- United States

- /

- Capital Markets

- /

- NasdaqGS:GLXY

Galaxy Digital (TSX:GLXY): Assessing Valuation After a Sharp Pullback in the Share Price

Reviewed by Simply Wall St

Galaxy Digital (GLXY) has quietly slipped about 17% over the past week and roughly 26% in the past 3 months, even as its year to date gain still sits above 30%.

See our latest analysis for Galaxy Digital.

That pullback comes after a powerful run, with the year to date share price return still firmly positive and the three year total shareholder return suggesting long term momentum is very much intact even if shorter term enthusiasm is cooling.

If Galaxy Digital’s volatility has you thinking more broadly about the theme, this could be a good moment to explore high growth tech and AI stocks for other potential high growth ideas.

With revenues growing but profits slipping and the share price trading at a steep discount to analyst targets, investors now face a key question: Is Galaxy Digital undervalued, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 49.2% Undervalued

With Galaxy Digital last closing at $24.31 against a narrative fair value near $47.82, the narrative frames a wide gap for patient investors.

The maturation of digital asset infrastructure, evidenced by large scale, long term data center developments and multi phase partnerships (e.g., CoreWeave), is poised to generate significant, high margin cash flows beginning in 2026, enhance earnings visibility, and improve the company's overall capitalization efficiency as these business lines scale.

Want to see what kind of revenue surge and margin reset this vision is banking on? The narrative leans on bold growth curves and premium future multiples. Curious how those projections stack up over the next few years, step by step? Unlock the full playbook behind that upside case.

Result: Fair Value of $47.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in CoreWeave and the capital hungry build out of AI data centers mean any demand shock or financing hiccup could quickly pressure this upside case.

Find out about the key risks to this Galaxy Digital narrative.

Another Way to Look at Value

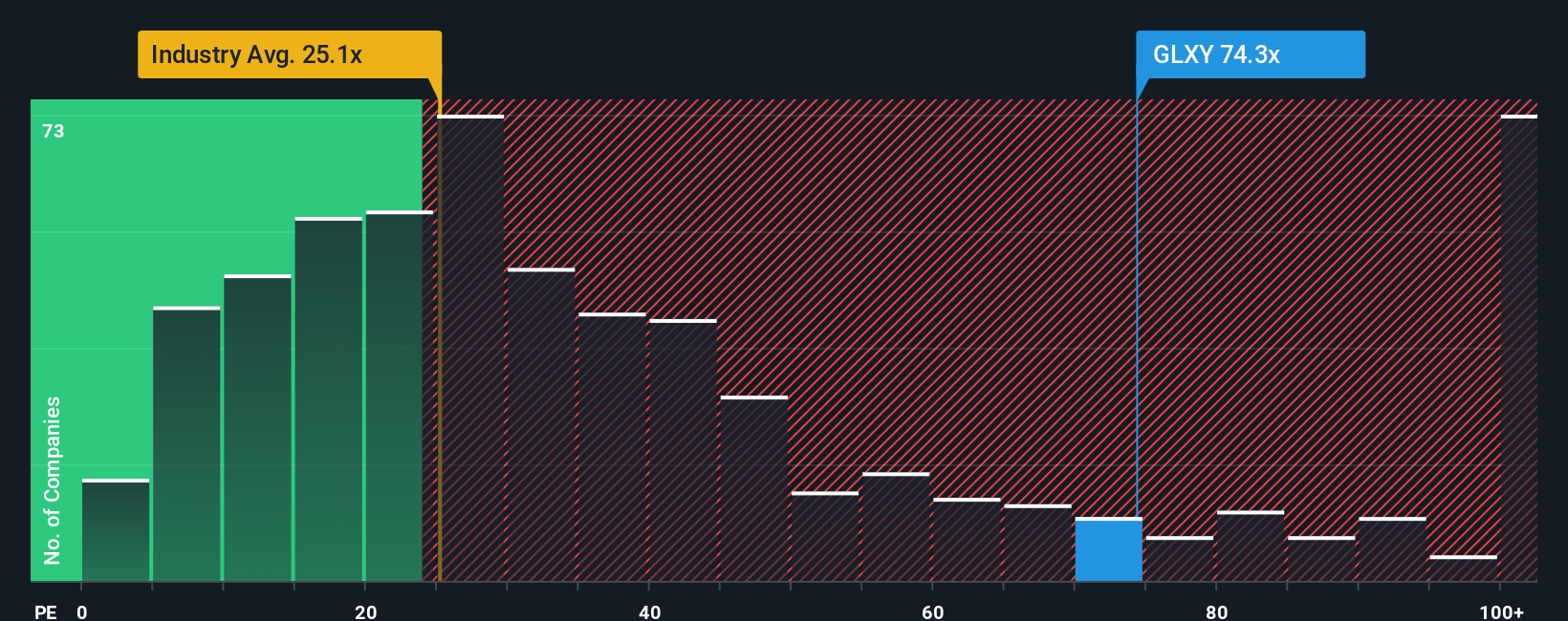

While the narrative fair value points to upside, Galaxy Digital currently trades on a 39.2x earnings multiple, well above the US Capital Markets average of 25x, its peer average of 20.8x, and a fair ratio of 14.5x. That rich gap suggests there may be downside risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If this perspective does not fully resonate with you, or you prefer hands on research, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Galaxy Digital research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next moves by checking targeted stock ideas built from real fundamentals, not hype, so you stay a step ahead.

- Capture potential mispricings early by reviewing these 909 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flows.

- Position yourself for the next wave of innovation by scanning these 25 AI penny stocks shaping breakthroughs in automation and intelligent software.

- Strengthen your income strategy by tapping into these 13 dividend stocks with yields > 3% that combine attractive yields with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLXY

Galaxy Digital

Engages in the digital asset and data center infrastructure businesses.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)