- United States

- /

- Diversified Financial

- /

- NasdaqGS:FLYW

Flywire (FLYW) Valuation Check as Voss Capital Endorsement and TenPay Deal Highlight Growth Momentum

Reviewed by Simply Wall St

Flywire (FLYW) is back on investor radar after Voss Capital called out its improving fundamentals, just as the company announced a TenPay Global partnership that extends Weixin Pay for Chinese students paying tuition in South Korea and Malaysia.

See our latest analysis for Flywire.

The latest TenPay Global deal and Voss Capital spotlight come after a volatile stretch, with Flywire’s 90 day share price return of 7.39% contrasting sharply with a year to date share price return of negative 30.60% and a 1 year total shareholder return of negative 34.57%. This suggests sentiment may be stabilising from a low base as investors reassess its growth trajectory.

If this kind of payments led rebound catches your interest, it could be worth scanning high growth tech and AI stocks to see what other tech names are quietly building momentum.

With revenue still growing double digits, profitability inflecting, and shares trading below analyst targets, investors face a familiar dilemma: Is Flywire quietly undervalued, or is the recent optimism already pricing in its next leg of growth?

Most Popular Narrative Narrative: 15.9% Undervalued

Against Flywire’s last close of $13.95, the most followed narrative pegs fair value higher, framing today’s price as a potential discount rather than a peak.

Ongoing investment in proprietary technology, AI driven automation, and integration capabilities is yielding significant platform efficiencies (e.g., 25% operational cost improvements, 90% automated payment matching, and 40% automated customer service). These developments support Flywire's ability to maintain or increase net margins and deliver stronger earnings leverage as scale increases.

Curious how those efficiency gains, earnings ramp expectations, and a re rated profit multiple combine into that upside case? The narrative spells out the full math.

Result: Fair Value of $16.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if student visa rules tighten further or if higher growth travel and B2B volumes continue to pressure Flywire’s margins.

Find out about the key risks to this Flywire narrative.

Another View: Multiples Flash A Caution Sign

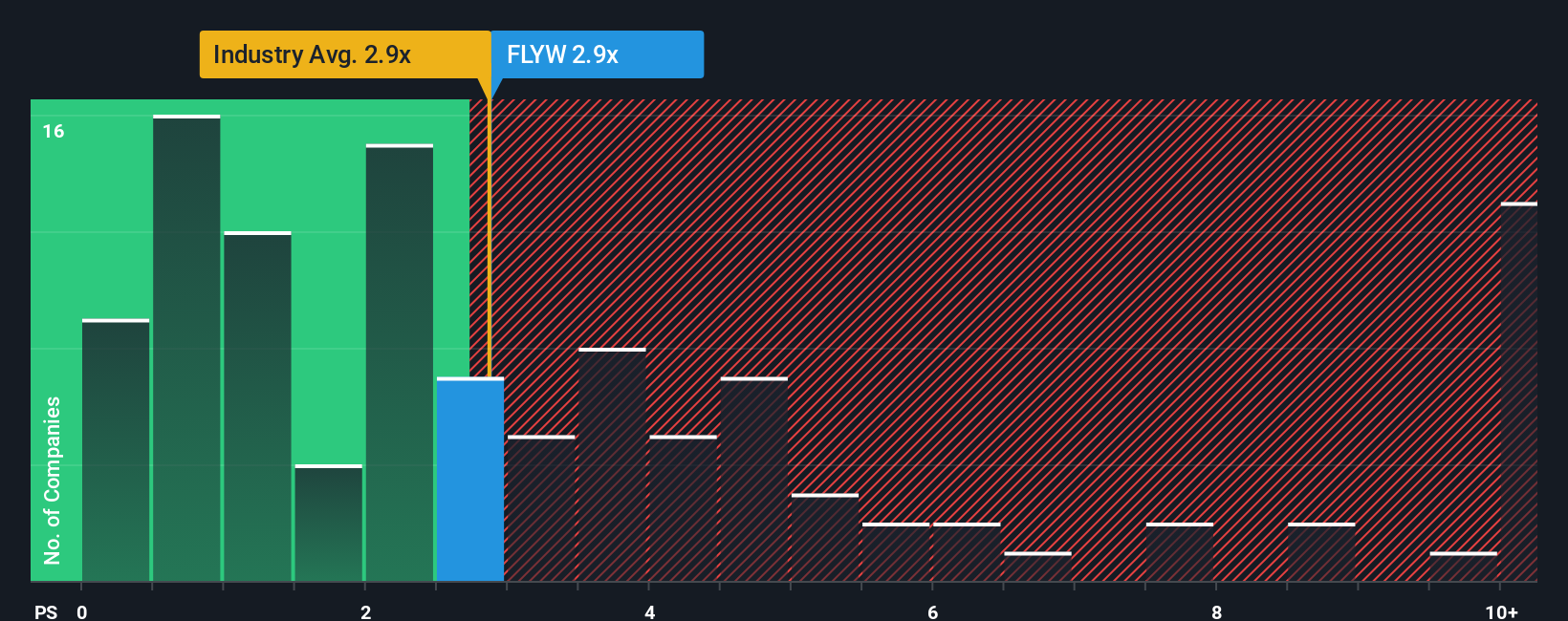

While the narrative and analyst targets suggest Flywire is modestly undervalued, the market is still paying up on a sales basis. At 2.9 times revenue, Flywire trades richer than both peers at 2.8 times and the industry at 2.5 times, and above a fair ratio of 2.3 times that the market could drift back toward. Is this a small premium for growth, or a warning that expectations are already stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flywire Narrative

If you see Flywire differently or prefer to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Flywire.

Looking for more high conviction ideas?

Before you move on, lock in your next potential winner with a few targeted screens that surface opportunities other investors might be ignoring.

- Capture overlooked growth stories by scanning these 920 undervalued stocks based on cash flows that pair strong fundamentals with attractive prices the market has not fully recognised yet.

- Ride the next wave of innovation by targeting these 25 AI penny stocks positioned to benefit from accelerating adoption of automation and intelligent software.

- Turn volatility into potential upside by screening these 81 cryptocurrency and blockchain stocks at the intersection of blockchain technology, digital payments, and emerging financial infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLYW

Flywire

Operates as a payments enablement and software company in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026