- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Futu Holdings (FUTU) Is Up 7.1% After Upward Analyst Revisions and Strong Zacks Rank

Reviewed by Simply Wall St

- Futu Holdings was recently highlighted for strong momentum by analysts, earning a Zacks Rank of #1 (Strong Buy) and receiving multiple upward earnings estimate revisions in the past two months.

- This wave of positive analyst sentiment reflects greater confidence in Futu Holdings' outlook, driven by optimism over its client acquisition and innovation strategy.

- With those upward earnings estimate revisions fueling analyst optimism, we'll explore how this development could shape Futu Holdings' investment narrative going forward.

Futu Holdings Investment Narrative Recap

Futu Holdings shareholders are essentially buying into ongoing digital transformation in Asian securities brokerage and wealth management, with the main short-term catalyst being continued client growth and innovation in client services. While recent momentum in analyst upgrades and share price is encouraging, it does not materially reduce the biggest near-term risk: rising client acquisition costs and ongoing volatility in underlying China equity markets that could still pressure future revenue growth if trends reverse.

Of recent announcements, the Q1 2025 results stand out as particularly relevant, Futu reported year-on-year revenue and net income growth, which supports the positive earnings estimate revisions behind the current analyst momentum. This suggests that, for now, fundamental business factors remain in line with market optimism, though the sustainability of that trend will depend on continued success in expanding client assets and managing acquisition costs.

However, with historically rising client acquisition expenses, it’s important for investors to remember that...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' narrative projects HK$21.7 billion in revenue and HK$10.0 billion in earnings by 2028. This requires 22.0% yearly revenue growth and an earnings increase of HK$4.6 billion from the current HK$5.4 billion.

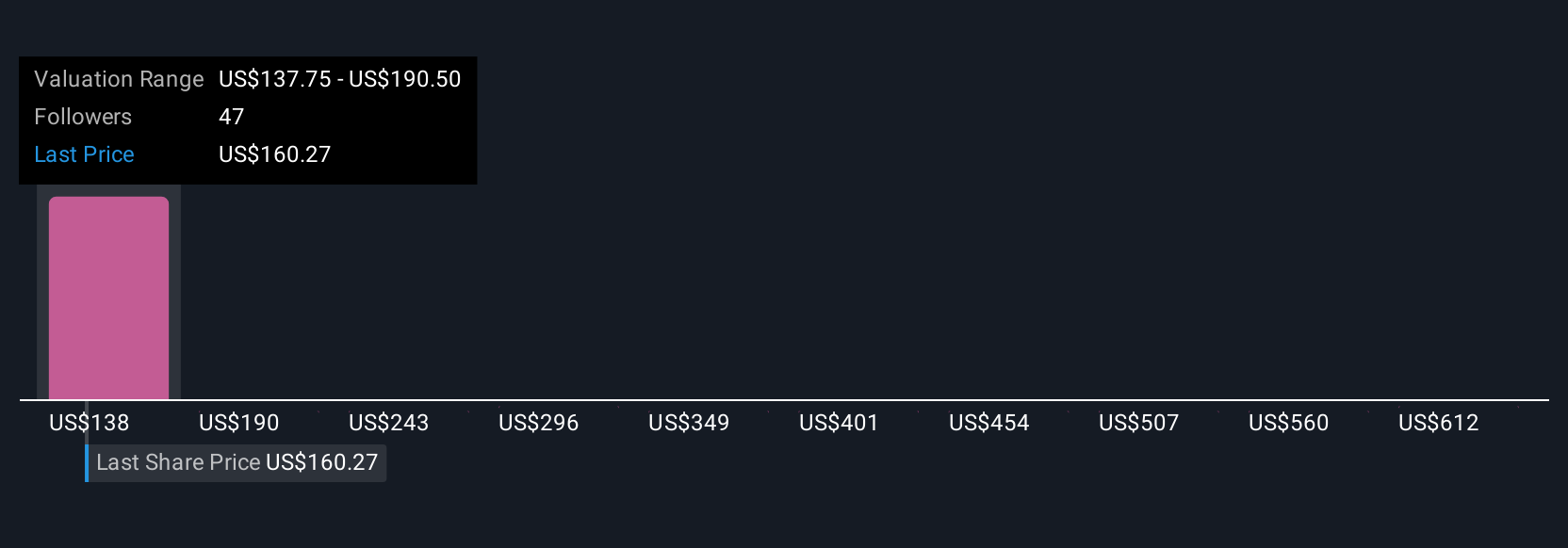

Uncover how Futu Holdings' forecasts yield a $162.85 fair value, in line with its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community place Futu’s potential between HK$136.85 and HK$665.22, illustrating considerable divergence. With upward momentum and analyst optimism driven by increased earnings estimates, consider how sharply opinions can differ when reviewing your own view on future risk and reward.

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives