- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Interactive Brokers Group (IBKR): Evaluating Valuation Following Addition to S&P 500 Equal Weighted and Global 1200 Indices

Reviewed by Simply Wall St

Interactive Brokers Group (IBKR) just landed spots in both the S&P 500 Equal Weighted and S&P Global 1200 indices, a shift that has already drawn extra attention from all corners of the investing world. For many, this is more than just a technical milestone, as index inclusions often trigger real buying from funds that must track these benchmarks. It is not surprising then that investors are debating what this means for IBKR, and whether it is a signal to look deeper at the stock today.

Index moves like these do not happen in isolation. Over the past year, IBKR’s shares have surged 98%, and in the past 3 months alone the stock has climbed 19%. Momentum has clearly picked up. Combine this rapid ascent with a broader boost in sentiment towards growth-oriented assets, especially after the Federal Reserve hinted at potential rate cuts, and you have a company sitting at the crossroads of two powerful investment trends.

So after the big run and all this institutional attention, are investors actually looking at a bargain or is the market already pricing in all the growth IBKR has to offer?

Most Popular Narrative: 7.7% Undervalued

According to the most widely followed narrative, Interactive Brokers Group is considered undervalued by nearly 8%. Analysts believe the company's underlying strengths and future growth have not been fully recognized by the current market price.

The introduction of new products and enhancements, such as the strengthened ATS with new liquidity providers and order types, enhancements to the IBKR Financial Advisor Portal, and the launch of securities lending for Swedish stocks, suggests potential for increased trading activity and higher commission revenue.

Want to know what's fueling this bullish price target? The narrative hinges on ambitious projections for earnings growth, capitalizing on new client balances, and optimistic future profit multiples. Hungry for the specific financial assumptions and the surprising multiples analysts expect? The underlying formula might just challenge your expectations of value investing in the brokerage industry.

Result: Fair Value of $66.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing geopolitical tensions or a sudden drop in trading activity could quickly shift sentiment and challenge the current bullish outlook on IBKR.

Find out about the key risks to this Interactive Brokers Group narrative.Another View: Valuation Based on Market Multiples

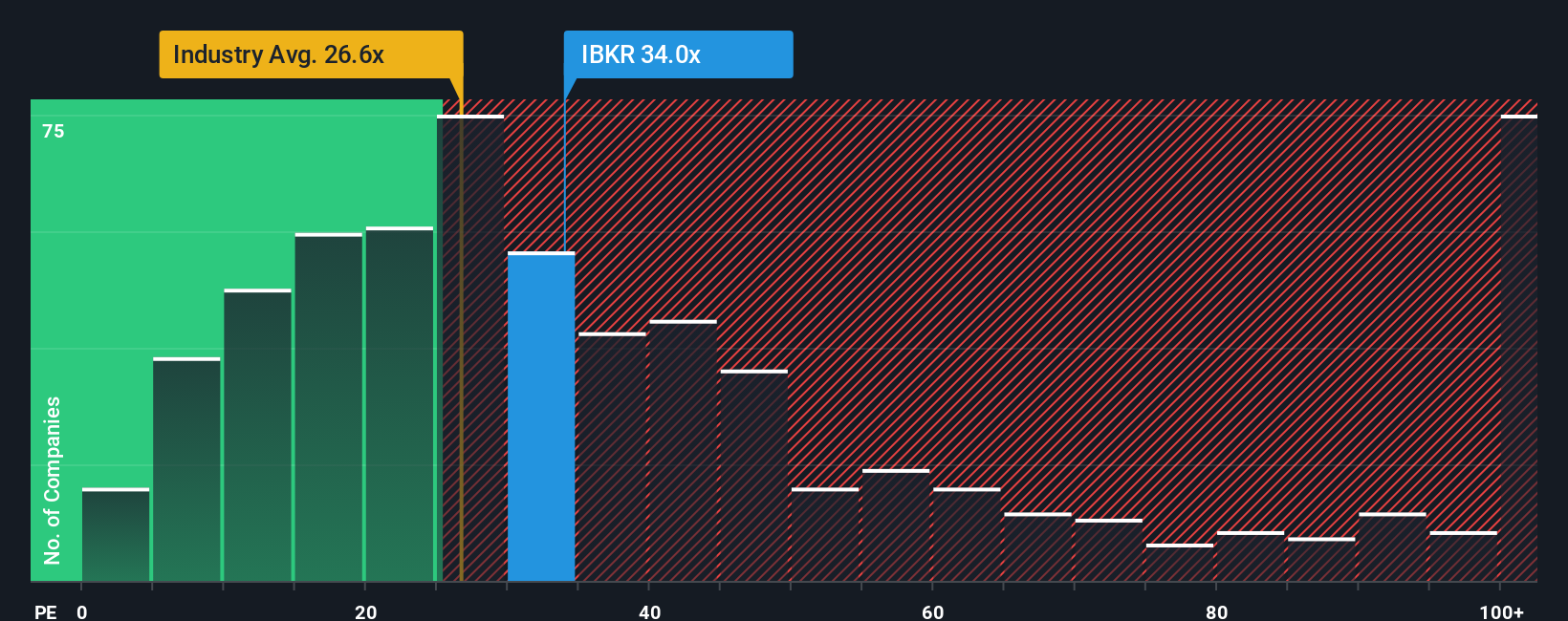

While many see Interactive Brokers as undervalued based on growth and analyst projections, a look at its price compared to similar companies in the industry tells a different story. By this measure, the stock actually appears expensive. This raises the question of whether the market is already factoring in all the good news, or if there is still room for further surprises.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Interactive Brokers Group Narrative

If you believe there is more narrative beneath the surface or want to unpack the data on your own terms, you can draft a custom argument in just a few minutes. Do it your way.

A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Expand your portfolio by acting now and checking out truly unique stocks that could change your investment game.

- Tap into steady returns and peace of mind when you grow your income with dividend stocks with yields > 3%, which yields more than 3%.

- Fuel your curiosity for cutting-edge tech by tracking companies transforming the future with AI penny stocks, shaping everything from automation to intelligent enterprise solutions.

- Zero in on bargains with potential upside by targeting undervalued businesses using our undervalued stocks based on cash flows, designed to reveal hidden gems based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives