- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Is Flywire’s (FLYW) Healthcare Push and ERP Integrations Redefining Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- In recent days, Voss Capital highlighted Flywire Corporation's strong operational results and fundamental growth as diverging positively from its stock price, while the company also attended the UBS Global Tech and AI conference in Phoenix, engaging with industry participants and investors via a live webcast.

- Analyst commentary underscored Flywire’s momentum across UK education, healthcare, and B2B segments, noting especially the company’s growing total addressable market, new ERP system integrations, and the potential for its healthcare business to accelerate further following contract wins.

- We'll examine how Flywire’s continued outperformance and new business integrations could reshape its investment narrative and growth outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Flywire Investment Narrative Recap

To be a shareholder in Flywire, you need to believe that its technology-driven payment solutions will keep capturing market share in global education, healthcare, and B2B verticals, enabling steady revenue growth despite margin pressures and sector-specific vulnerabilities. The recent spotlight from Voss Capital and Flywire’s visible presence at the UBS Global Tech and AI conference may buoy short-term sentiment, but are not likely to materially change the influence of regulatory and macroeconomic risks, which remain the most important factors impacting near-term performance.

Of the recent company announcements, Flywire’s deepened integration with Workday’s ERP platform stands out, directly linking to the expanding digital payments adoption and total addressable market highlighted as key growth catalysts. This partnership may strengthen the company’s position in the global education market by streamlining payments for institutions, which could support Flywire’s ongoing push to diversify revenue away from its most mature sectors.

In contrast, investors should be aware that recurring regulatory uncertainties and policy shifts in international education markets could still ...

Read the full narrative on Flywire (it's free!)

Flywire's narrative projects $817.0 million in revenue and $102.1 million in earnings by 2028. This requires 14.8% yearly revenue growth and a $95.3 million increase in earnings from the current $6.8 million level.

Uncover how Flywire's forecasts yield a $16.59 fair value, a 20% upside to its current price.

Exploring Other Perspectives

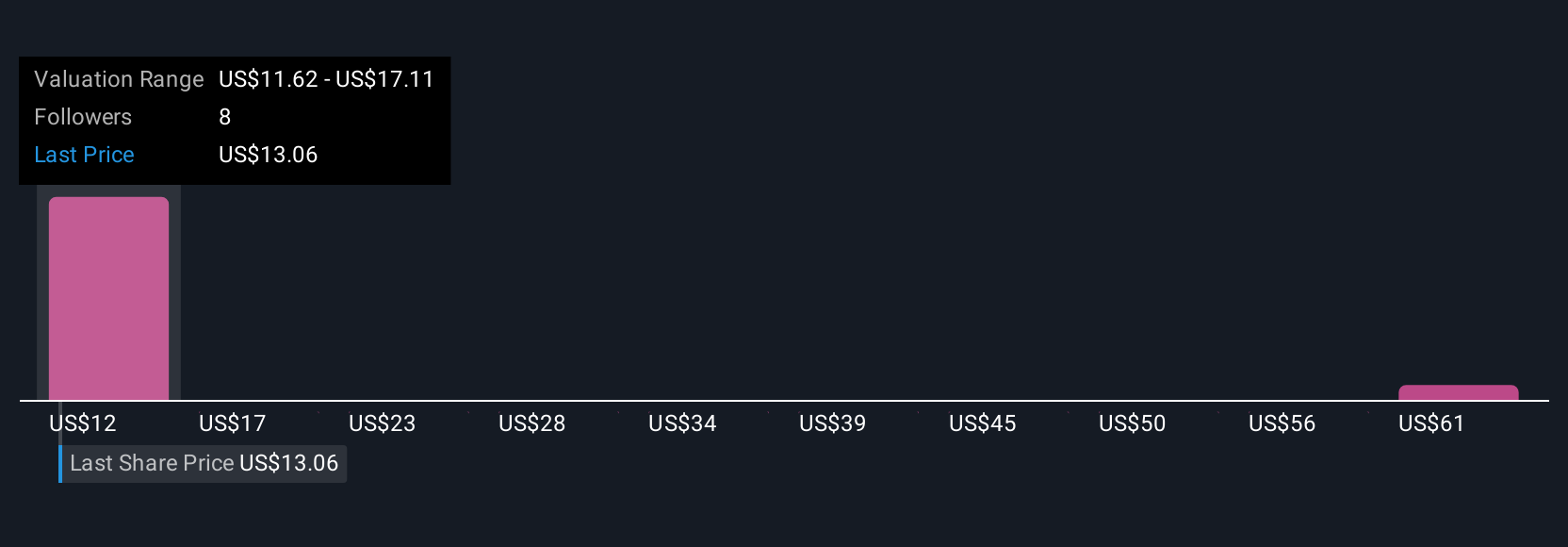

Simply Wall St Community members estimate Flywire’s fair value anywhere from US$14.16 to US$66.49, based on three independently constructed forecasts. Given ongoing global expansion efforts and sector diversification, this broad range reflects how investor conviction and risk focus can widely differ, explore a range of perspectives to inform your outlook.

Explore 3 other fair value estimates on Flywire - why the stock might be worth over 4x more than the current price!

Build Your Own Flywire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flywire research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Flywire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flywire's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026