- United States

- /

- Consumer Finance

- /

- NasdaqGM:JFIN

Further Upside For Jiayin Group Inc. (NASDAQ:JFIN) Shares Could Introduce Price Risks After 26% Bounce

Despite an already strong run, Jiayin Group Inc. (NASDAQ:JFIN) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 165% in the last year.

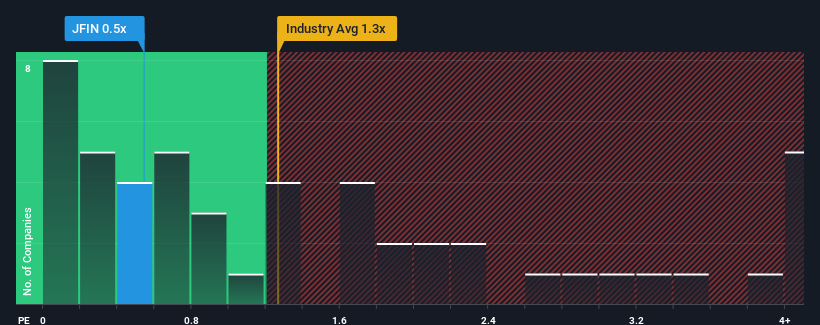

In spite of the firm bounce in price, given about half the companies operating in the United States' Consumer Finance industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Jiayin Group as an attractive investment with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jiayin Group

What Does Jiayin Group's Recent Performance Look Like?

Recent times have been quite advantageous for Jiayin Group as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiayin Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Jiayin Group?

Jiayin Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 90% last year. Pleasingly, revenue has also lifted 278% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 34% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Jiayin Group's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Jiayin Group's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Jiayin Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Jiayin Group with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:JFIN

Jiayin Group

Engages in the provision of online consumer finance services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026