- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Will Upward Earnings Revisions Change the Competitive Narrative for Futu Holdings (FUTU)?

Reviewed by Sasha Jovanovic

- Futu Holdings recently drew investor interest after its earnings estimates were revised upward, highlighting positive sentiment around the company's financial outlook and business fundamentals.

- This focus on the company’s momentum and improving estimates reflects analyst expectations for stronger performance and growing traction among digital investment platforms.

- We’ll explore how the improved earnings outlook reshapes Futu Holdings’ investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Futu Holdings Investment Narrative Recap

To be a Futu Holdings shareholder, you need to believe in the accelerating adoption of digital investing platforms across Asia and beyond, as well as Futu's execution in acquiring and retaining users in increasingly competitive, regulated markets. The recent upward revisions in earnings estimates highlight positive momentum but do not meaningfully reduce the biggest immediate risk: that aggressive local competition in Japan and mature markets could pressure profits and slow expansion, despite near-term growth catalysts from new product rollouts and international traction.

One of the most relevant recent announcements is Futu’s second quarter 2025 earnings, which showed revenue and net income growth significantly year-over-year. This financial result underscores the positive shift picked up by analyst estimate upgrades and highlights the short-term catalyst of strong asset inflows and higher engagement on its platform.

But in contrast to the optimism around upgraded earnings estimates, investors should also be alert to how aggressive competition in core growth markets could impact...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' outlook suggests revenue of HK$26.3 billion and earnings of HK$12.9 billion by 2028. This scenario depends on an annual revenue growth rate of 17.8% and anticipates a HK$5.0 billion increase in earnings from the current HK$7.9 billion.

Uncover how Futu Holdings' forecasts yield a $204.77 fair value, a 23% upside to its current price.

Exploring Other Perspectives

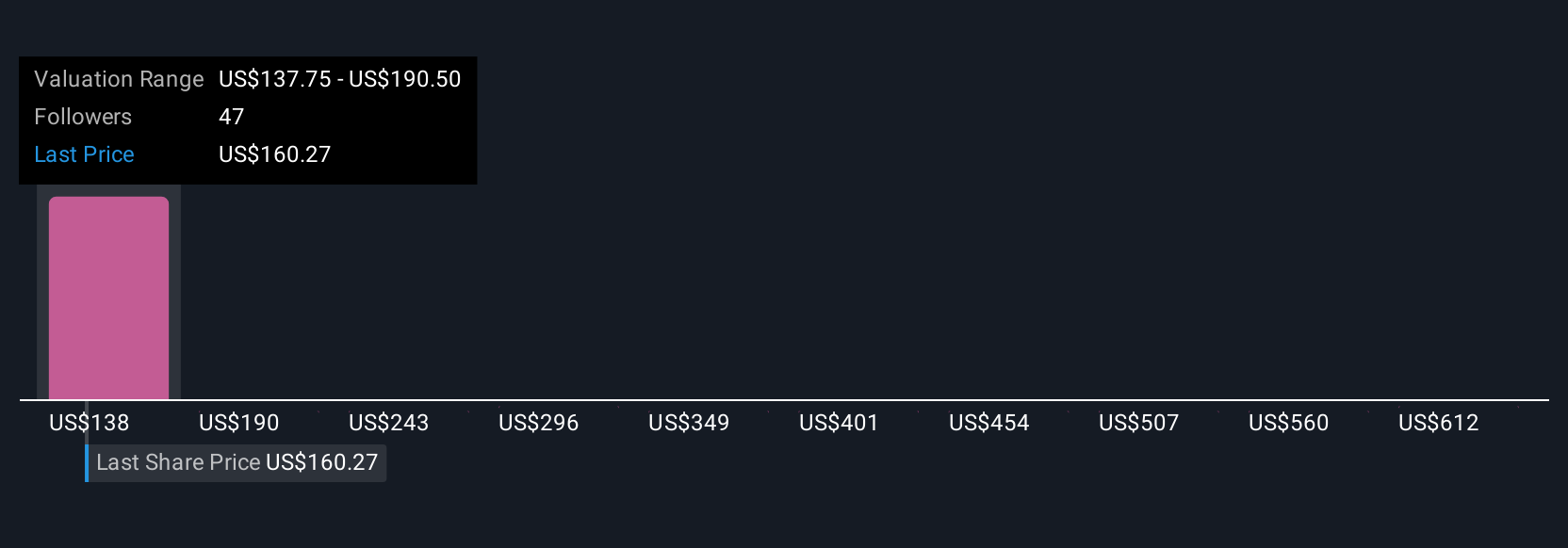

Seven fair value estimates from the Simply Wall St Community for Futu range from HK$165.64 to HK$665.22 per share, showing a wide spread in outlooks. As many see international expansion as a revenue catalyst, the broad range of opinions invites you to weigh several viewpoints on Futu’s future.

Explore 7 other fair value estimates on Futu Holdings - why the stock might be worth just $165.64!

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives