- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Futu Holdings (NasdaqGM:FUTU): Evaluating Valuation After Moomoo’s Surge as Australia’s Top Trading App

Reviewed by Kshitija Bhandaru

Futu Holdings (NasdaqGM:FUTU) is seeing tangible results from its international growth strategy, with its trading app Moomoo now crowned the most downloaded in Australia for 2025. The company’s wider operational momentum is hard to ignore lately.

See our latest analysis for Futu Holdings.

Momentum is clearly building for Futu Holdings, with the company rapidly expanding its client base and Moomoo gaining recognition in new markets. Despite a recent pullback, including a 13.16% 1-month share price return, the year-to-date share price return sits at a striking 103.16%. The 1-year total shareholder return has reached 55.28%. Longer-term investors have seen even more impressive results, with total shareholder returns topping 430% over five years, reflecting both growth potential and renewed investor confidence.

If Futu’s international breakthroughs sparked your curiosity, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst price targets despite rapid global growth, investors must ask if Futu Holdings is currently undervalued or if the market has already factored in its future expansion. Is there a genuine buying opportunity here?

Most Popular Narrative: 21.2% Undervalued

With Futu Holdings closing at $161.43, the most widely followed narrative places fair value much higher, creating a striking potential upside. This sets the stage for a valuation built on strong growth assumptions and future profit margins.

Continued rollout of new investment products, including wealth management services, fixed income, crypto trading, and tokenized assets, broadens Futu's product suite and drives higher customer stickiness and lifetime value. These developments have a direct positive impact on fee-based income and net margin expansion. Significant increases in client asset inflows (almost doubled YoY), record-high AUM, and exceptionally high client retention above 98% indicate increasing customer trust and engagement. This trend amplifies platform resilience and the recurring revenue base.

Want to uncover why analysts see double-digit growth driving this story? The bold earnings and margin projections at the heart of this narrative break from industry trends. Curious which ambitious financial forecasts set it apart? Discover the full rationale behind this valuation call.

Result: Fair Value of $204.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fierce competition in major markets and tighter regulations could quickly challenge Futu's expansion story. These factors may put pressure on both growth and profitability.

Find out about the key risks to this Futu Holdings narrative.

Another View: Market Ratios Tell a Different Story

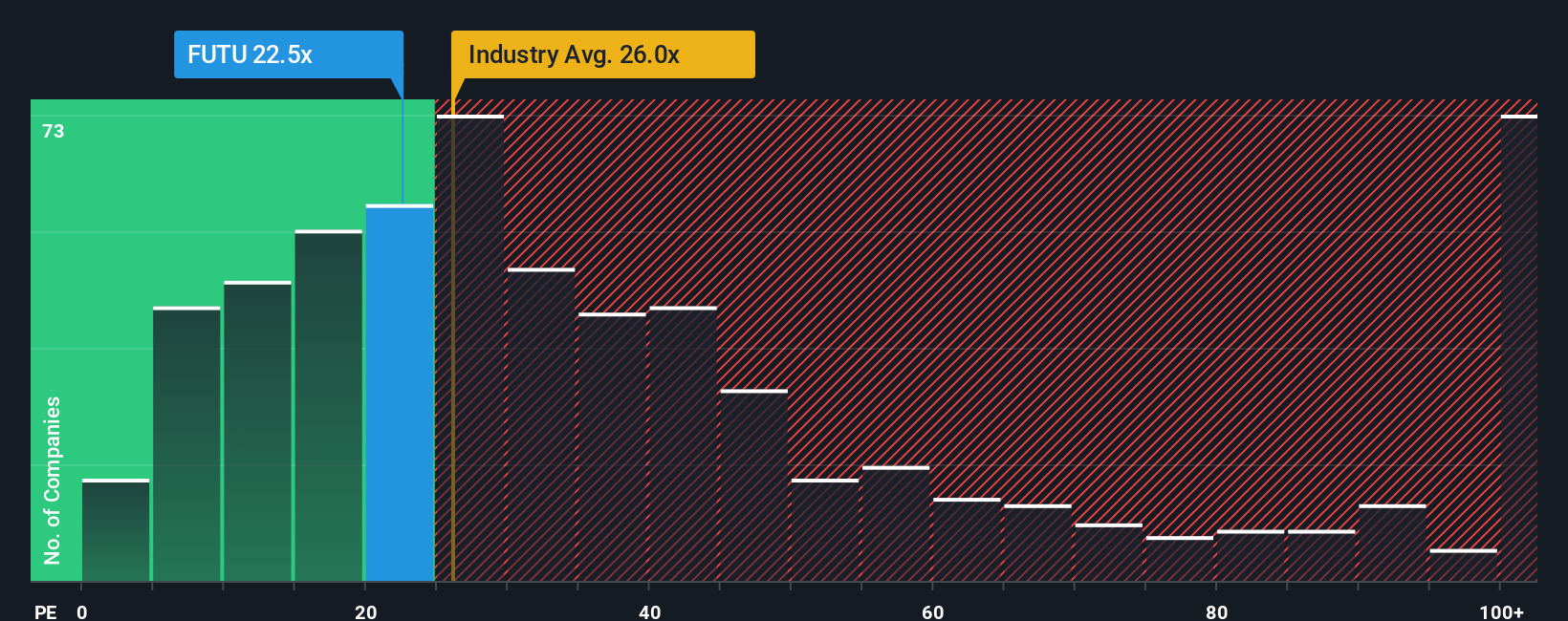

Looking beyond projected growth and fair value models, the company's current price-to-earnings ratio of 22.1x puts it slightly above what the fair ratio suggests (21.4x), and a touch higher than the peer average (22x), while still undercutting the industry average of 25.8x. This narrow margin signals little room for error. Will the market eventually demand a lower valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Futu Holdings Narrative

Keep in mind, if you see the story differently or want to build your own perspective, our tools let you create a custom narrative in under three minutes, so you can Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Futu Holdings.

Looking for More Smart Investment Moves?

Confident investors don’t wait for tomorrow’s headlines. Seize your advantage and use the Simply Wall Street Screener to find the next big opportunity today.

- Target reliable income streams by checking out these 18 dividend stocks with yields > 3%, which offers strong yields exceeding 3% for steady potential returns.

- Access the future of tech with these 25 AI penny stocks, a group composed of innovators making waves in artificial intelligence sectors.

- Capitalize on potential bargains by reviewing these 881 undervalued stocks based on cash flows, where cash flow fundamentals suggest solid stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives