- United States

- /

- Capital Markets

- /

- NasdaqGS:GEMI

Assessing Gemini Space Station After 26.7% Drop and Regulatory Headlines in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Gemini Space Station stock lately, you are not alone. Investors are weighing their options closely, especially after watching the share price close at $23.45. This level has some asking whether the current dip signals opportunity or deeper problems ahead. The stock has slid by 7.3% over the past week, and the 30-day picture is even rougher, showing a drop of 26.7%. That kind of movement catches attention, and it is no wonder many are trying to decide whether now might be a compelling entry point or just a risky bet.

Some of these moves can be traced back to broader space industry trends. As regulatory discussions and partnerships with satellite manufacturers have made headlines, risk sentiment around Gemini Space Station has shifted. This has been reflected in the share price volatility we have seen recently, adding an extra layer of uncertainty for those on the sidelines.

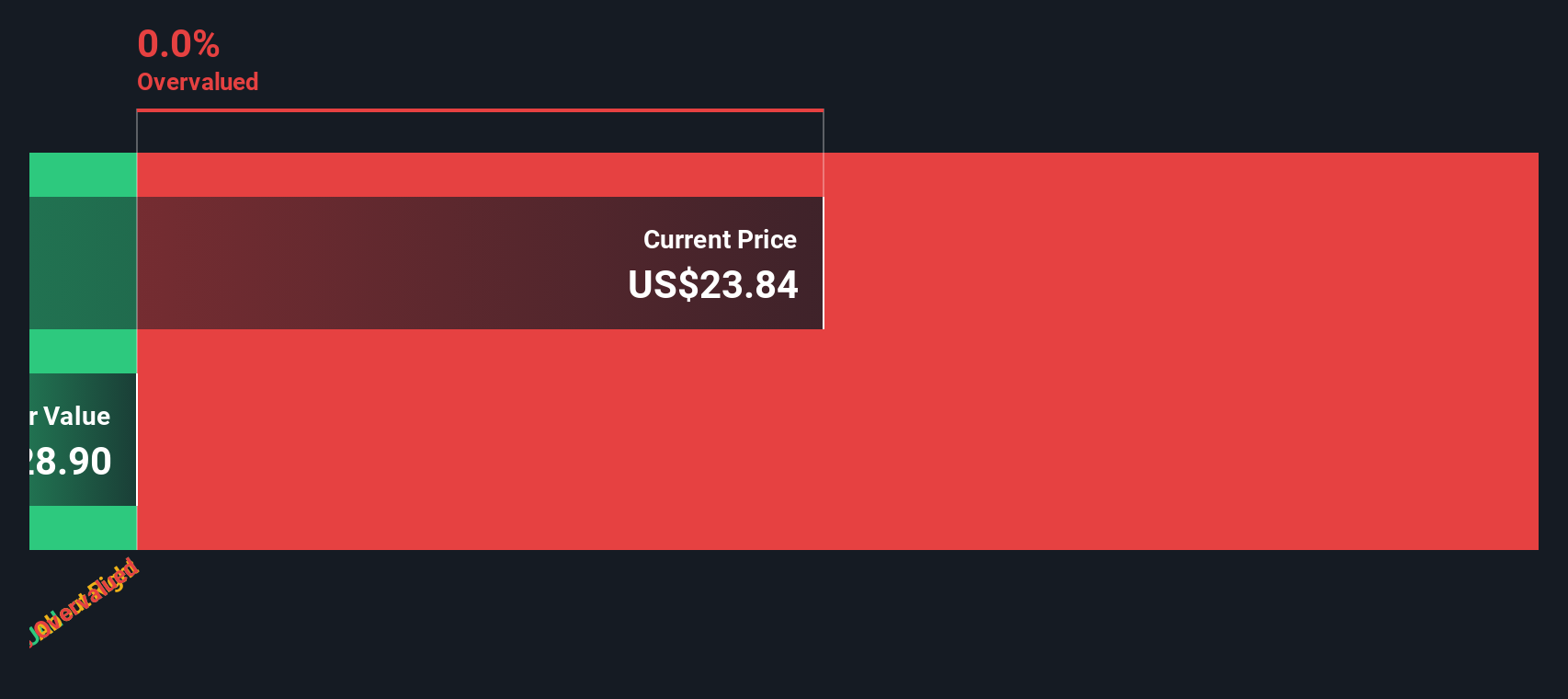

When it comes to valuation, though, the numbers are clear: Gemini Space Station registers a valuation score of 0 out of 6. That means it does not meet any of the standard criteria for being undervalued right now. For anyone looking to make an informed decision, evaluating the company through various valuation lenses is essential, even if the early numbers seem discouraging. Let’s break down those approaches in detail. Stay with us, because at the end we will share the key factor many miss when thinking about what a stock is truly worth.

Gemini Space Station scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Gemini Space Station Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future free cash flows and discounts them back to today’s value. This approach helps investors estimate what a business is really worth based on how much cash it is expected to generate for shareholders in the years ahead, rather than relying only on current financial results.

Examining Gemini Space Station’s latest numbers, current Free Cash Flow stands at -$32.1 Million, highlighting the company’s negative cash generation over the last twelve months. Analysts expect significant swings: after a deep drop in 2026 to -$69 Million, projections call for a rebound to $38.1 Million by 2027. In the following years, based on Simply Wall St extrapolations, forecasts indicate consistent growth, with Free Cash Flow reaching $143.1 Million by 2035. All these projections are denominated in US dollars.

Using the 2-Stage Free Cash Flow to Equity model, Gemini Space Station’s estimated intrinsic value comes out to just $11.26 per share, which is well below the current market price of $23.45. This DCF valuation implies the stock is 108.3% overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gemini Space Station may be overvalued by 108.3%. Find undervalued stocks or create your own screener to find better value opportunities.

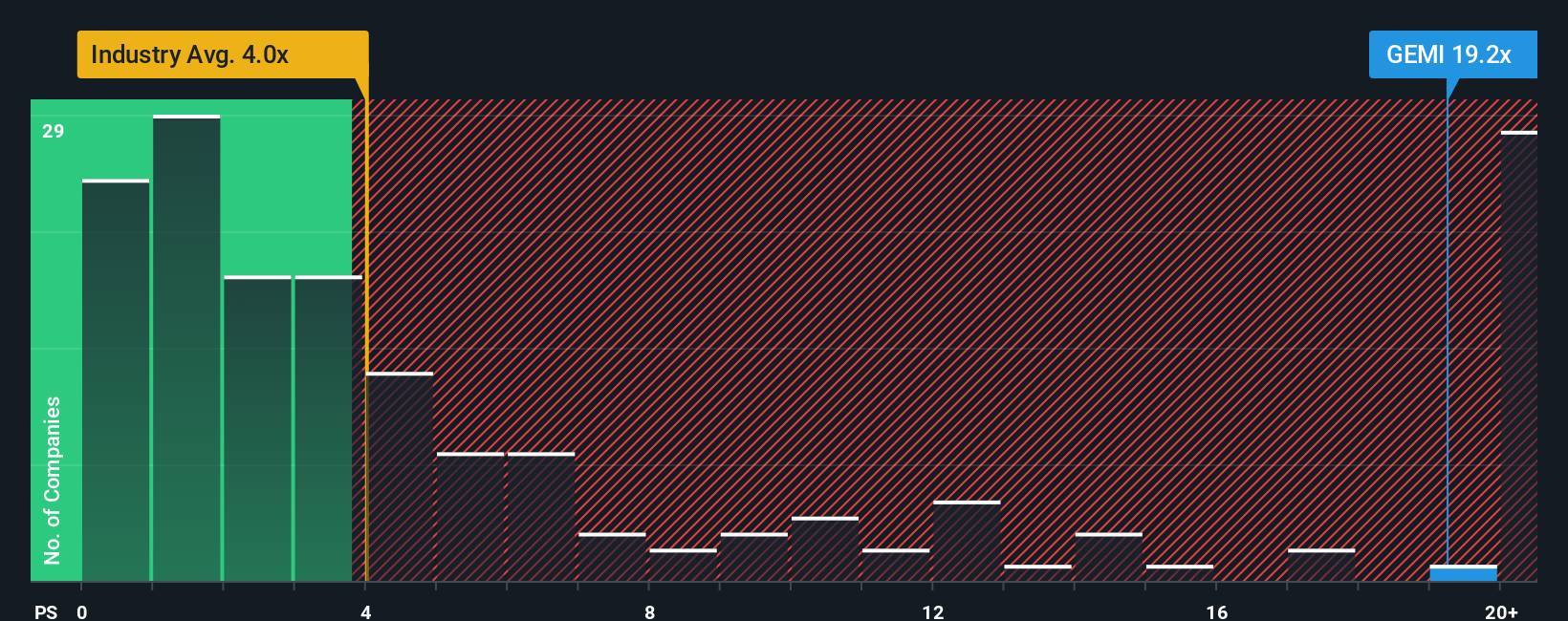

Approach 2: Gemini Space Station Price vs Sales

The Price-to-Sales (P/S) ratio is a powerful tool for valuing companies, especially when traditional metrics like earnings are less informative. This is often the case for businesses still working toward profitability or those experiencing substantial revenue growth. The P/S ratio is favored here because Gemini Space Station remains unprofitable but does generate significant sales, making it possible to compare its revenue base with both peers and the broader industry.

Growth expectations and risk are central to what makes a “normal” or “fair” multiple. High-growth or high-margin companies can often justify a higher P/S ratio, while riskier firms or those with uncertain paths ahead typically receive discounts. The Capital Markets industry average P/S currently sits at 3.9x, and Gemini’s closest peers average around 4.2x. In contrast, Gemini Space Station currently trades at a hefty 20.2x, far higher than either benchmark. This signals that investors are pricing in ambitious growth or significant strategic advantages.

This is where Simply Wall St’s “Fair Ratio” comes into play. Instead of just stacking up the company against the industry or a basket of peers, the Fair Ratio considers a more personalized set of factors: Gemini’s expected revenue growth, profit margins, size, sector dynamics, and risk profile. This proprietary metric aims to provide a grounded perspective on where a reasonable valuation multiple should sit for a company like this one, regardless of market hype or pessimism.

Comparing Gemini’s actual P/S ratio of 20.2x against its Fair Ratio, the gap is wide. The company’s stock price is pushing well beyond what the data suggests is justified for its fundamentals and risk. That means even after accounting for all its opportunities, Gemini Space Station is likely overvalued by this measure as well.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gemini Space Station Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, connecting what you believe about its future with a personalized financial forecast and ultimately, a fair value estimate. Narratives help bring numbers to life by letting you map your assumptions about Gemini Space Station's revenue growth, profit margins, and strategic direction directly to a fair value you believe in.

Narratives are made easy and accessible on Simply Wall St’s Community page, used by millions of investors worldwide. With Narratives, you can compare your own fair value with others, see when the current price is above or below your number, and quickly spot when it might be time to buy or sell. These Narratives update automatically when major news or earnings are released, so your perspective always reflects the latest information.

For example, one investor might see Gemini Space Station’s fair value as much higher by projecting aggressive expansion, while another may be more cautious with a much lower estimate based on recent setbacks. Narratives let you harness these dynamic viewpoints and make investment decisions with greater confidence.

Do you think there's more to the story for Gemini Space Station? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEMI

Gemini Space Station

Develops a crypto platform to buy, sell, and store crypto assets.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)