- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:CCTG

US Penny Stocks Spotlight: HeartBeam And Two More Standout Picks

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed landscape of earnings reports and inflation data, major indexes like the S&P 500 and Nasdaq Composite are on track for gains, reflecting investor optimism despite recent volatility. For those looking beyond well-known stocks, penny stocks—often representing smaller or newer companies—continue to hold potential for growth. While the term may seem outdated, these investments can offer unique opportunities when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $119.09M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.91 | $6.62M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.274193 | $10.24M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.46 | $48.51M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.54 | $41.73M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.88 | $83.72M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.12 | $53.61M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $80.14M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.30 | $22.88M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

HeartBeam (NasdaqCM:BEAT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HeartBeam, Inc. is a medical technology company that develops and commercializes ambulatory electrocardiogram solutions for cardiac disease detection and monitoring in various settings, with a market cap of $57.86 million.

Operations: HeartBeam, Inc. has not reported any revenue segments.

Market Cap: $57.86M

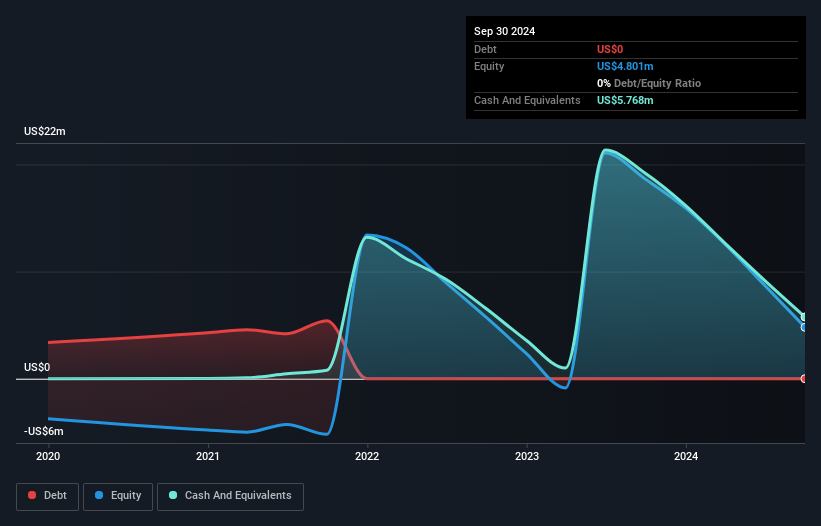

HeartBeam, Inc. is a pre-revenue medical technology firm with a market cap of US$57.86 million, focusing on innovative cardiac monitoring solutions. Recently, it submitted a 510(k) application to the FDA for its 12-lead ECG synthesis software after successful trials showing clinical equivalence with standard ECGs. Despite being unprofitable and having limited cash runway, HeartBeam remains debt-free and has raised additional capital through equity offerings. The management team is relatively new but aims to leverage AI in future developments to enhance cardiovascular care accessibility outside medical facilities, potentially transforming patient outcomes globally.

- Get an in-depth perspective on HeartBeam's performance by reading our balance sheet health report here.

- Gain insights into HeartBeam's future direction by reviewing our growth report.

CCSC Technology International Holdings (NasdaqCM:CCTG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CCSC Technology International Holdings Limited, with a market cap of $20.04 million, designs, manufactures, and sells interconnect products across Asia, Europe, and the Americas through its subsidiaries.

Operations: The company generates revenue from its Electronic Components & Parts segment, totaling $16.46 million.

Market Cap: $20.04M

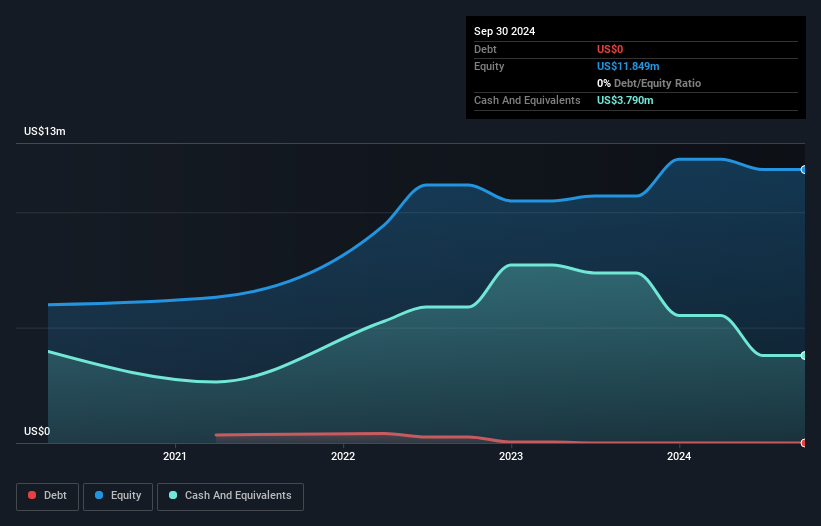

CCSC Technology International Holdings, with a market cap of US$20.04 million, operates in the Electronic Components & Parts sector and reported revenues of US$9.22 million for the half year ending September 30, 2024. Despite increased sales from the previous year, it remains unprofitable with a net loss of US$0.74432 million. The company is debt-free and its short-term assets significantly exceed both short- and long-term liabilities, indicating solid liquidity management. Recent filing for a US$100 million Shelf Registration suggests potential capital raising efforts to support future growth or operational needs amidst ongoing volatility in share price performance.

- Click to explore a detailed breakdown of our findings in CCSC Technology International Holdings' financial health report.

- Explore historical data to track CCSC Technology International Holdings' performance over time in our past results report.

Heritage Global (NasdaqCM:HGBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Heritage Global Inc. is an asset services company specializing in financial and industrial asset transactions, with a market cap of $75.96 million.

Operations: Heritage Global Inc. has not reported any specific revenue segments.

Market Cap: $75.96M

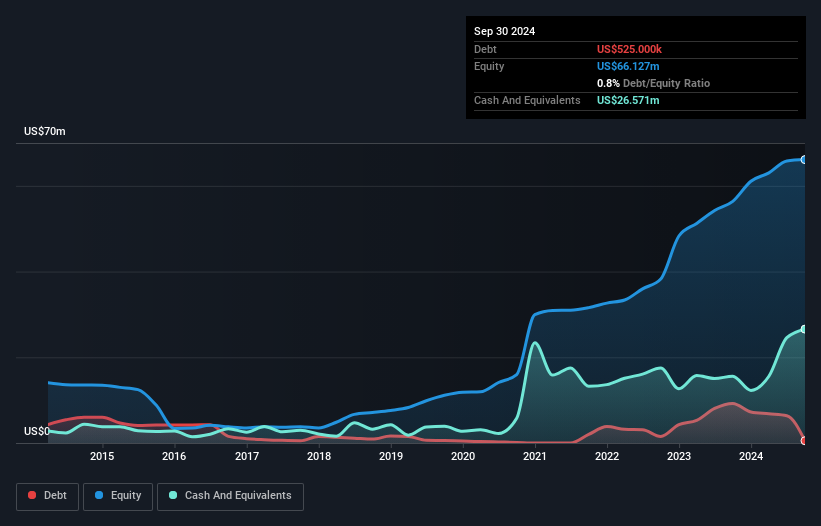

Heritage Global Inc., with a market cap of US$75.96 million, has demonstrated financial resilience despite recent earnings declines. The company's short-term assets of US$37 million comfortably cover both its short- and long-term liabilities, indicating strong liquidity. Although profits have grown significantly over the past five years, recent results show a decrease in revenue and net income compared to the previous year. Despite this, Heritage Global maintains high-quality earnings and has reduced its debt-to-equity ratio from 5.1% to 0.8% over five years. The company's strategic share buyback further underscores its commitment to shareholder value amidst fluctuating profitability metrics.

- Take a closer look at Heritage Global's potential here in our financial health report.

- Explore Heritage Global's analyst forecasts in our growth report.

Taking Advantage

- Get an in-depth perspective on all 706 US Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CCSC Technology International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CCTG

CCSC Technology International Holdings

Through its subsidiaries, designs, manufactures, and sells interconnect products in Asia, Europe, and the Americas.

Flawless balance sheet very low.

Market Insights

Community Narratives