- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Interactive Brokers Group (IBKR): Evaluating Valuation as Momentum Rebounds and Long-Term Returns Impress

Reviewed by Simply Wall St

Interactive Brokers Group (IBKR) has been catching attention following a recent move in its stock price. Investors are taking note of its performance this month, with the stock currently trading near $64 per share.

See our latest analysis for Interactive Brokers Group.

Momentum has picked up for Interactive Brokers Group, with the stock rebounding from recent lows and showing impressive resilience this year. While the one-month share price return is down, the year-to-date share price is up 40.7%, and long-term total shareholder returns have been strong. The five-year total return of 379% indicates sustained value creation for investors.

If strong, long-term performers like this have you curious, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the stock trading at a notable discount to analyst price targets, along with robust long-term gains, investors are left wondering whether Interactive Brokers Group remains undervalued or if the market has fully priced in its future growth prospects.

Most Popular Narrative: 16.4% Undervalued

Comparing the narrative’s fair value to Interactive Brokers Group’s last close at $64.19 reveals a notable upside, which has contributed to a bullish outlook among market watchers. The most widely followed narrative highlights several drivers that are shaping this positive valuation case.

The introduction of new products and enhancements, such as the strengthened ATS with new liquidity providers and order types, improvements to the IBKR Financial Advisor Portal, and the launch of securities lending for Swedish stocks, suggests potential for increased trading activity and higher commission revenue.

Curious about why this positive valuation is attracting so much attention? The narrative relies on quantitative forecasts that focus on strong profit growth and ambitious margin projections. Want to see which future profitability metric analysts are forecasting well above industry norms? Delve into the full narrative to learn what supports this target.

Result: Fair Value of $76.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition and unpredictable market conditions could challenge Interactive Brokers Group’s momentum. This may potentially shift analyst optimism in the months ahead.

Find out about the key risks to this Interactive Brokers Group narrative.

Another View: What Do Valuation Ratios Tell Us?

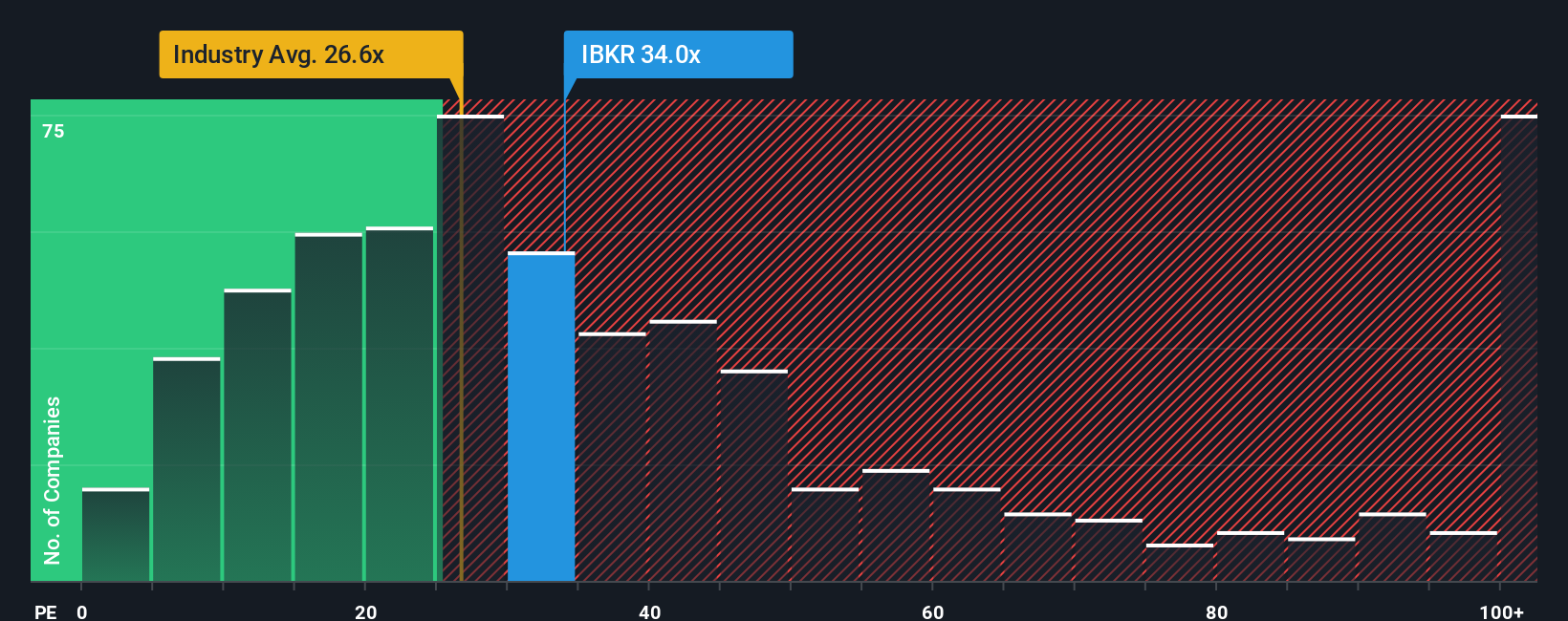

Looking beyond analyst price targets, Interactive Brokers Group currently trades at a price-to-earnings ratio of 31.2x. This is higher than both the US Capital Markets industry average of 23.6x and the peer average of 26.7x. It also stands well above the fair ratio of 21.1x that our research suggests the market could move toward. This gap may signal increased valuation risk, challenging the idea that the stock is purely an undervalued opportunity based on analyst forecasts. How might these competing signals influence future investor sentiment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Interactive Brokers Group Narrative

If you have a different perspective or want to dig deeper with your own research, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Interactive Brokers Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Step ahead of the crowd by tapping into exciting opportunities the market has to offer. Don't let the best stocks slip by unnoticed; your next big winner could be just a click away.

- Unlock the potential of fast-growing companies in artificial intelligence by checking out these 25 AI penny stocks and see which innovators are pushing the boundaries of tomorrow’s tech.

- Boost your portfolio with reliable income streams and steady returns when you browse these 15 dividend stocks with yields > 3%, connecting you to stocks yielding over 3% and delivering consistency.

- Catch early-stage companies poised for outsized moves. Start your search with these 3577 penny stocks with strong financials and spot hidden gems before they hit the headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.