- United States

- /

- Capital Markets

- /

- NasdaqGS:HLNE

Can Hamilton Lane Recover After Recent 10% Drop in June 2025?

Reviewed by Bailey Pemberton

Thinking about what’s next for Hamilton Lane? You are not alone. Investors are eyeing this specialist in private markets as its stock has endured a rocky stretch, and everyone wants to know if a rebound or more pain is in store. The past week saw a 10% drop, extending to a 14.4% loss over the past month. Year-to-date, Hamilton Lane is down 16.1%, and the last year looks rough at a 26.3% decline. However, zooming out changes the picture. Over three and five years, the stock actually delivered returns of 120.1% and 96.3%, highlighting long-term strength that short-term volatility can obscure.

What is behind these moves? Some recent market volatility in the alternative assets space has weighed on sentiment, contributing to the pullback. At the same time, macroeconomic shifts have put pressure on financial stocks broadly, with investors reassessing risk and pricing for higher borrowing costs. Some of these concerns may end up being overdone, especially when considering how the company has performed across a cycle.

Now, to the real question: Is Hamilton Lane undervalued today, or are the risks justified? By standard valuation checks, Hamilton Lane comes in with a value score of 2 out of 6, suggesting it screens as undervalued on two criteria. That kind of score can mean different things depending on the approach to valuation, so it is useful to examine what those valuation methods reveal before considering a more insightful approach.

Hamilton Lane scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hamilton Lane Excess Returns Analysis

The Excess Returns valuation model assesses how efficiently a company generates profits beyond its cost of equity capital. This reflects the extra value created for shareholders compared to simply investing in safe assets. This model is especially relevant for companies like Hamilton Lane, where returns on invested capital matter greatly.

According to the latest data, Hamilton Lane’s Book Value per share is $17.44, with a stable Earnings Per Share (EPS) of $3.66. These figures are drawn from the median return on equity over the past five years, which averaged 30.20%. The cost of equity is estimated at $1.00 per share, meaning the company generates an Excess Return of $2.66 for each share annually. Stable Book Value over the same period is $12.12 per share, offering additional reassurance that the business’s value base is steady.

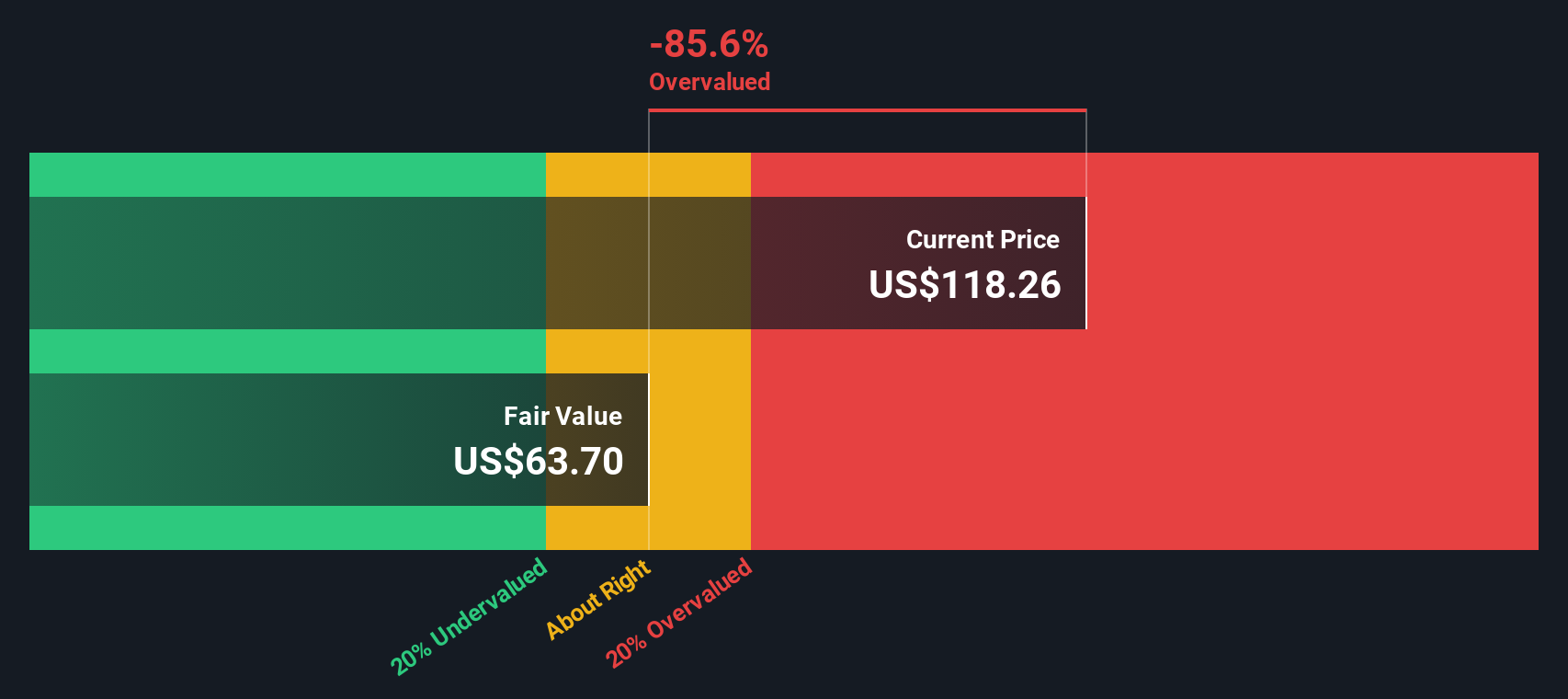

Using these assumptions, the Excess Returns model calculates an intrinsic fair value of $63.94 per share. However, with the current price trading 95.6% above this intrinsic value, the stock appears significantly overvalued by this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests Hamilton Lane may be overvalued by 95.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hamilton Lane Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Hamilton Lane because it tells you how much investors are willing to pay right now for each dollar of current or future earnings. It is a practical yardstick, especially for businesses with steady profits, since it quickly compares the value the market places on a company versus its earnings power.

That said, what makes for a "fair" PE ratio actually depends on expectations of future growth and the risk profile of the business. Companies with strong, sustained growth and lower risks are typically awarded higher PE multiples by the market. However, if growth prospects cool or risks increase, the fair multiple contracts in turn.

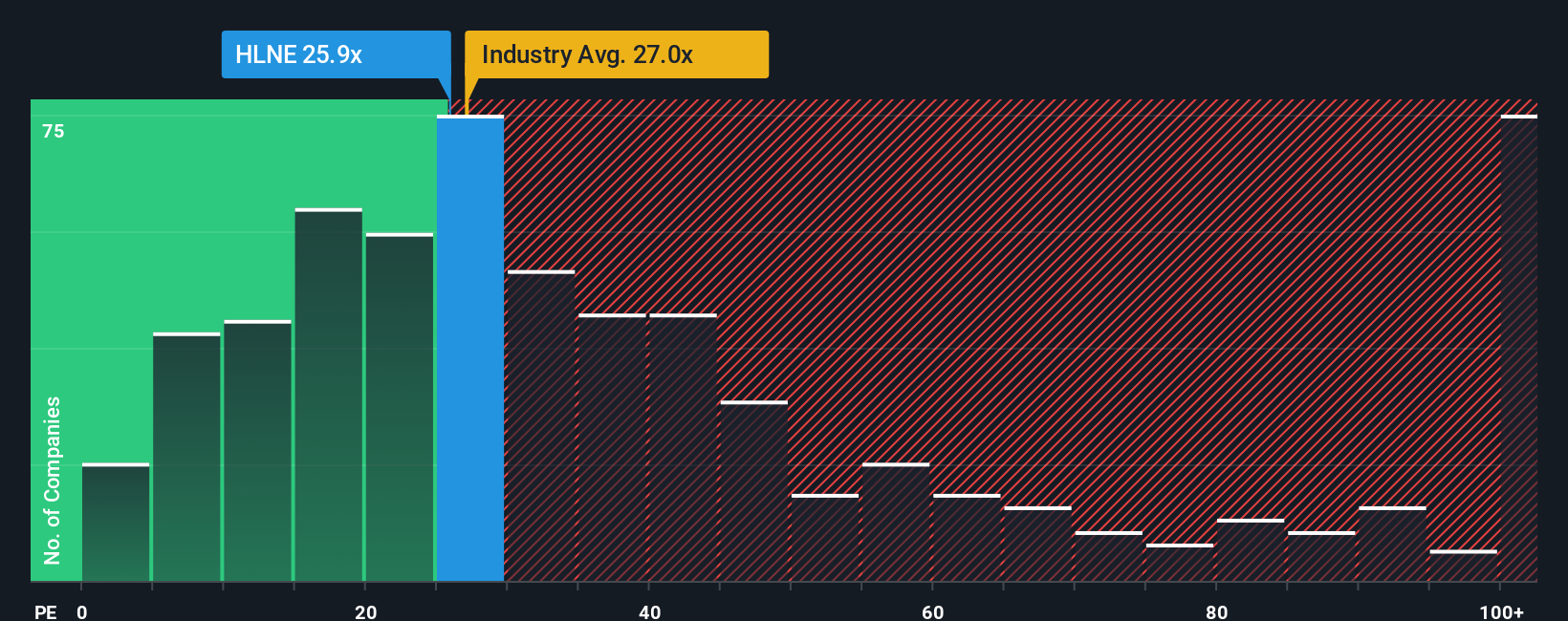

Hamilton Lane currently trades at a PE of 25.9x. For context, this sits just below the Capital Markets industry average of 27.0x, but well above the peer average of 13.7x. These basic comparisons provide some color, but do not paint the full picture. Enter Simply Wall St’s proprietary Fair Ratio, a tailored multiple that accounts for not just sector averages but also company-specific expectations, profitability, risk, and market cap. For Hamilton Lane, the Fair Ratio is set at 18.9x, reflecting what the stock might reasonably deserve in light of its recent performance and fundamentals.

The real value here is that the Fair Ratio adapts to the company’s unique setup rather than relying only on broad benchmarks. By comparing Hamilton Lane’s current PE of 25.9x to its Fair Ratio of 18.9x, the takeaway is clear: the stock trades at a premium to what its fundamentals suggest is fair.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hamilton Lane Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful concept: it is your story behind the numbers, where you outline your own expectations for a company’s future revenue, margins, and fair value. This story is then directly connected to a financial forecast and a clear fair value estimate.

Instead of relying only on rigid models or benchmarks, Narratives let you test your investment thesis using your own assumptions or those from leading analysts. On Simply Wall St’s platform, millions of investors access and update Narratives from the Community page. This makes it easy to see a variety of perspectives and adjust your view as new information emerges from news or earnings reports.

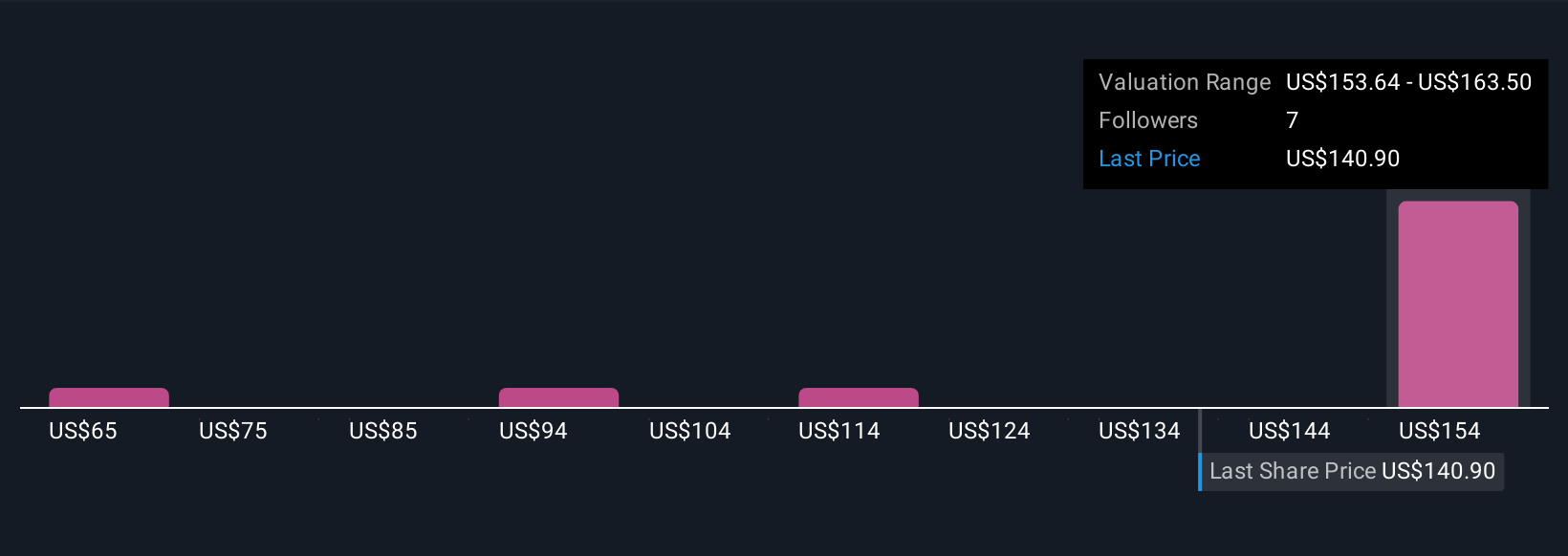

This approach helps you cut through noise and decide when to buy or sell by comparing your calculated Fair Value with today’s market price. As assumptions or real-world developments shift, the Narrative automatically updates, keeping your analysis relevant. For example, some investors believe Hamilton Lane’s expansion into global funds and technology will drive robust growth and assign a fair value of $160 per share. Others cite regulatory and competition risks and set a fair value closer to $147, showing how Narratives tailor valuation to your individual outlook.

Do you think there's more to the story for Hamilton Lane? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Lane might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLNE

Hamilton Lane

A private equity and venture capital firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, mezzanine in growth capital companies.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives