- United States

- /

- Consumer Finance

- /

- NasdaqGS:FIGR

Is Figure Technology Solutions Worth the Hype After 21% Weekly Surge on New Fintech Deals?

Reviewed by Bailey Pemberton

If you’re sizing up what to do with Figure Technology Solutions stock right now, you’re definitely not alone. After a quiet period, the price has soared 21.6% in just the last week and is up 42.2% since January. These are numbers that will grab anyone’s attention. For anyone who missed the news, this jump lines up with fresh optimism around the company’s technology expansion and partnerships in the fintech space. The mood around Figure Technology Solutions hasn’t always been this lively, so such a quick swing higher reveals a shift in how investors are betting on its next chapter.

But let’s get to the heart of what really matters: is Figure Technology Solutions a steal at $44.23? According to a range of standard valuation checks, the value score comes in at 0 out of 6, meaning it doesn’t register as undervalued by these traditional standards. This doesn’t tell the whole story, though. Seasoned investors know there is a lot more nuance below the surface.

Up next, we’ll walk through each common approach to valuation, highlighting where Figure Technology Solutions stands. And if you’re looking for a smarter, more insightful way to assess its true worth, stay tuned for the end. That’s where things get really interesting.

Figure Technology Solutions scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Figure Technology Solutions Excess Returns Analysis

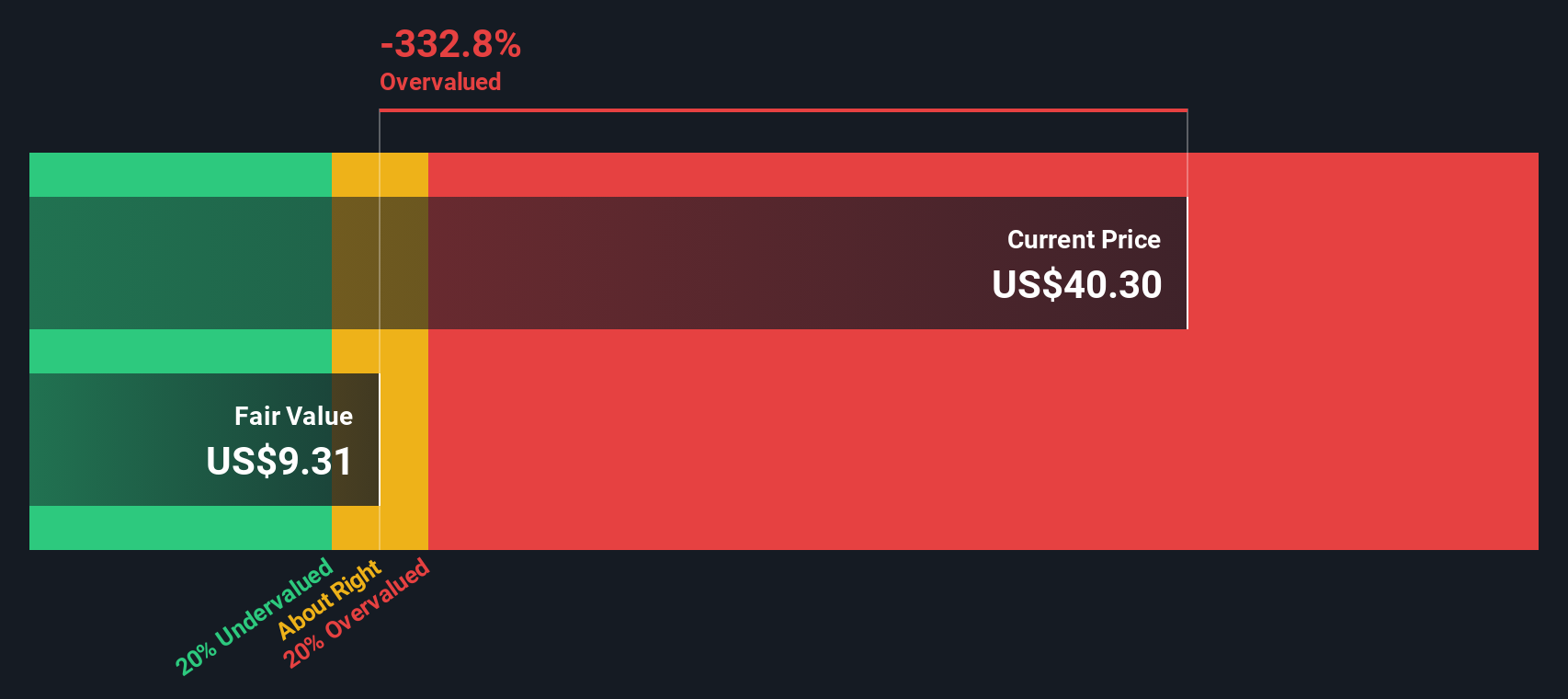

The Excess Returns model examines how much profit Figure Technology Solutions generates above its cost of equity, using historical averages to forecast long-term value. Simply put, it compares the returns delivered by the company on its invested capital to what investors require for putting their money at risk.

Here are the key inputs for Figure Technology Solutions:

- Book Value: $7.99 per share

- Stable EPS: $0.68 per share (based on the median return on equity over the past 5 years)

- Cost of Equity: $0.58 per share

- Excess Return: $0.10 per share

- Average Return on Equity: 9.25%

- Stable Book Value: $7.33 per share (from the 5-year median)

The Excess Returns approach uses these figures to estimate an intrinsic value for the stock. According to this analysis, Figure Technology Solutions is currently trading at a price that is 374.5% above what this model suggests is fair. The calculated fair value per share is significantly below the current trading price of $44.23, indicating substantial overvaluation.

Result: OVERVALUED

Our Excess Returns analysis suggests Figure Technology Solutions may be overvalued by 374.5%. Find undervalued stocks or create your own screener to find better value opportunities.

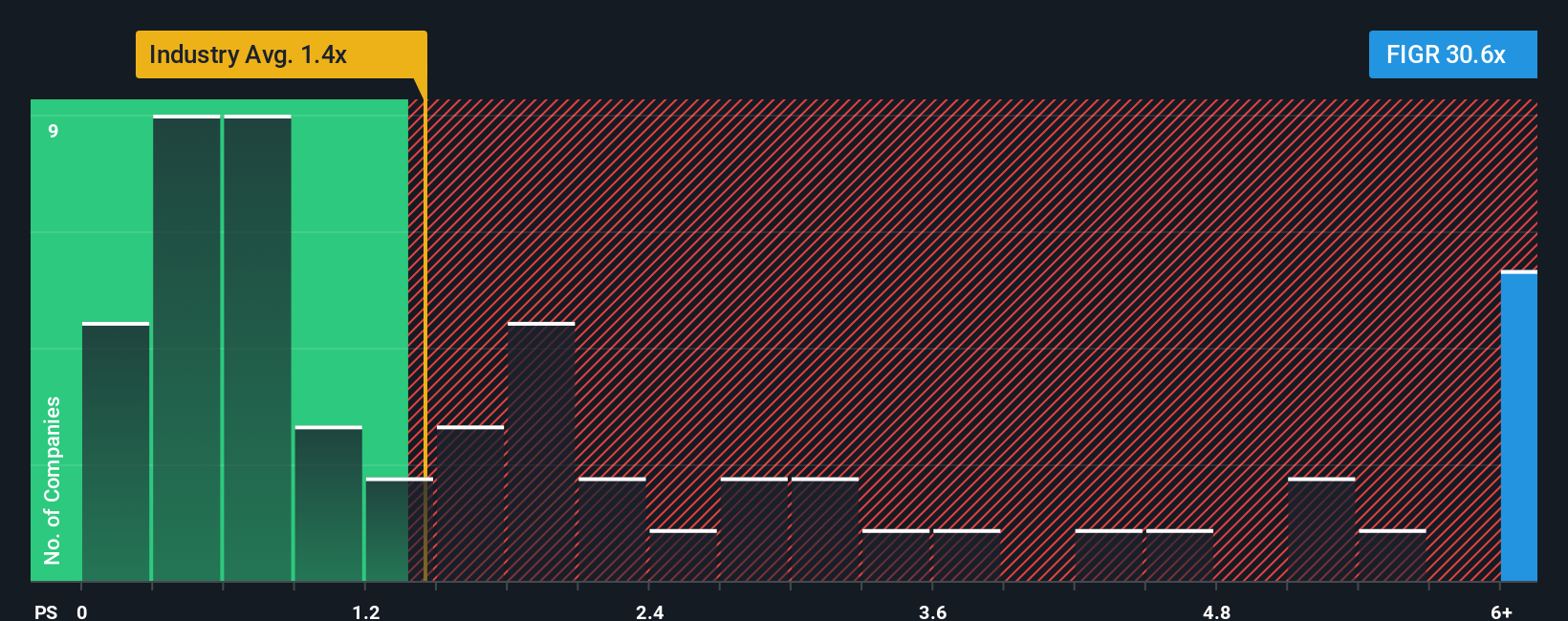

Approach 2: Figure Technology Solutions Price vs Sales

For companies in high-growth sectors or those still working toward profitability, the Price-to-Sales (P/S) ratio is often the best lens for valuation. This metric gives a clear view of how much investors are paying for each dollar of revenue, making it especially useful when earnings are inconsistent or negative.

Growth expectations and risk play a big role in determining what a “normal” or “fair” P/S ratio should be. Companies with rapid revenue growth or lower perceived risk tend to command premium multiples, sometimes far above the industry average. By contrast, higher risks or weak growth prospects usually drag that valuation down.

Right now, Figure Technology Solutions trades on a steep P/S multiple of 32x. For context, the industry average in Consumer Finance is only 1.57x, and its peer group sits at 2.17x. Clearly, investors are pricing in outsized growth or a unique business model. However, comparing only to these benchmarks can miss the mark if a company’s future looks dramatically different from those around it.

This is where the concept of a “Fair Ratio” becomes essential. Simply Wall St’s proprietary Fair Ratio does not just weigh peers or industry; it blends together multiple signals, such as Figure Technology Solutions’ revenue growth outlook, profit margins, size, and risk profile. This makes for a more tailored and accurate assessment of what a reasonable multiple should be right now.

In the case of Figure Technology Solutions, the Fair Ratio reflects the company’s actual prospects and risks, instead of relying purely on past industry trends. When comparing the Fair Ratio to the present P/S of 32x, the gap signals that the current valuation is significantly higher than what would be expected as fair, even after accounting for future growth and sector dynamics.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Figure Technology Solutions Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, yet powerful way to invest by sharing your perspective on a company’s future: you tell the story behind the numbers, outline your assumptions for fair value, and set your expectations for future revenue, earnings, and margins.

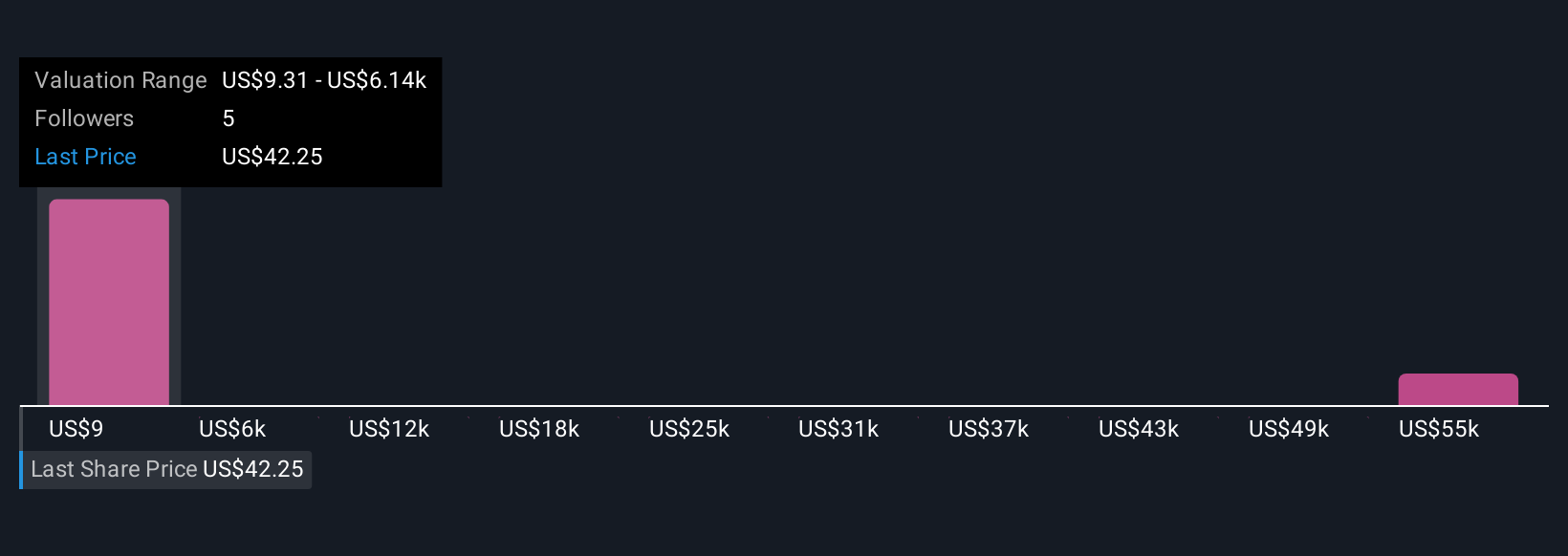

With Narratives, you connect Figure Technology Solutions’ story—such as why it might succeed or face challenges—directly to a financial forecast, and then see what that means for a fair value today. Narratives are an easy, accessible tool found on Simply Wall St’s Community page, used by millions of investors to compare and update their outlooks.

These Narratives help you decide when to buy or sell by showing how your fair value stacks up against the market price, and they dynamically update as new news, earnings, or data comes in. For Figure Technology Solutions, you might see one investor’s optimistic Narrative with a fair value of $70 per share, while another expects just $18, reflecting their unique outlooks and forecasts.

Do you think there's more to the story for Figure Technology Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIGR

Figure Technology Solutions

Develops and operates a blockchain-based consumer lending platform.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives