- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Futu Holdings (NasdaqGM:FUTU): Valuation Insights After New Initiatives Drive Optimism and Strong Analyst Support

Reviewed by Simply Wall St

Futu Holdings (FUTU) shares have edged higher after the company rolled out new engagement initiatives and received supportive commentary highlighting its growing international presence and progress in digital assets. Both factors are fueling investor optimism this week.

See our latest analysis for Futu Holdings.

After rallying on upbeat company news and supportive broker commentary, Futu Holdings’ share price is now up more than 110% year-to-date, easily outpacing most peers. Momentum appears to be building; just look at that impressive 425% total shareholder return over three years.

If this kind of momentum has you searching for more opportunities, consider broadening your watchlist and discover fast growing stocks with high insider ownership

With momentum running hot and new growth initiatives underway, is Futu Holdings still trading below its true value, or has the market already priced in all of its future upside potential?

Most Popular Narrative: 18% Undervalued

Futu Holdings is currently trading well below what the most popular narrative sees as its real worth, with last close price lagging the fair value estimate by a significant margin. This creates a growing tension between market pricing and bullish expectations supported by international growth and digital finance initiatives.

The rapid growth in funded accounts, especially from international markets such as Singapore, the U.S., Malaysia, and Japan, signals ongoing global expansion and diversification of Futu's user base. This positions the company to capture rising middle-class wealth and increased digital financial adoption in Asia, supporting long-term revenue and assets under management growth.

Want to know if Futu's ambitious international push and digital finance upgrades justify this valuation surge? The narrative hinges on assumptions about user growth, product innovation, and margin strength. Curious what kind of future numbers analysts expect to make the math work? See just how bold the projections behind this story really are.

Result: Fair Value of $207.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as intensifying competition in established markets and unpredictable regulatory changes could quickly dampen Futu's growth outlook and test bullish assumptions.

Find out about the key risks to this Futu Holdings narrative.

Another View: Is the Market Multiple Telling a Different Story?

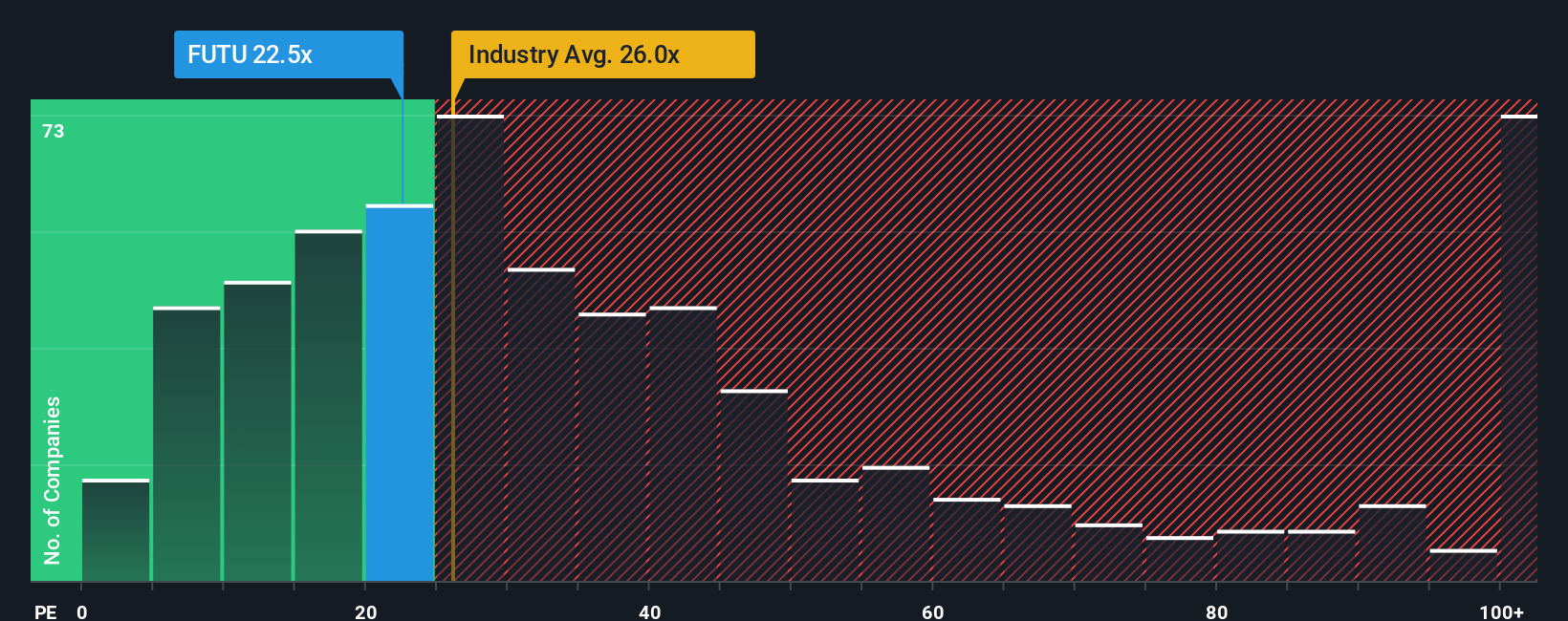

Looking at Futu’s price-to-earnings ratio from another angle, its 23.1x is below the US Capital Markets industry average of 26x and far under peer averages at 47.7x. However, it is still just above the fair ratio of 21.5x, suggesting modest overvaluation if the market moves towards the fair ratio. Does this gap signal limited further upside, or is there room for sentiment to push higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Futu Holdings Narrative

If you want your own take or would rather dive into the numbers yourself, you can build a personalized narrative of Futu Holdings in just a few minutes as well: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Futu Holdings.

Looking for More Investment Ideas?

If you want to keep your portfolio on the front foot, don’t miss out on these handpicked stock themes worth watching right now.

- Boost your potential income by targeting steady earners with these 17 dividend stocks with yields > 3% featuring yields above 3% and a record of stable payouts.

- Unlock tomorrow’s opportunities by researching these 24 AI penny stocks that power innovation through AI-driven business models, automation, and cutting-edge analytics.

- Capitalize on rapid growth with these 3574 penny stocks with strong financials that combine financial strength, high upside, and surprising resilience in volatile markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives