- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Can Futu Holdings' (FUTU) User Engagement Strategy Deepen Loyalty Among Digital Investors?

Reviewed by Sasha Jovanovic

- In recent days, Moomoo, the global investment platform under Futu Holdings, announced a partnership with W!se to launch the 'Student Stock Showdown,' a simulated stock trading competition for high schoolers, and kicked off its second Global Paper Trading Competition, attracting more than 150,000 participants in just two days.

- These engagement initiatives reflect Futu's efforts to foster financial literacy among younger generations and strengthen user loyalty across its rapidly expanding digital investing ecosystem.

- We'll consider how Futu's strong user engagement, highlighted by the success of its trading competitions, factors into its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Futu Holdings Investment Narrative Recap

To be a shareholder in Futu Holdings, you need to believe in its ability to drive sustained client growth and engagement across global markets, leveraging technology and financial education. The recent surge in participation in Moomoo’s competitions highlights rising user activity and sentiment, but does not fundamentally change the key short-term catalyst: continuing revenue and net asset inflow growth. The primary risk remains regulatory shifts, particularly in cross-border and emerging digital asset markets, which could disrupt expansion plans.

The announced alliance between Moomoo and W!se to launch the 'Student Stock Showdown,' alongside the record-breaking turnout for Moomoo’s Global Paper Trading Competition, is especially relevant. These programs showcase Futu’s ongoing efforts to engage new demographics, grow its global user base, and reinforce user loyalty, a core element tied directly to its growth catalysts and ongoing international expansion.

However, investors should also be wary of how evolving regulatory requirements could suddenly affect...

Read the full narrative on Futu Holdings (it's free!)

Futu Holdings' narrative projects HK$26.3 billion in revenue and HK$12.9 billion in earnings by 2028. This requires 17.8% annual revenue growth and a HK$5 billion earnings increase from the current HK$7.9 billion.

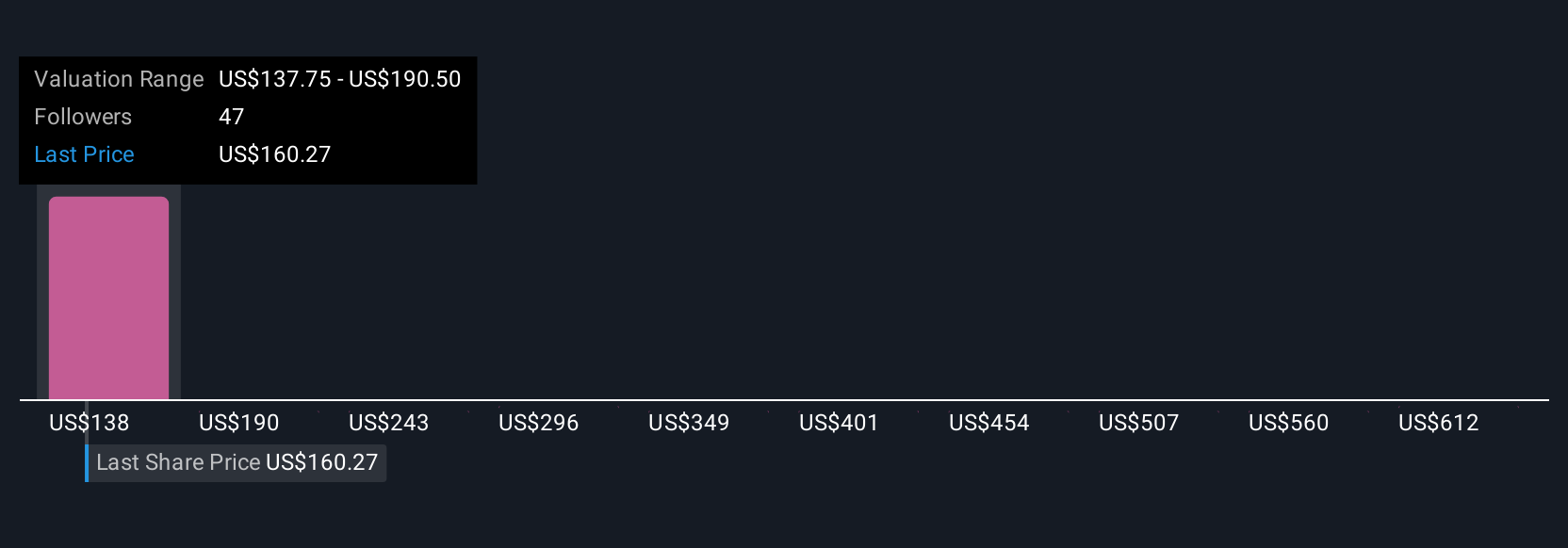

Uncover how Futu Holdings' forecasts yield a $207.27 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted nine fair value estimates for Futu Holdings, ranging from HK$165.64 to HK$665.22 per share. While community valuations span an exceptionally wide range, the backdrop of ongoing global user expansion and competition in new markets signals you should consider several distinct viewpoints before forming your outlook.

Explore 9 other fair value estimates on Futu Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Futu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Futu Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Futu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Futu Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives