- United States

- /

- Capital Markets

- /

- NasdaqGS:IBKR

Can Interactive Brokers Sustain Its 97% Rally After Strong Customer Account Growth in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Interactive Brokers Group, you know this is a stock that keeps surprising investors, pushing higher at nearly every turn. In just the last year, shares have climbed an impressive 97.1%, and over five years, they’ve surged a staggering 467.8%. Even in the past month, with a gain of 11.0%, the momentum has been hard to ignore. What’s fueling this rally? For one thing, the fintech and online brokerage landscape keeps evolving as more investors look for transparent pricing and robust trading platforms. Interactive Brokers often stands out as a low-cost alternative, and those tailwinds have not gone unnoticed in the market.

It’s not just investor enthusiasm at play, though. The broader trend toward digitized finance, news about expanding brokerage services, and ongoing global market volatility have all contributed to renewed interest in the stock. At a recent closing price of $70.95, you might be wondering: Is it too late to buy? Or is there more room to run?

Before you decide, it’s crucial to look at valuation. Using a standard six-point value scoring system, where a company collects one point for each undervalued category, Interactive Brokers comes in at 0 out of 6, indicating it isn’t undervalued on any of the usual checks. But as you’ll see, evaluating a company’s worth isn’t as simple as just ticking boxes. Let’s walk through the major valuation approaches, and stick around for an even more insightful way to measure the company’s true potential at the end.

Interactive Brokers Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Interactive Brokers Group Excess Returns Analysis

The Excess Returns model estimates a company’s intrinsic value by looking at how efficiently it turns shareholders’ equity into profits above its cost of capital. This approach centers on the difference between the company’s return on invested capital and the required return by investors, effectively measuring how much real value is created above basic expectations. For Interactive Brokers Group, this model draws directly from several key metrics.

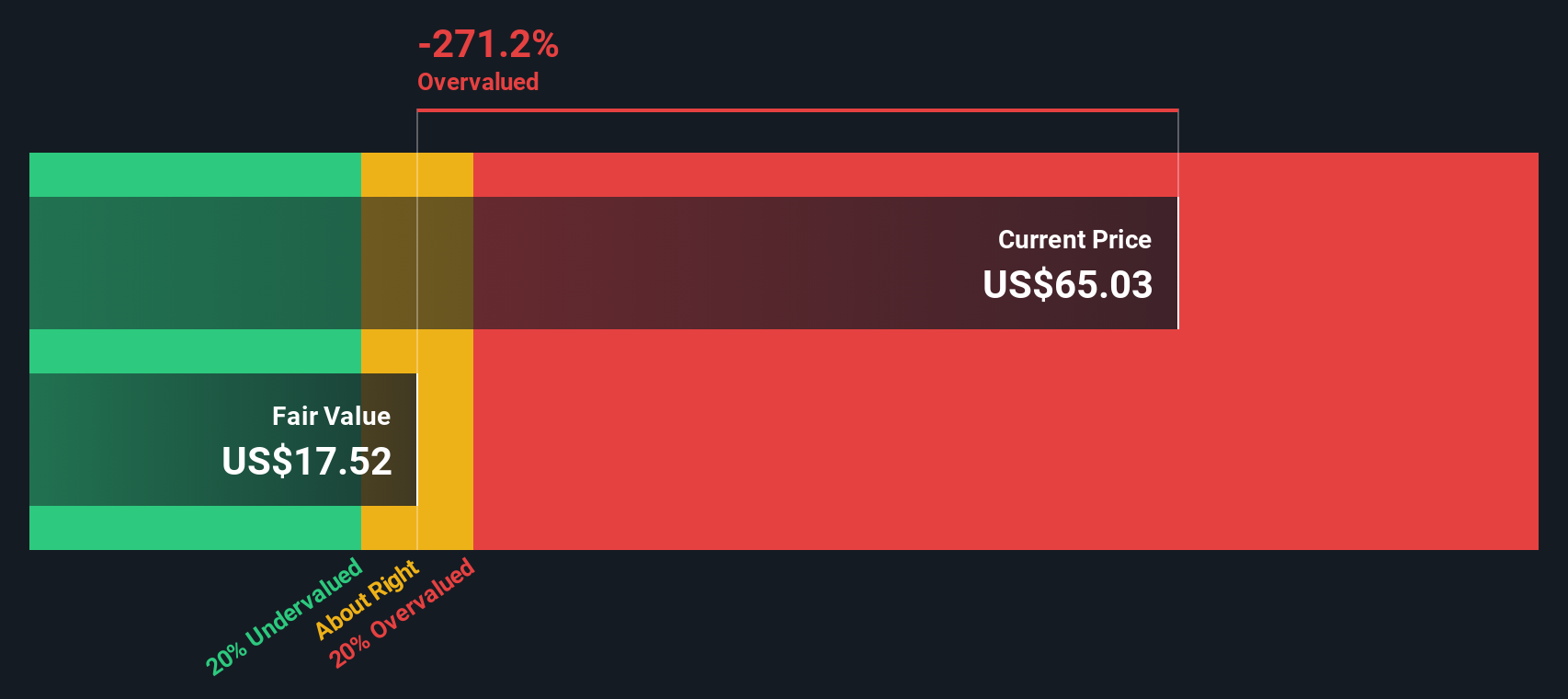

Currently, Interactive Brokers has a Book Value of $10.93 per share and a stable Earnings Per Share (EPS) estimate of $1.45. The cost of equity is $0.82 per share, which means the excess return, or the value created over and above what shareholders demand, is calculated at $0.64 per share. Over recent years, the average return on equity has stood at an impressive 17.37%, well above many industry peers. The model also relies on a stable book value of $8.37 per share, derived from the median over the last five years.

Applying these figures, the Excess Returns model arrives at an intrinsic value of $17.88 per share. With shares recently trading at $70.95, this implies the stock is 296.9% overvalued according to this analysis.

Result: OVERVALUED

Our Excess Returns analysis suggests Interactive Brokers Group may be overvalued by 296.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Interactive Brokers Group Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it directly links a company’s stock price to its earnings, giving investors a quick sense of how much they are paying for each dollar of profit. In today’s market, where growth expectations and perceived risks can swing investor sentiment, the “normal” or “fair” PE ratio should factor in both the likely future growth of earnings as well as how risky or stable that growth appears to be.

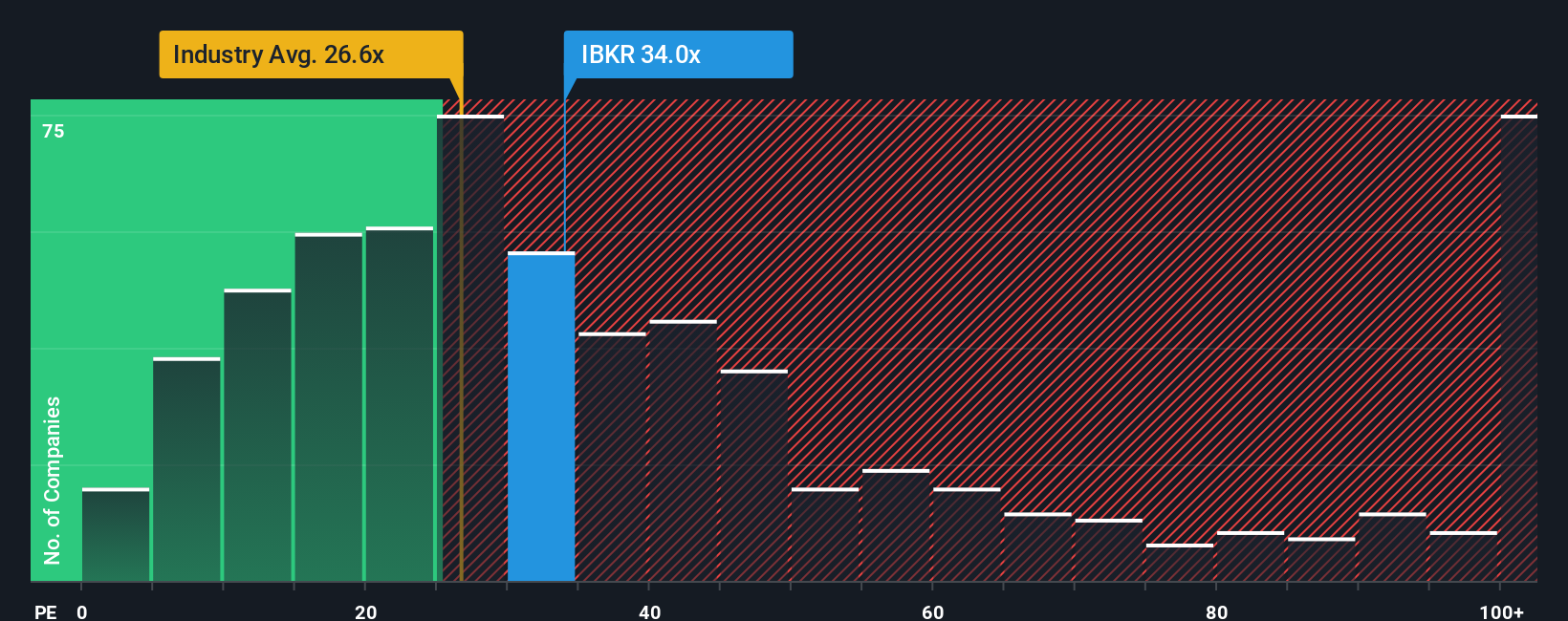

Interactive Brokers Group is currently trading at a PE of 37.7x, which stands noticeably higher than the industry average of 26.2x and above the peer average of 32.9x. This implies that investors are either quite optimistic about the company’s future earnings growth, or they are comfortable with a premium for perceived stability and execution.

However, Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark by taking into account not just industry and profit trends, but also growth forecasts, risks, and the company’s own market cap. In this case, the Fair PE Ratio for Interactive Brokers is calculated at 21.7x. This is well below both the current PE and the averages cited above, reflecting a more complete picture of value than standard peer or industry comparisons alone can provide.

With the current PE ratio sitting far above the Fair Ratio, this model suggests the stock is overvalued based on earnings multiples.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Interactive Brokers Group Narrative

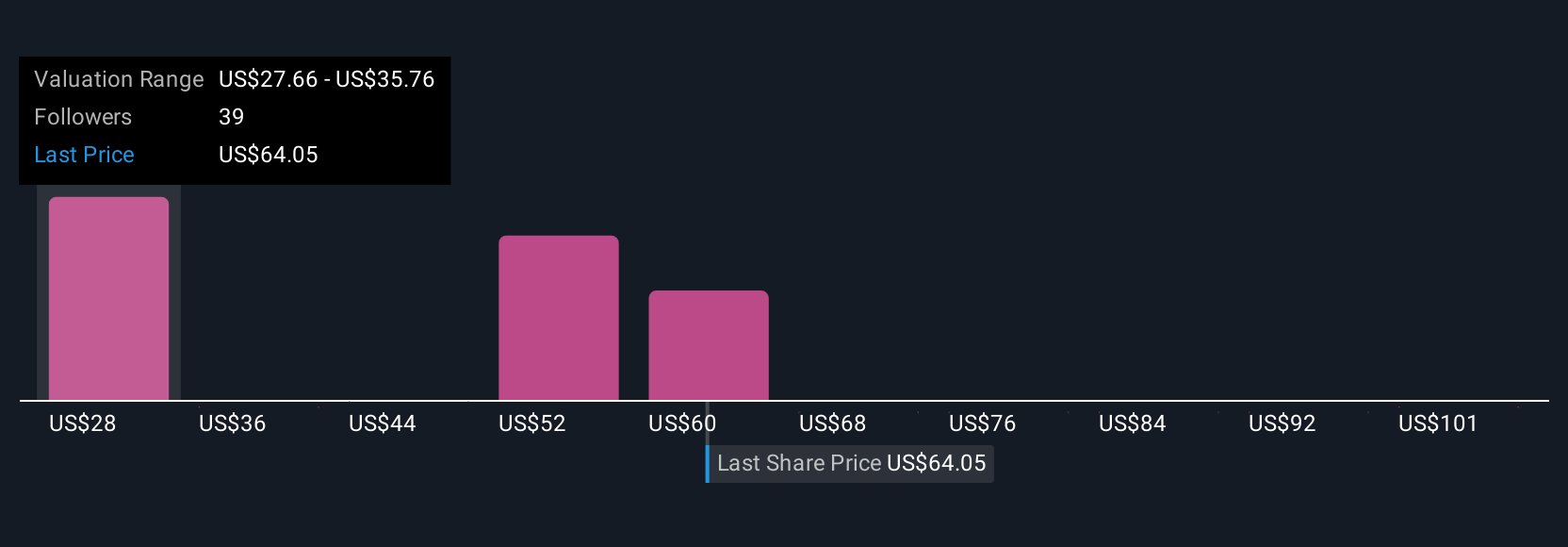

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a concise story investors create to support their view of a company’s future, linking the business’s unique developments and risks directly to financial forecasts and an estimated fair value.

Narratives make investing easier and more dynamic by connecting the company’s story to concrete numbers. This allows you to go beyond standard valuation models. Now you’re not just crunching numbers, but factoring in real business changes and your perspective on what matters most. On Simply Wall St’s Community page, you’ll find Narratives contributed by millions of investors, making it an accessible tool for investors at any level.

As new information, such as earnings reports or company news, becomes available, Narratives are updated automatically. This helps you see right away if your investment thesis still holds and what others in the community believe. Narratives make it clearer than ever to see if the fair value you expect matches up with the current share price, which may help make buy or sell decisions more straightforward.

For example, some Interactive Brokers Group Narratives point to global expansion and new products as major growth drivers and assign a bullish fair value of $288 per share, while others focus on competitive pressures and market uncertainties for a much lower target of $140.

Do you think there's more to the story for Interactive Brokers Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBKR

Interactive Brokers Group

Operates as an automated electronic broker in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives