- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Will Growing Institutional Support for Futu Holdings (FUTU) Reshape Its Global Expansion Ambitions?

Reviewed by Sasha Jovanovic

- In recent weeks, Covea Finance expanded its holdings in Futu Holdings Limited by 52.3%, as the company’s management emphasized a stronger push into overseas markets, particularly the U.S., supported by growth in new clients and brand expansion.

- This uptick in institutional interest highlights investor confidence in Futu’s evolving digital brokerage and wealth management business model, especially as it targets global markets and deepens its international presence.

- We’ll explore how rising institutional backing and U.S. expansion efforts could impact Futu’s future growth and investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Futu Holdings Investment Narrative Recap

To be a shareholder in Futu Holdings, you have to believe in the company’s ability to grow its digital brokerage and wealth management business internationally, particularly in the U.S., while maintaining strong client growth and brand expansion. The recent uptick in institutional investment from Covea Finance may support sentiment for Futu’s U.S. ambitions, but it does not materially change the immediate catalyst: rapid expansion into major international markets. The primary risk remains regulatory uncertainty, especially as Futu pursues cross-border business opportunities.

Among recent announcements, Futu’s latest quarterly results stand out, with Q2 2025 revenue rising to HK$5,310.89 million and net income hitting HK$2,574.21 million, reflecting robust client acquisition and expanding international operations. This earnings momentum supports the company’s expansion narrative, but execution risks in newly entered markets and varying regulatory regimes could affect the sustainability of these results.

However, rather than solely focusing on growth stories, investors should also pay attention to how Futu addresses the ever-changing regulatory landscape that...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' outlook anticipates HK$26.3 billion in revenue and HK$12.9 billion in earnings by 2028. This forecast is based on a projected 17.8% annual revenue growth rate and a HK$5.0 billion earnings increase from the current HK$7.9 billion.

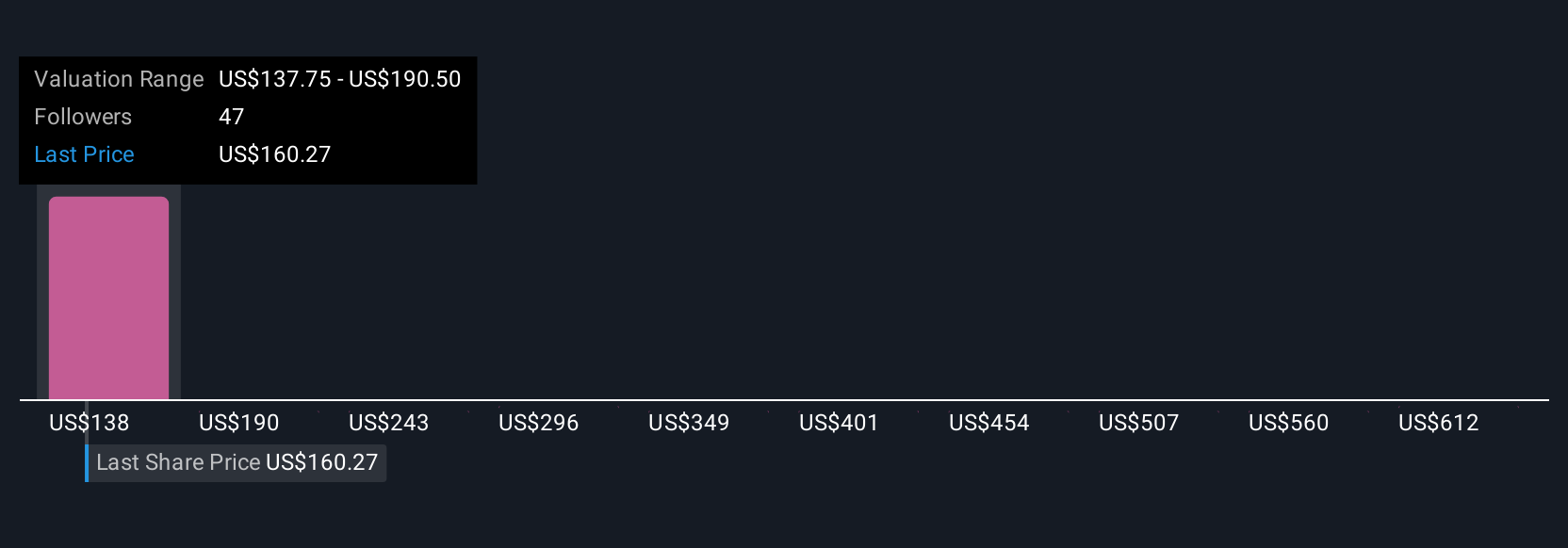

Uncover how Futu Holdings' forecasts yield a $204.77 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community range widely, from HK$165.64 to HK$665.22 per share. While community expectations differ, regulatory risks tied to Futu’s global expansion remain a topic many market participants are watching closely.

Explore 7 other fair value estimates on Futu Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives