- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Robinhood Markets (NasdaqGS:HOOD) Surges 18% Last Quarter Following Earnings Report

Reviewed by Simply Wall St

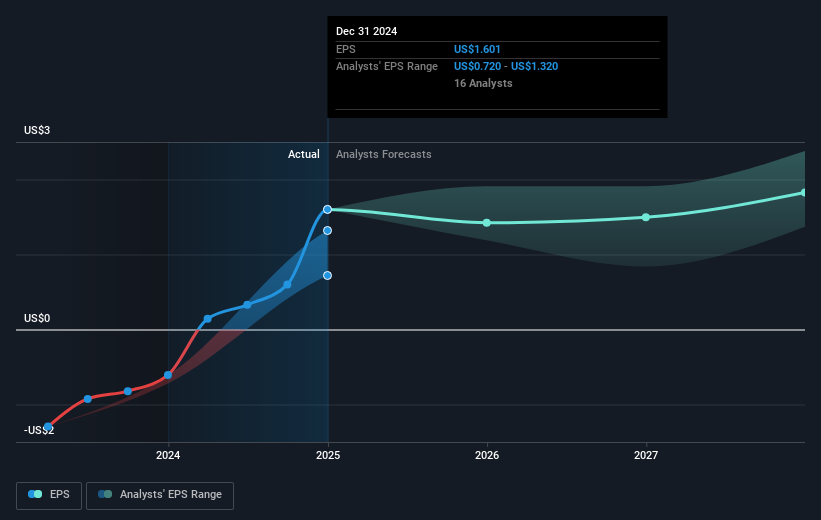

Robinhood Markets (NasdaqGS:HOOD) experienced an 18% price increase over the last quarter, likely influenced by its strong earnings report and ongoing share buyback program. The company reported a dramatic rise in revenue and net income for the fourth quarter compared to the previous year, making its financial performance a potential driver of the stock's upward trajectory. Additionally, Robinhood's share buyback initiative, resulting in over 5 million shares repurchased, helped reinforce investor confidence. During the broader market period, both the S&P 500 and Nasdaq saw upward movement, which may have provided a supportive backdrop for the company's stock rally.

Over the past three years, Robinhood Markets' shares provided total returns of approximately 258%, driven by several key developments. The company’s strategic expansion into the derivatives market and innovative product launches like the Robinhood Legend platform and Gold Card service contributed significantly to this growth. Particularly notable was the Robinhood Legend platform, generating $50 million in annualized revenue, reflecting enhanced transaction volumes. Simultaneously, the rapid increase in Gold subscribers indicated improved average revenue per user.

Additionally, Robinhood's international expansion, highlighted by the integration of Bitstamp, opened global market avenues and new revenue streams within the crypto sector. The strategic implementation of a comprehensive share buyback program, authorizing up to $1 billion in repurchases, further reinforced shareholder value. In the past year, Robinhood's share performance exceeded market returns, underscoring its competitive strength within the US Capital Markets industry, which recorded returns of 19.5% in the same timeframe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Acceptable track record with mediocre balance sheet.