- United States

- /

- Capital Markets

- /

- NasdaqGS:HOOD

Assessing Robinhood (HOOD) Valuation After Its 164% One-Year Share Price Surge

Reviewed by Simply Wall St

Robinhood Markets (HOOD) has quietly turned into a big winner for patient investors, with the stock up around 164% over the past year as the business scales and profitability improves.

See our latest analysis for Robinhood Markets.

That momentum has been fueled by improving fundamentals and growing engagement on the platform, with a robust year to date share price return of 244.09% and a powerful 1-year total shareholder return of 263.25% signaling that sentiment has meaningfully shifted in Robinhood’s favor.

If Robinhood’s surge has you rethinking what could run next, it is a good time to scout high growth tech and AI stocks that might be building similar momentum.

With shares now flirting with analyst targets and profitability improving, investors have to ask: Is Robinhood still trading below its true potential, or has the market already priced in the bulk of its future growth?

Most Popular Narrative: 10.5% Undervalued

With Robinhood Markets last closing at $135.71 against a narrative fair value of $151.55, the most followed view sees further upside still on the table.

The analysts have a consensus price target of $113.086 for Robinhood Markets based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $50.0.

Want to see what justifies a richer future earnings multiple and robust margins over time, even as growth cools from its breakneck pace? The full narrative unpacks the tug of war between moderating top line expansion, elevated profitability, and a premium valuation multiple that echoes high growth market leaders. Curious which specific earnings and margin trajectories are baked into that fair value, and how sensitive it is to even small shifts in those assumptions? Dive in to see the explicit roadmap behind this 10.5 percent upside case.

Result: Fair Value of $151.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, much depends on sustaining margin strength as compliance and marketing costs rise, and on prediction markets avoiding regulatory or competitive setbacks.

Find out about the key risks to this Robinhood Markets narrative.

Another Lens on Valuation

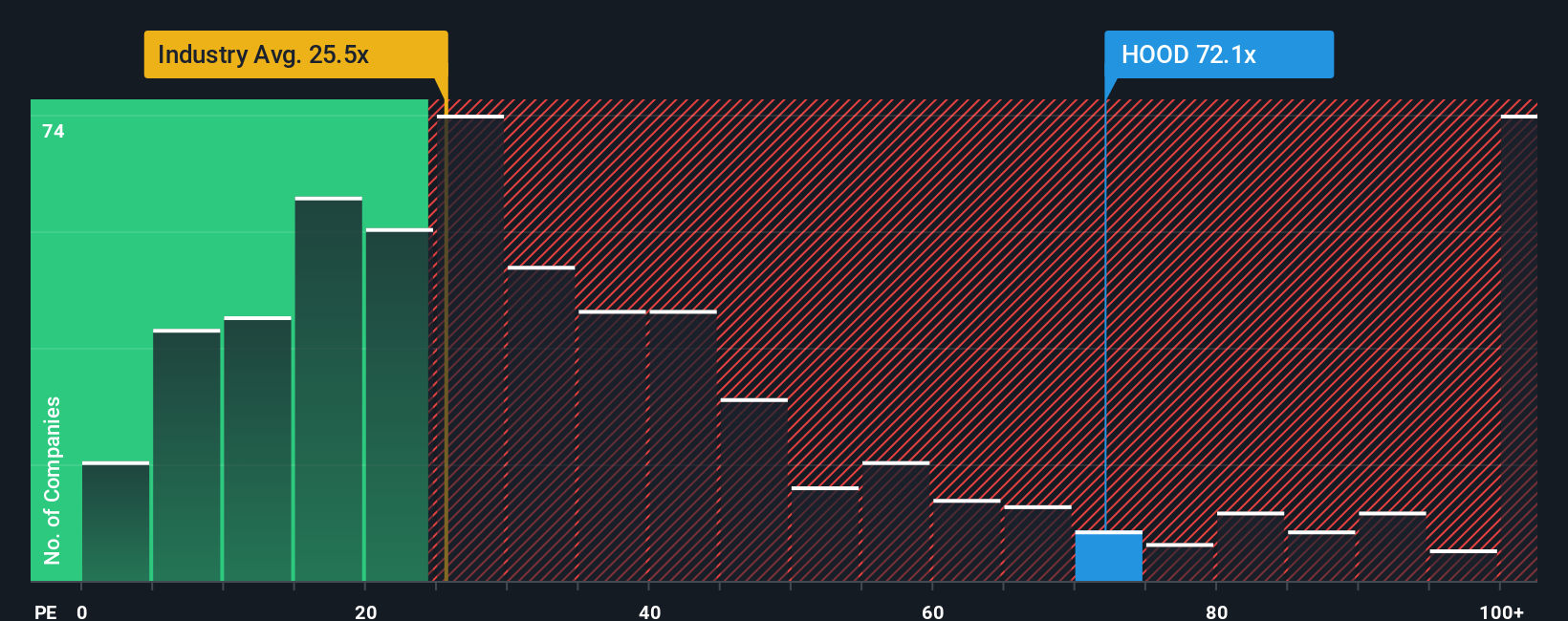

Step away from the narrative fair value and Robinhood looks far less forgiving. On a price to earnings basis of 55.6 times, the stock trades at more than double both peers at 22.3 times and a fair ratio of 27.3 times, pointing to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Robinhood Markets Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Robinhood. Use the Simply Wall St Screener to track fresh opportunities and position your portfolio ahead of the next big move.

- Target strong potential rebounds by reviewing these 3589 penny stocks with strong financials that pair low share prices with improving business fundamentals and room for sentiment to shift.

- Capitalize on structural tech shifts by focusing on these 27 AI penny stocks that harness artificial intelligence to scale products, revenues, and operating leverage over time.

- Lock in a steadier income stream by prioritizing these 15 dividend stocks with yields > 3% that combine solid yields with balance sheets built to support consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOOD

Robinhood Markets

Operates financial services platform in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026