- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

How Investors Are Reacting To Hamilton Lane (HLNE) Analyst Upgrade and $77.5M Share Offering

Reviewed by Simply Wall St

- Earlier this week, Goldman Sachs upgraded Hamilton Lane Inc. from Sell to Neutral and highlighted the company's expanded presence in the wealth management channel and enhanced product lineup.

- Hamilton Lane also announced a public offering of 528,705 shares of Class A common stock to raise approximately US$77.5 million, reflecting ongoing corporate activity and plans for further expansion.

- We'll now examine how the analyst upgrade, driven by product growth and new offerings, affects Hamilton Lane's investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Hamilton Lane Investment Narrative Recap

To own shares in Hamilton Lane, an investor needs to believe in the ongoing demand for private markets products, the company's ability to grow fee-earning assets, and sustained expansion in the wealth management channel. While Goldman Sachs' recent upgrade draws attention to these strengths, it does not materially change the short-term catalyst of accelerating net inflows from wealth clients. The most important risk remains fee compression as competition intensifies and digitalization empowers clients to demand lower fees.

Of recent announcements, the US$77.5 million follow-on equity offering is most relevant, underscoring Hamilton Lane’s ongoing efforts to capitalize on new opportunities and support future expansion, aligning with the company's push for product growth and distribution reach. However, future success may be tempered if higher operational costs or margin pressures outpace the benefits of these initiatives.

Yet, in contrast, investors should also pay close attention to the risk of shrinking margins and what this could mean for long-term returns, as...

Read the full narrative on Hamilton Lane (it's free!)

Hamilton Lane's narrative projects $1.0 billion revenue and $426.8 million earnings by 2028. This requires 13.2% yearly revenue growth and a $214.6 million earnings increase from $212.2 million.

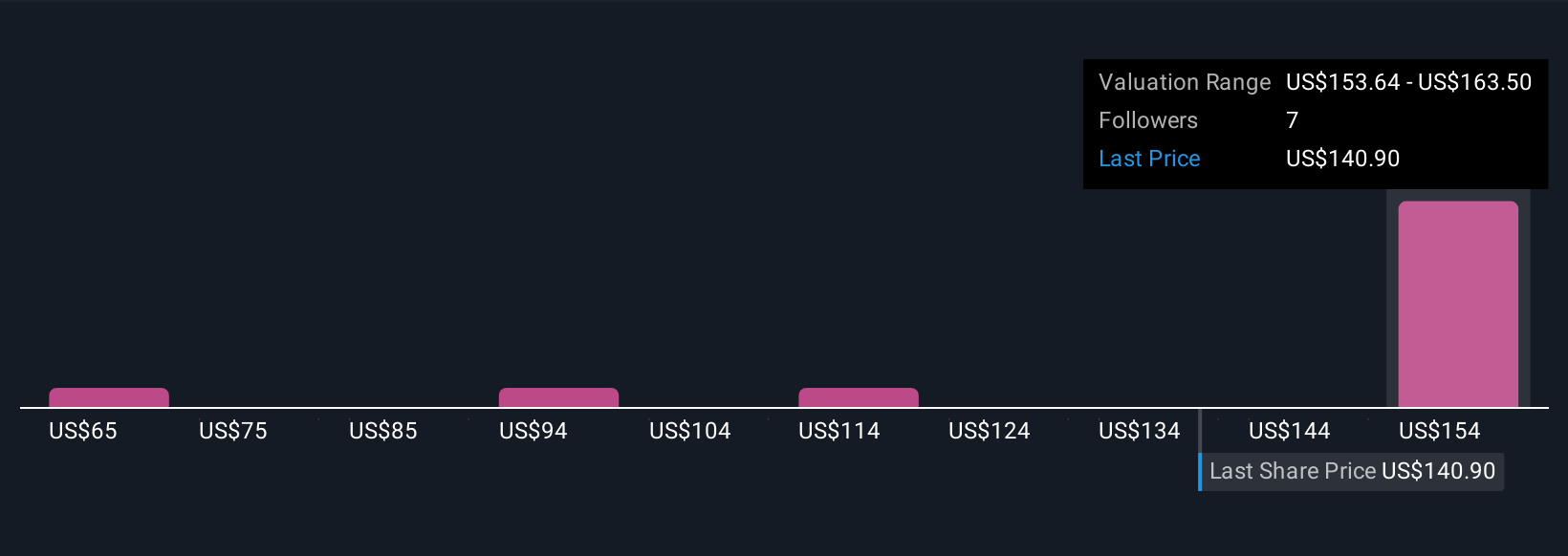

Uncover how Hamilton Lane's forecasts yield a $163.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered fair values for Hamilton Lane ranging from US$64 to US$163.50 across four opinions. As competition continues to put fee income under pressure, the variety of fair value perspectives invites you to compare your view against several alternatives.

Explore 4 other fair value estimates on Hamilton Lane - why the stock might be worth less than half the current price!

Build Your Own Hamilton Lane Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Lane research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hamilton Lane research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Lane's overall financial health at a glance.

No Opportunity In Hamilton Lane?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives