnings expected to grow by 15% per annum in the coming years. In light of these conditions, identifying stocks with strong fundamentals and growth potential can uncover hidden gems that may offer promising opportunities for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Nanophase Technologies | 40.87% | 24.19% | -9.71% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

IBEX (NasdaqGM:IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-enabled customer lifecycle experience solutions globally and has a market cap of $326.58 million.

Operations: IBEX Limited generates revenue primarily from its Business Process Outsourcing segment, which accounts for $513.68 million. The company's market cap stands at $326.58 million.

IBEX, a nimble player in the professional services sector, has shown commendable financial health with no debt and high-quality earnings. Over the past five years, its earnings have surged at an impressive 41.4% annually. Despite trading at a significant discount of 76.9% below estimated fair value, IBEX's recent quarterly results reveal steady growth with sales reaching US$129.72 million and net income at US$7.53 million for Q1 2025. The company repurchased shares worth US$3.13 million recently, reflecting confidence in its valuation amidst ongoing expansion efforts like their new AI solutions and Honduras operations enlargement.

- Click here and access our complete health analysis report to understand the dynamics of IBEX.

Understand IBEX's track record by examining our Past report.

Jiayin Group (NasdaqGM:JFIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiayin Group Inc., with a market cap of $345.77 million, operates in the People’s Republic of China offering online consumer finance services through its subsidiaries.

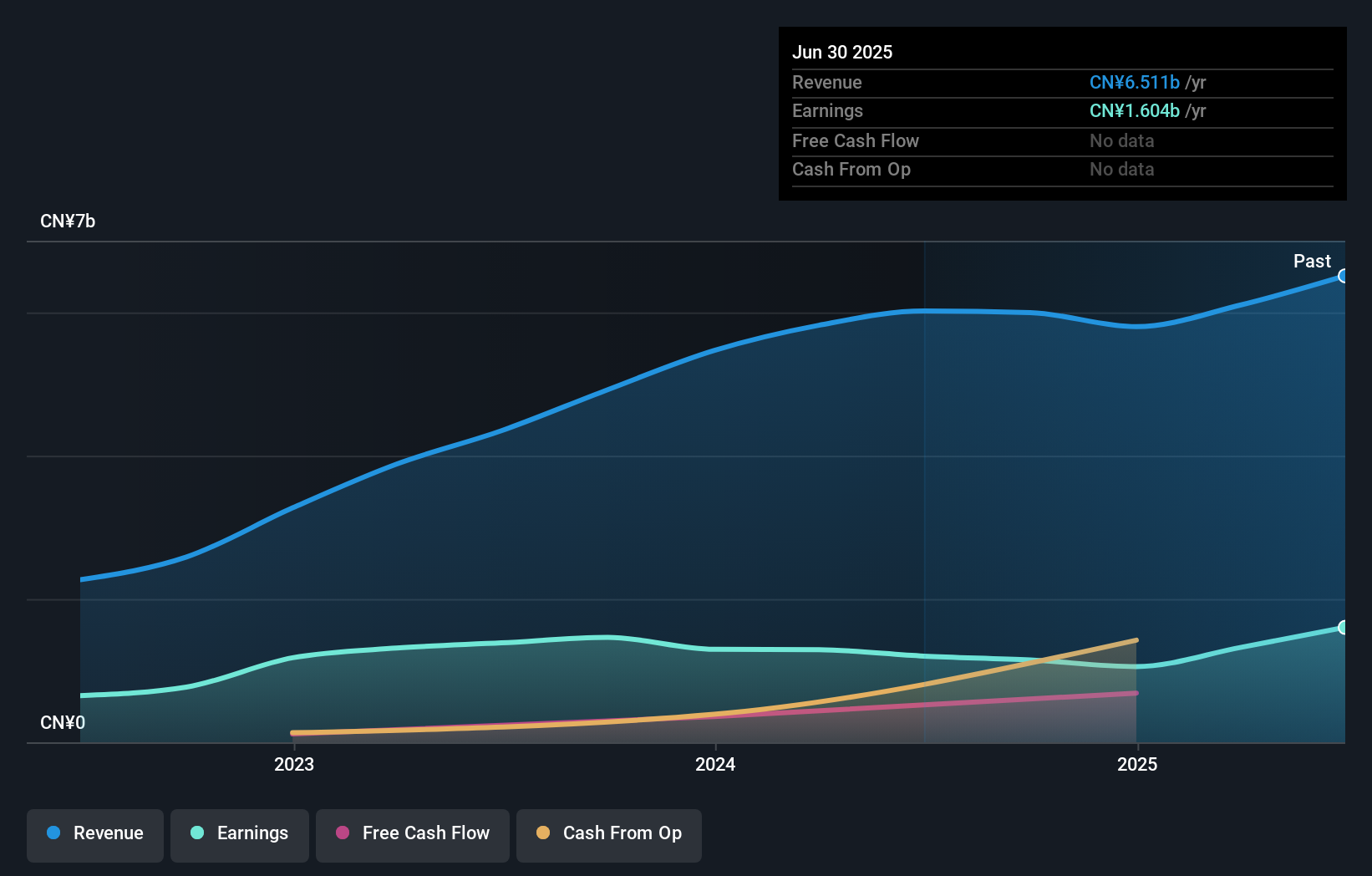

Operations: Jiayin Group generates revenue primarily from its online consumer finance services, amounting to CN¥6.02 billion. The company reports a market cap of $345.77 million.

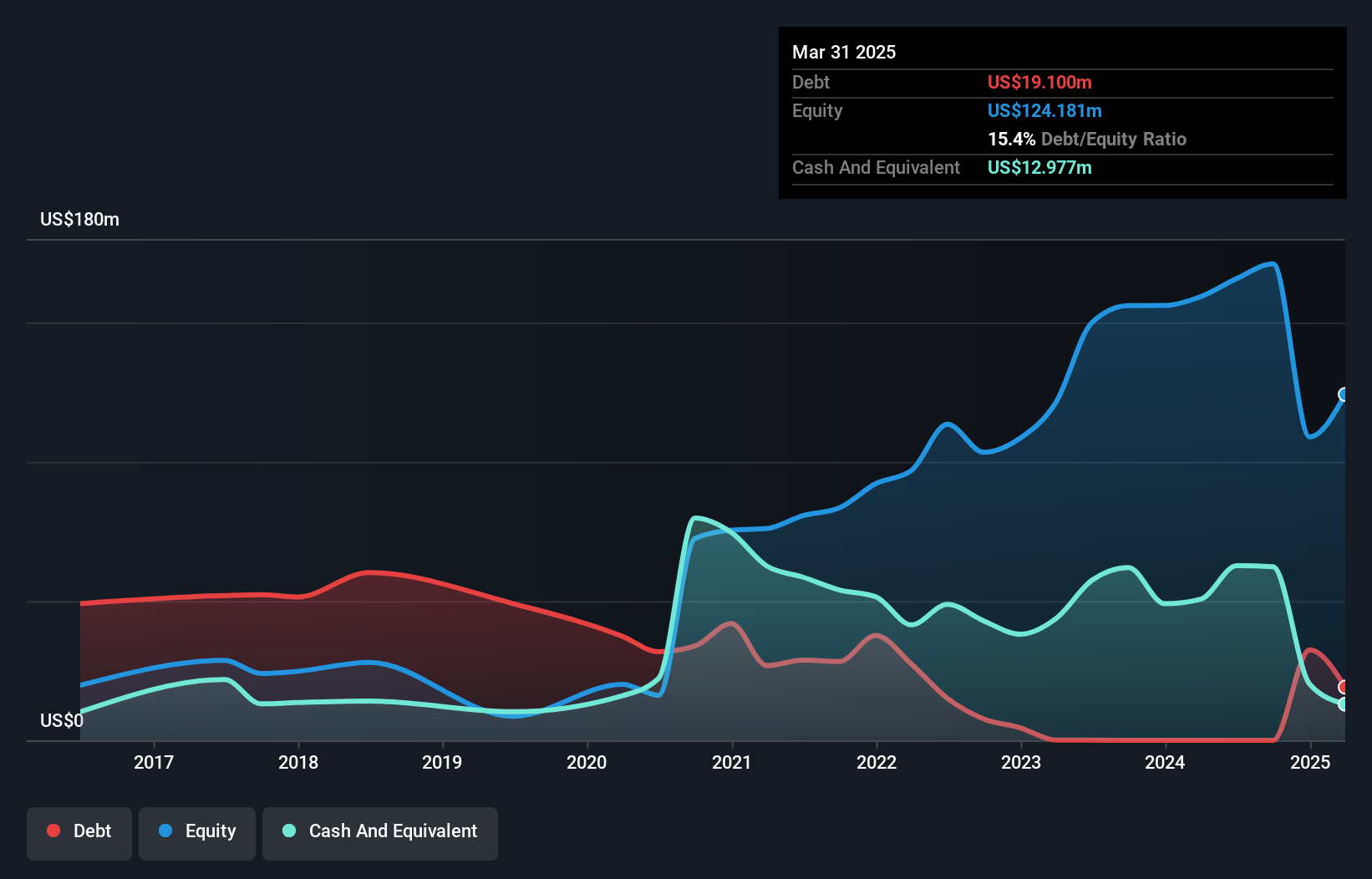

Jiayin Group, a relatively small player in the financial sector, showcases a mixed performance. Despite trading at 89% below its estimated fair value, its net profit margin has slipped to 20% from last year's 31.9%. The company remains debt-free, which eliminates concerns about interest coverage. Recent earnings reports indicate sales of CNY 1.48 billion for Q2 2024 and net income of CNY 238 million, reflecting a dip from the previous year’s figures. Notably volatile share prices have been observed over recent months. Additionally, Jiayin completed a significant share buyback program worth US$13.9 million this year.

- Get an in-depth perspective on Jiayin Group's performance by reading our health report here.

Examine Jiayin Group's past performance report to understand how it has performed in the past.

EZCORP (NasdaqGS:EZPW)

Simply Wall St Value Rating: ★★★★★☆

Overview: EZCORP, Inc. operates pawn services in the United States and Latin America with a market capitalization of $644.29 million.

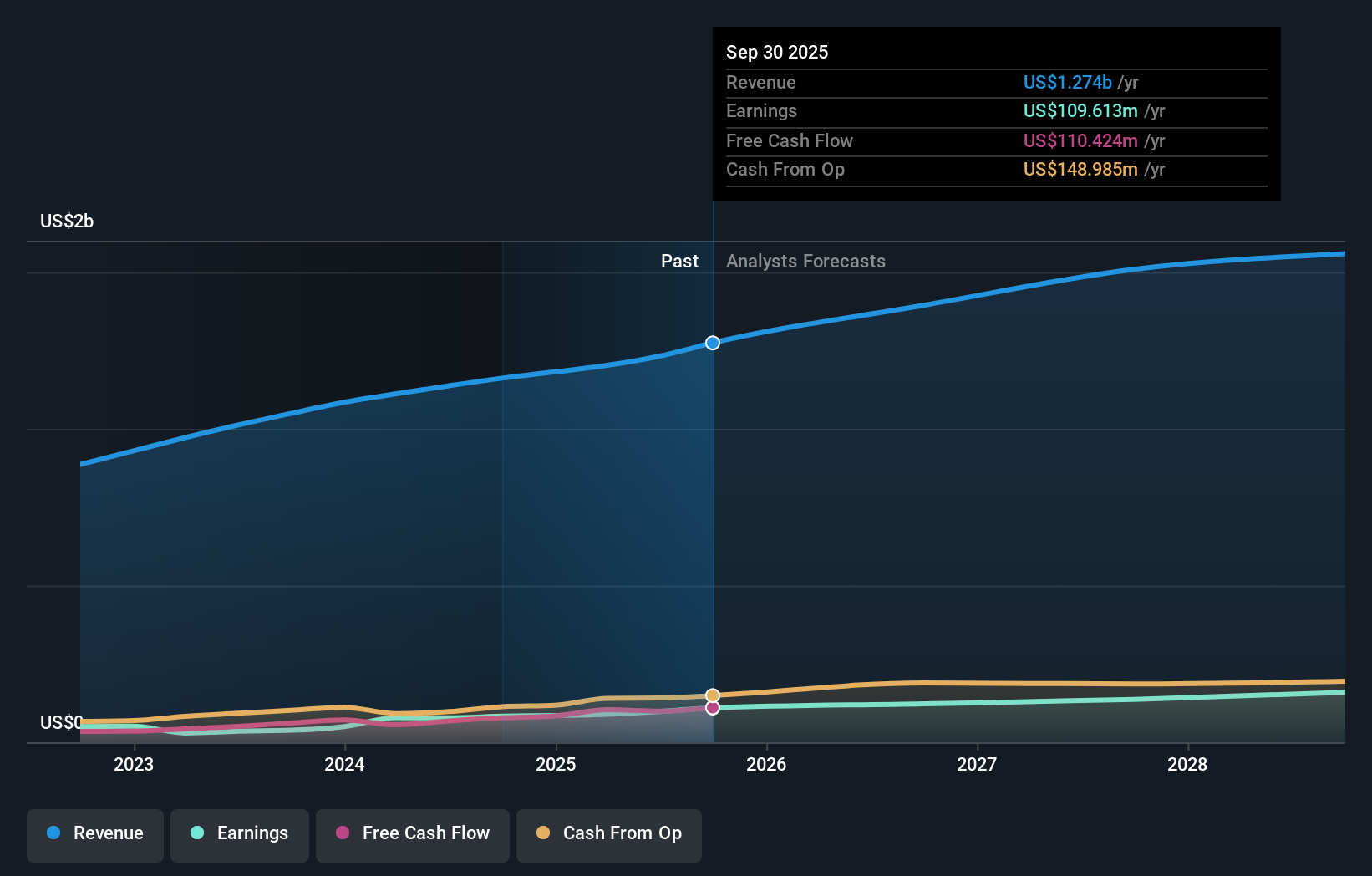

Operations: The company generates revenue primarily from its U.S. Pawn segment at $818.54 million and Latin America Pawn segment at $318.95 million, with a negligible contribution from Other Investments.

EZCORP has been making waves with its strategic expansions in Latin America and the U.S., focusing on boosting market share through new stores and online growth. The company reported a strong financial performance, with full-year revenue reaching US$1.16 billion, up from US$1.05 billion last year, while net income more than doubled to US$83.1 million from US$38.46 million previously. Its price-to-earnings ratio of 8.3x suggests good value compared to the broader market's 19.1x, supported by high-quality earnings and satisfactory debt levels at a net debt-to-equity ratio of 17.9%.

Next Steps

- Click through to start exploring the rest of the 218 US Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:JFIN

Jiayin Group

Provides online consumer finance services in the People’s Republic of China.

Flawless balance sheet and good value.